Answered step by step

Verified Expert Solution

Question

1 Approved Answer

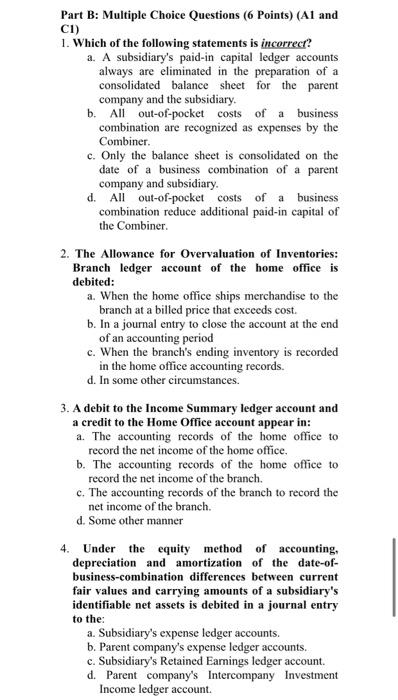

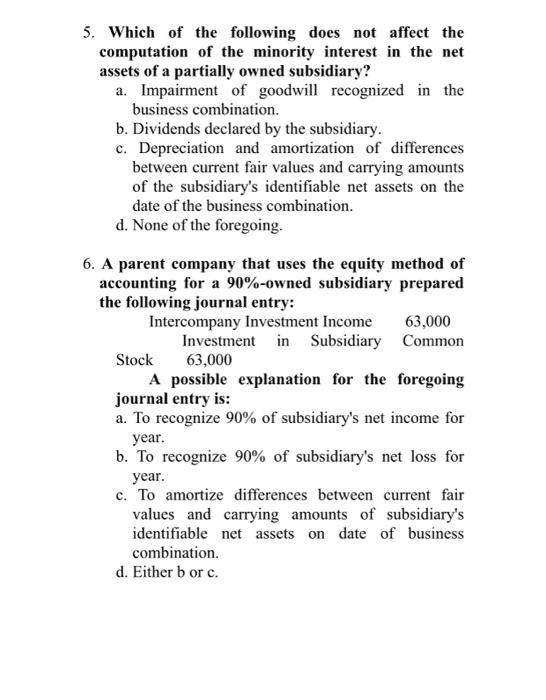

x Part B: Multiple Choice Questions (6 Points) (A1 and C1) 1. Which of the following statements is incorrect? a. A subsidiary's paid-in capital ledger

x

Part B: Multiple Choice Questions (6 Points) (A1 and C1) 1. Which of the following statements is incorrect? a. A subsidiary's paid-in capital ledger accounts always are eliminated in the preparation of a consolidated balance sheet for the parent company and the subsidiary. b. All out-of-pocket costs of a business combination are recognized as expenses by the Combiner. c. Only the balance sheet is consolidated on the date of a business combination of a parent company and subsidiary. d. All out-of-pocket costs of a business combination reduce additional paid-in capital of the Combiner. 2. The Allowance for Overvaluation of Inventories: Branch ledger account of the home office is debited: a. When the home office ships merchandise to the branch at a billed price that exceeds cost. b. In a journal entry to close the account at the end of an accounting period c. When the branch's ending inventory is recorded in the home office accounting records. d. In some other circumstances. 3. A debit to the Income Summary ledger account and a credit to the Home Office account appear in: a. The accounting records of the home office to record the net income of the home office. b. The accounting records of the home office to record the net income of the branch. c. The accounting records of the branch to record the net income of the branch. d. Some other manner 4. Under the equity method of accounting, depreciation and amortization of the date-ofbusiness-combination differences between current fair values and carrying amounts of a subsidiary's identifiable net assets is debited in a journal entry to the: a. Subsidiary's expense ledger accounts. b. Parent company's expense ledger accounts. c. Subsidiary's Retained Eamings ledger account. d. Parent company's Intercompany Investment Income ledger account. 5. Which of the following does not affect the computation of the minority interest in the net assets of a partially owned subsidiary? a. Impairment of goodwill recognized in the business combination. b. Dividends declared by the subsidiary. c. Depreciation and amortization of differences between current fair values and carrying amounts of the subsidiary's identifiable net assets on the date of the business combination. d. None of the foregoing. 6. A parent company that uses the equity method of accounting for a 90%-owned subsidiary prepared the following journal entry: Intercompany Investment Income 63,000 Stock 63,000 A possible explanation for the foregoing journal entry is: a. To recognize 90% of subsidiary's net income for year. b. To recognize 90% of subsidiary's net loss for year. c. To amortize differences between current fair values and carrying amounts of subsidiary's identifiable net assets on date of business combination. d. Either b or c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started