Answered step by step

Verified Expert Solution

Question

1 Approved Answer

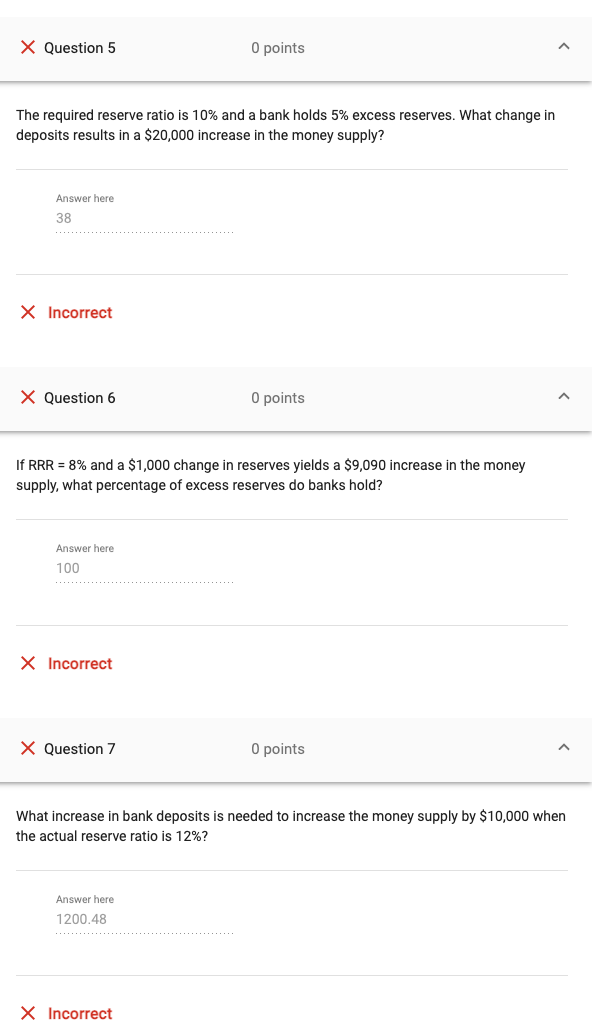

X Question 5 The required reserve ratio is 10% and a bank holds 5% excess reserves. What change in deposits results in a $20,000

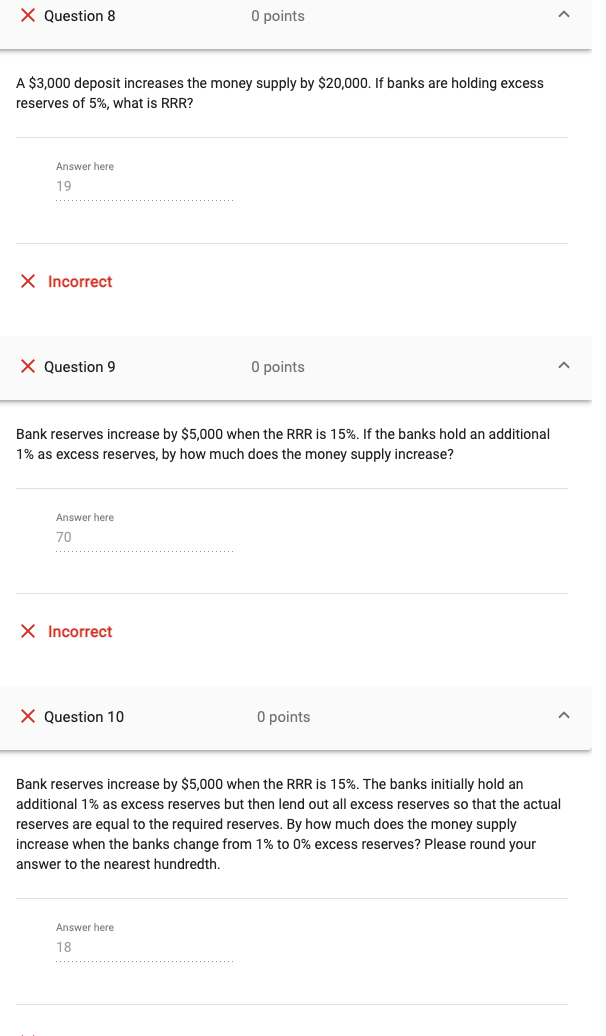

X Question 5 The required reserve ratio is 10% and a bank holds 5% excess reserves. What change in deposits results in a $20,000 increase in the money supply? Answer here 38 X Incorrect X Question 6 Answer here 100 If RRR = 8% and a $1,000 change in reserves yields a $9,090 increase in the money supply, what percentage of excess reserves do banks hold? X Incorrect X Question 7 0 points Answer here 1200.48 0 points X Incorrect What increase in bank deposits is needed to increase the money supply by $10,000 when the actual reserve ratio is 12%? 0 points X Question 8 A $3,000 deposit increases the money supply by $20,000. If banks are holding excess reserves of 5%, what is RRR? Answer here 19 X Incorrect X Question 9 Answer here 70 Bank reserves increase by $5,000 when the RRR is 15%. If the banks hold an additional 1% as excess reserves, by how much does the money supply increase? X Incorrect 0 points X Question 10 0 points Answer here 18 0 points < Bank reserves increase by $5,000 when the RRR is 15%. The banks initially hold an additional 1% as excess reserves but then lend out all excess reserves so that the actual reserves are equal to the required reserves. By how much does the money supply increase when the banks change from 1% to 0% excess reserves? Please round your answer to the nearest hundredth.

Step by Step Solution

★★★★★

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Lets go through each question and calculate the correct answers Question 5 textChange in deposits ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started