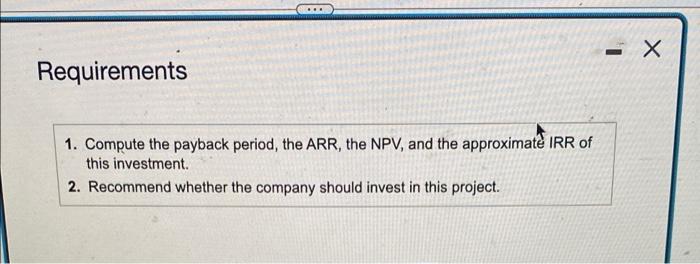

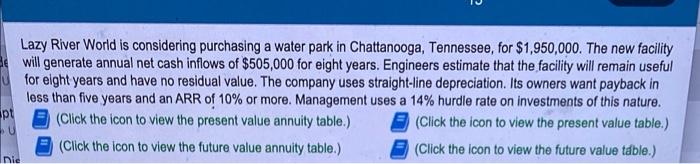

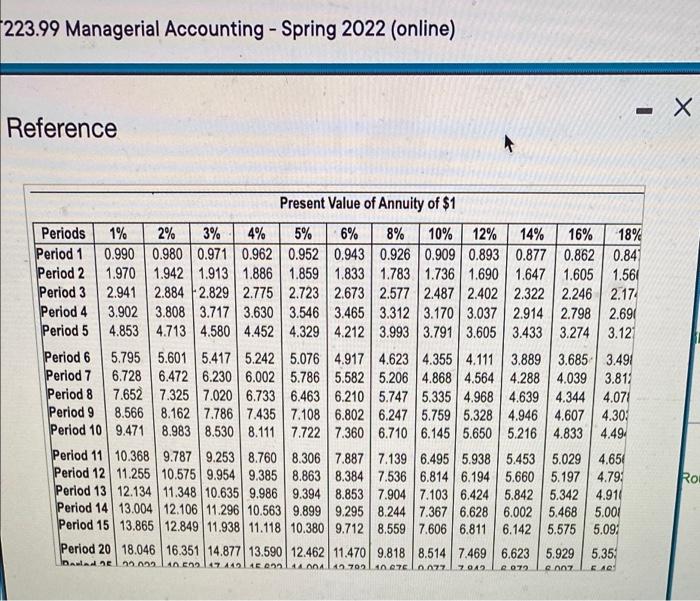

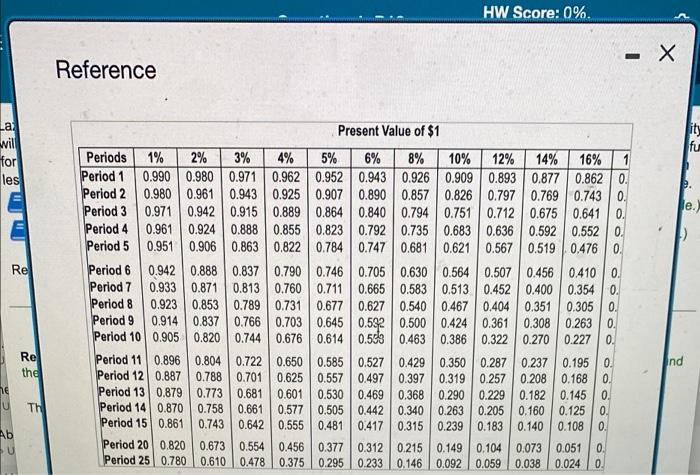

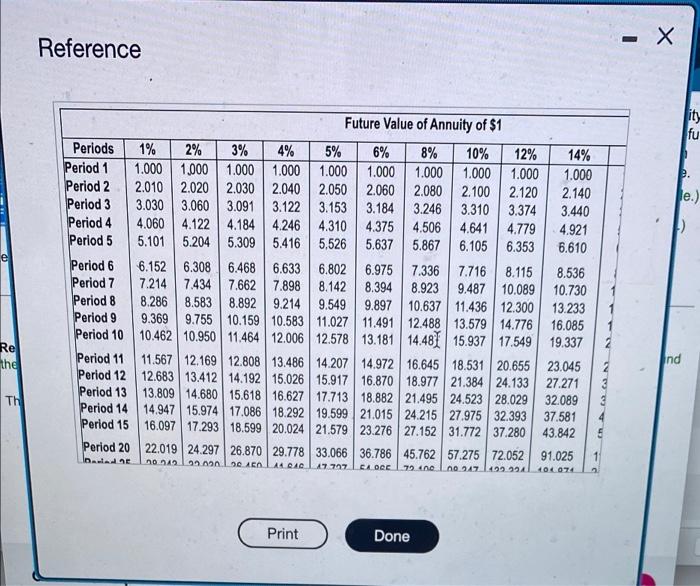

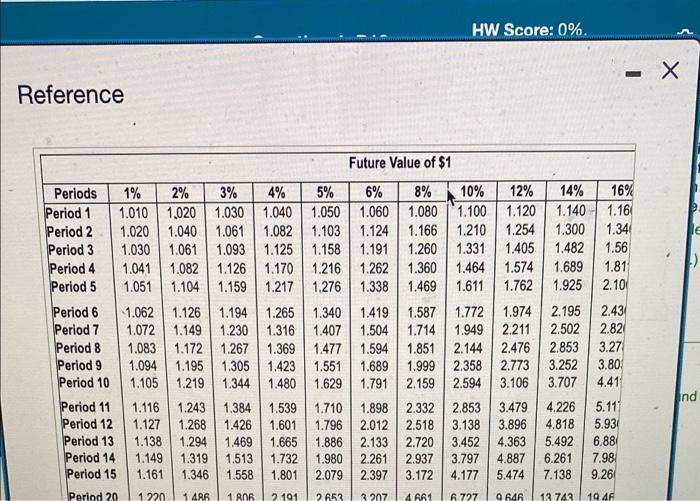

... - X Requirements 1. Compute the payback period, the ARR, the NPV, and the approximate IRR of this investment. 2. Recommend whether the company should invest in this project. Lazy River World is considering purchasing a water park in Chattanooga, Tennessee, for $1,950,000. The new facility will generate annual net cash inflows of $505,000 for eight years. Engineers estimate that the facility will remain useful for elght years and have no residual value. The company uses straight-line depreciation. Its owners want payback in less than five years and an ARR of 10% or more. Management uses a 14% hurdle rate on investments of this nature. pt (Click the icon to view the present value annuity table.) (Click the icon to view the present value table.) U (Click the icon to view the future value annuity table.) (Click the icon to view the future value table.) Die 223.99 Managerial Accounting - Spring 2022 (online) - X Reference Present Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.84 Period 2 1.970 1.942 1.9131.886 1.859 1.833 1.783 1.736 1.690 1.6471.605 1.561 Period 3 2.9412.884 2.829 2.775 2.723 2.673 2.577 2.487 2.402 2.322 2.246 2.17 Period 4 3.902 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3.037 2.914 2.798 2.691 Period 5 4.853 4.713 4.580 4.452 4.329 4.2123.993 3.791 | 3.605 3.433 3.274 3.12 Period 6 5.795 5.601 5.417 5.242 5.076 4.917 4.623 4.355 4.111 3.889 3.685 3.49 Period 7 6.728 6.472 6.230 6.0025.786 5.5825.206 4.868 4.564 4.288 4.039 3.811 Period 8 7.652 7.325 7.020 6.733 6.463 6.210 5.747 5.335 4.9684.6394.344 4.07 Period 9 8.566 8.162 7.786 7.4357.108 6.8026.247 5.759 5.328 4.946 4.607 4.30 Period 10 9.471 8.983 8.530 8.111 7.722 7.360 6.710 6.145 5.6505.216 4.833 4.49 Period 11 | 10.3689.787 9.253 8.760 8.306 7.887 7.139 6.495 5.938 5.453 5.029 4.65 Period 12 11.255 10.575 9.9549.385 8.8638.384 7.536 6.814 6.194 5.660 5.1974.79; Period 13 12.134 11.348 10.635 9.986 9.394 8.853 7.904 7.103 6.424 5.842 5.342 4.91 Period 14 13.004 12.106 11.296 10.563 9.899 9.2958.244 7.367 6.6286.002 