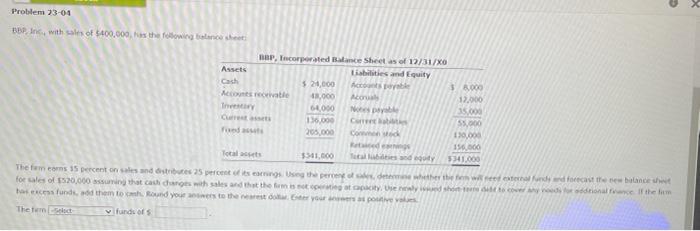

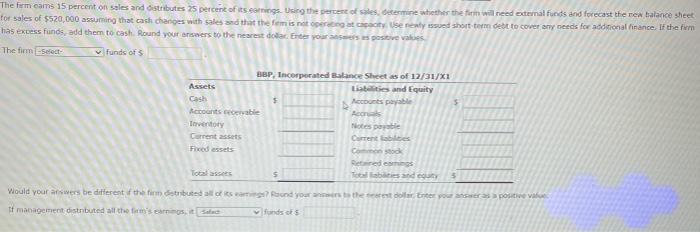

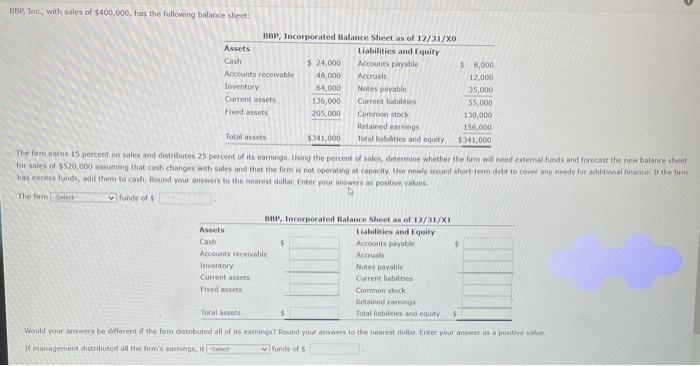

X Problem 23-01 BOP Inc. with sales of $400,000, as the following the NBP, Incorporated Balance Sheet as of 12/31/X0 abilities and Equity Costi $ 24,000 be 3.000 cate 13,000 17.000 66,000 Nos pa 15.00 16.000 55.000 205,000 Con 130.000 150.000 5341.000 The fum com 15 percent on sales and stributed 25 percent of sergs Use the procede there will feel extern und dere blandet for sales of $520,000 asuing that catures with sales and that the form og ky, sed shots on the im ce fund them to Round your the rest or your sportives Theme funds of The firm cams 15 percent on sales and distributes 25 percent of its cames. Using the percent of sales determine whether the firm will need external funds and forecast the new balance sheet for sales of $520,000 assuming that cash changes with sales and that the form is not person to Use realy essed short-term debt to cover any needs for additional finance. If the form has excess funds, add them to cash Round your answers to the nearest doar Enter your positive values The firm select funds of BBP, Incorporated Balance Sheet as of 12/31/X1 Assets Lisbetes and Equity Cash Accounts payable 5 Account corable Reak levertory Garent assets Carrentables Feed assets Com stod Dendemos Tocadas 5 5 Would your answers be different them distributed all of it and your attentottet youts positive If management distnbuted all the firm's mostSalt BBP, Inc., with sales of $400,000, has the following balance sheet: BBP, Incorporated Balance Sheet as of 12/31/XO Assets Liabilities and Equity Cash 5 24,000 Accounts payable $ 8,000 Accounts receivable 18,000 Accruals 12,000 Inventory 64,000 Notes payable 35,000 Current as 136,000 Current liabilities 55,000 Fixed assets 205,000 Common stock 130,000 Retained earnings 156,000 Total assets $341,000 Total Babies and equity $341,000 The formers 35 percent on sales and distributes 25 percent of its earnings. Using the percent of sales, determine whether the firm will need external funds and forecast the new balance sheet for sales of $520,000 assuming that cash changes with sales and that the firm is not operating at capacity, se newly wed short-term debt to cover any needs for additional finanon. I the tim has excess Funds, add them to cosh Round your answers to the nearest dollar. Enter your answers a positive values The format funds of A. Incorporate Balance sheets of 12/31/X1 Assets Liabilities and Equity Cach $ Accounts payable $ Accounts receivable Accruals Inventory Notes payable Current assets Current Babies Fixed assets Common stock Retained wings Totalisses Total abilities and equity 5 Would your answers be diferent the form distnbuted all of its ning Round your answers to the nearest dolor. Enter your answer as a nosite wa Il management distributed all the firm's earnings itt funds of