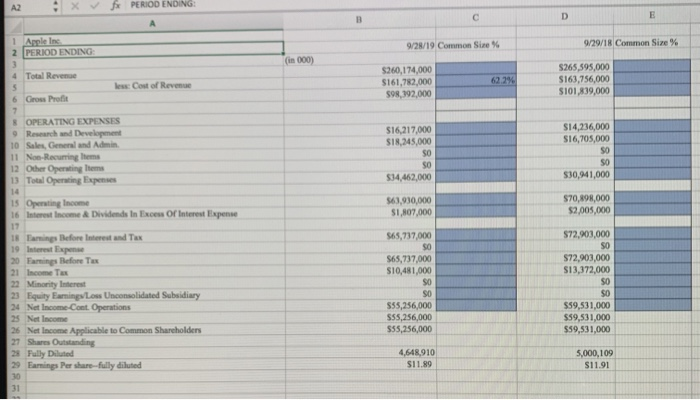

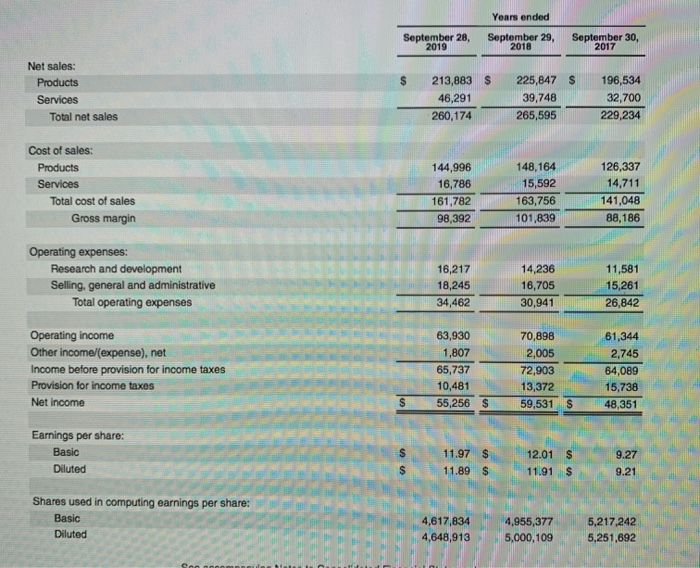

:x v f PERIOD ENDING: A2 1 Apple Inc 2 PERIOD ENDING 9/29/18 Common Size % 9/28/19 Common Size % (in 000) 3. $265,595,000 S163,756,000 S101,839,000 $260,174,000 S161,782,000 S98,392,000 4 Total Revenue 62.2% less: Cost of Revenue 6 Gross Profit 7. 8 OPERATING EXPENSES 9 Research and Development 10 Sales, General and Admin. 11 Non-Recuring hems 12 Other Operating Items 13 Total Operating Expenses S14,236,000 S16,705,000 S16,217,000 SI8,245,000 $30,941,000 $34,462,000 14 $63,930,000 S1,807,000 S70,898,000 $2,005,000 15 Operating Income 16 Interest Income& Dividends In Excess Of Interest Expense 17 S72,903,000 18 Tamings Before Interest and Tax 19 Interest Expense 20 Farmings Before Tax 21 Income Tax 22 Minority Interest 23 Equity Eamings/Loss Unconsolidated Subsidiary 24 Net Income-Cont. Operations 25 Net Income 26 Net Income Applicable to Common Shareholders 27 Shares Outstanding 28 Pully Diluted 29 Earmings Per share-fully diluted 30 $65,737,000 $65,737,000 S10,481,000 S0 S72,903,000 S13,372,000 S0 S55,256,000 S55,256,000 S59,531,000 S59,531,000 $59,531,000 S55,256,000 4,648,910 5,000,109 SI1.89 S11.91 31 Years ended September 28, 2019 September 29, 2018 September 30, 2017 Net sales: 213,883 $ 225,847 S 196,534 Products 46,291 39,748 32,700 Services 265,595 229,234 260,174 Total net sales Cost of sales: 148,164 126,337 Products 144,996 Services 16,786 15,592 14,711 163,756 141,048 Total cost of sales 161,782 Gross margin 101,839 88,186 98,392 Operating expenses: Research and development 16,217 14,236 11,581 Selling, general and administrative Total operating expenses 18,245 16,705 15,261 34,462 30,941 26,842 Operating income 63,930 70,898 61,344 Other income/(expense), net 1,807 2,005 2,745 72,903 Income before provision for income taxes Provision for income taxes 65,737 64,089 10,481 13,372 15,738 48,351 Net income 59,531 S 55,256 $ Earnings per share: Basic 11.97 $ 12.01 $ 9.27 Diluted 11.89 $ 11.91 $ 9.21 Shares used in computing earnings per share: Basic 4,617,834 4,955,377 5,217,242 Diluted 4,648,913 5,000,109 5,251,692 :x v f PERIOD ENDING: A2 1 Apple Inc 2 PERIOD ENDING 9/29/18 Common Size % 9/28/19 Common Size % (in 000) 3. $265,595,000 S163,756,000 S101,839,000 $260,174,000 S161,782,000 S98,392,000 4 Total Revenue 62.2% less: Cost of Revenue 6 Gross Profit 7. 8 OPERATING EXPENSES 9 Research and Development 10 Sales, General and Admin. 11 Non-Recuring hems 12 Other Operating Items 13 Total Operating Expenses S14,236,000 S16,705,000 S16,217,000 SI8,245,000 $30,941,000 $34,462,000 14 $63,930,000 S1,807,000 S70,898,000 $2,005,000 15 Operating Income 16 Interest Income& Dividends In Excess Of Interest Expense 17 S72,903,000 18 Tamings Before Interest and Tax 19 Interest Expense 20 Farmings Before Tax 21 Income Tax 22 Minority Interest 23 Equity Eamings/Loss Unconsolidated Subsidiary 24 Net Income-Cont. Operations 25 Net Income 26 Net Income Applicable to Common Shareholders 27 Shares Outstanding 28 Pully Diluted 29 Earmings Per share-fully diluted 30 $65,737,000 $65,737,000 S10,481,000 S0 S72,903,000 S13,372,000 S0 S55,256,000 S55,256,000 S59,531,000 S59,531,000 $59,531,000 S55,256,000 4,648,910 5,000,109 SI1.89 S11.91 31 Years ended September 28, 2019 September 29, 2018 September 30, 2017 Net sales: 213,883 $ 225,847 S 196,534 Products 46,291 39,748 32,700 Services 265,595 229,234 260,174 Total net sales Cost of sales: 148,164 126,337 Products 144,996 Services 16,786 15,592 14,711 163,756 141,048 Total cost of sales 161,782 Gross margin 101,839 88,186 98,392 Operating expenses: Research and development 16,217 14,236 11,581 Selling, general and administrative Total operating expenses 18,245 16,705 15,261 34,462 30,941 26,842 Operating income 63,930 70,898 61,344 Other income/(expense), net 1,807 2,005 2,745 72,903 Income before provision for income taxes Provision for income taxes 65,737 64,089 10,481 13,372 15,738 48,351 Net income 59,531 S 55,256 $ Earnings per share: Basic 11.97 $ 12.01 $ 9.27 Diluted 11.89 $ 11.91 $ 9.21 Shares used in computing earnings per share: Basic 4,617,834 4,955,377 5,217,242 Diluted 4,648,913 5,000,109 5,251,692