5.468 5.001 Period 15 13.865 12.849 11.938 11.118 10.380 9.712 8.559 7.606 6.811 6.142 5.575 5.091 Period 20 18.046 16.351 14.877 13.590 12.462 11.470 9.818 8.514 7.469 6.623 5.929 5.35 Rou Dalada 0.003 10 147 ALCOOLAAAA 700 107 10.077 OAD Oy 007 HW Score: 0%. Reference Present Value of $1 La wil for its fu les Re Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 1 Period 1 0.990 0.980 0.971 0.962 0.9520.943 0.926 0.909 0.893 0.877 0.862 0. Period 2 0.9800.961 0.943 0.925 0.907 0.890 0.8570.826 0.797 0.769 0.743 0. Period 3 0.971 0.942 0.915 0.889 0.864 0.840 0.794 0.751 0.712 0.675 0.641 0. Period 4 0.961 0.924 0.888 0.855 0.823 0.792 0.735 0.683 0.636 0.592 552 0. Period 5 0.951 0.906 0.863 0.822 0.784 0.747 0.681 0.621 0.567 0.519 0.476 0. Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.630 0.564 0.507 0.4560.4100 Period 7 0.933 0.871 0.813 0.760 0.7110.665 0.583 0.513 0.452 0.400 0.354 0. Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.540 0.467 0.4040.351 0.305 0. Period 9 0.914 0.837 0.766 0.703 0.645 0.532 0.500 0.424 0.361 0.308 0.263 0. Period 100.905 0.820 0.744 0.676 0.614 0.50 0.463 0.386 0.322 0.270 0.227 0. Period 110.896 0.8040.722 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.1950. Period 12 0.887 0.788 0.701 0.625 0.557 0.497 0.397 0.319 0.257 0.208 0.168 0. Period 130.879 0.773 0.681 0.601 0.530 0.469 0.368 0.290 0.229 0.182 0.145 0. Period 14 0.870 0.758 0.661 0.577 0.505 0.442 0.340 0.263 0.205 0.160 0.125 0. Period 151 0.861 0.743 0.642 0.555 0.481 0.417 0.315 0.2390.183 0.140 0.1080. Period 200.820 0.673 0.554 0.456 0.377 0.312 0.215 0.149 0.104 0.073 0.051 0. Period 25 0.780 0.610 0.478 0.375 0.295 0.233 0.146 0.092 0.059 0.038 0.024 0 Re the nd Y TH Ab - X Reference ity fu P. e.) Future Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% Period 1 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 Period 2 2.010 2.020 2.030 2.040 2.050 2.060 2.080 2.100 2.120 2.140 Period 3 3.030 3.060 3.091 3.122 3.153 3.184 3.246 3.310 3.374 3.440 Period 4 4.0604.122 4.184 4.246 4.310 4.375 4.506 4.641 4.779 4.921 Period 5 5.101 5.204 5.309 5.416 5,526 5.637 5.8676.105 6.353 6.610 Period 6 6.152 6.308 6.468 6.633 6.802 6.975 7.336 7.716 8.115 8.536 Period 7 7.214 7.434 7.662 7.898 8.142 8.394 8.923 9.487 10.089 10.730 Period 8 8.286 8.5838.8929.214 9.549 9.897 10.637 11.436 12.300 13.233 Period 9 9.369 9.755 10.159 10.583 11.027 11.491 12.488 13.579 14.776 16.085 Period 10 10.462 10.950 11.464 12.006 12.578 13.181 14.4815.937 17.549 19.337 Period 11 11.567 12.169 12.808 13.486 14.207 14.972 16.645 18.531 20.655 23.045 Period 12 12.683 13.412 14.192 15.026 15.917 16.870 18.977 21.384 24.133 27.271 Period 13 13.809 14.680 15.618 16.627 17.713 18.882 21.495 24.523 28.029 32.089 Period 14 14.947 15.974 17.086 18.292 19.599 21.015 24.215 27.975 32.393 37.581 Period 15 16.097 17.293 18.599 20.024 21.579 23.276 27.152 31.772 37.280 43.842 Period 20 22.019 24.297 26.870 29.778 33.066 36.786 45.762 57.275 72.052 91.025 loaded 10 Ann. 100 AC 79.10 00.347 1494 104074 Re the nd Th ch A4010 47707 ti b Print Done HW Score: 0% - X Reference Future Value of $1 le Periods 1% 2% 3% 4% Period 1 1.010 1.020 1.030 1.040 Period 2 1.020 1.040 1.061 1.082 Period 3 1.030 1.061 1.093 1.125 Period 4 1.041 1.082 1.126 1.170 Period 5 1.051 1.104 1.159 | 1.217 Period 6 1.062 1.126 1.194 1.265 Period 7 1.072 1.149 1.2301.316 Period 8 1.083 1.1721.267 1.369 Period 9 1.094 1.195 1.305 1.423 Period 10 1.105 1.219 1.344 1.480 Period 11 1.116 1.243 1.384 1.539 Period 12 1.127 1.268 1.426 1.601 Period 13 1.138 1.294 1.469 1.665 Period 14 1.149 1.319 1.513 1.732 Period 15 1.161 1.346 1.558 1.801 5% 6% 8% 10% 12% 14% 16% 1.050 1.060 1.080 1.100 1.120 1.140 1.16 1.103 1.124 1.166 1.210 1.254 1.300 1.34 1.158 1.191 1.260 1.331 1.405 1.482 1.56 1.216 1.262 1.360 1.464 1.574 1.689 1.81 1.276 1.338 1.469 1.611 1.762 1.925 2.10 1.340 1.419 1.587 1.772 1.974 2.195 2.43 1.407 1.504 1.714 1.949 2.211 2.502 2.82 1.477 1.594 1.851 2.144 2.476 2.853 3.27 1.551 1.689 1.999 2.358 2.773 3.252 3.80 1.629 1.791 2.159 2.594 3.106 3.707 4.41 1.710 1.898 2.3322853 3.479 4.226 5.11 1.796 2.012 2.518 3.138 3.896 4.818 5.93 1.886 2.133 2.720 3.452 4.363 5.492 6.88 1.980 2.261 2.937 3.797 4.887 6.261 7.98 2.079 2.397 3.172 4.177 5.474 7.138 9.26 2653 3207 4 661 6727 946 13 743 1946 Ind Period 20 1220 1 4RR 1 AR 2 191 Acc DU Requirement 1. Compute the payback period, the ARR, the NPV, and the approximate IRR of this investment (Round the payback period to one decimal place.) Ton me HD The payback period (in years) is dak- Ab HOU udak-Ab sh HD