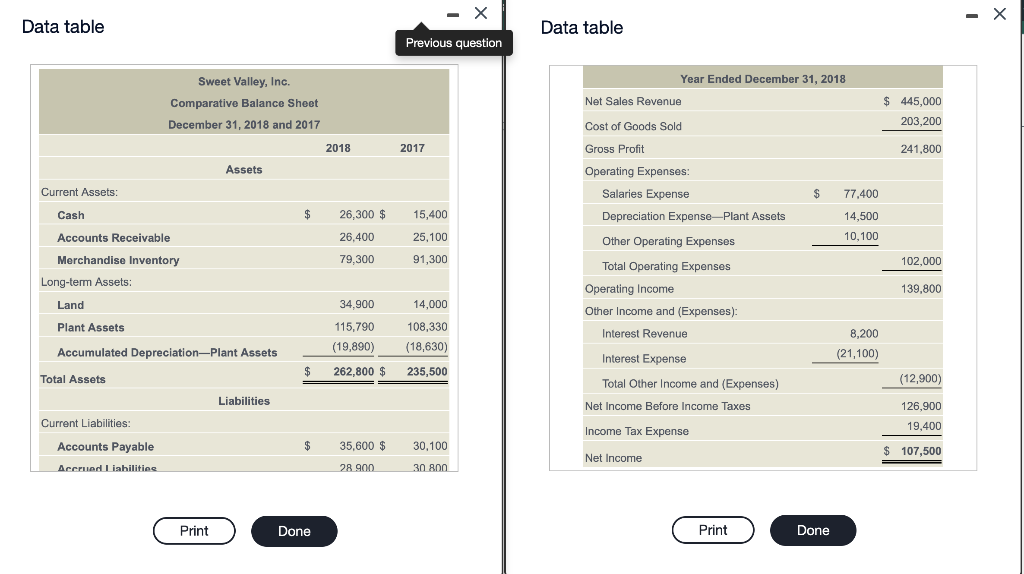

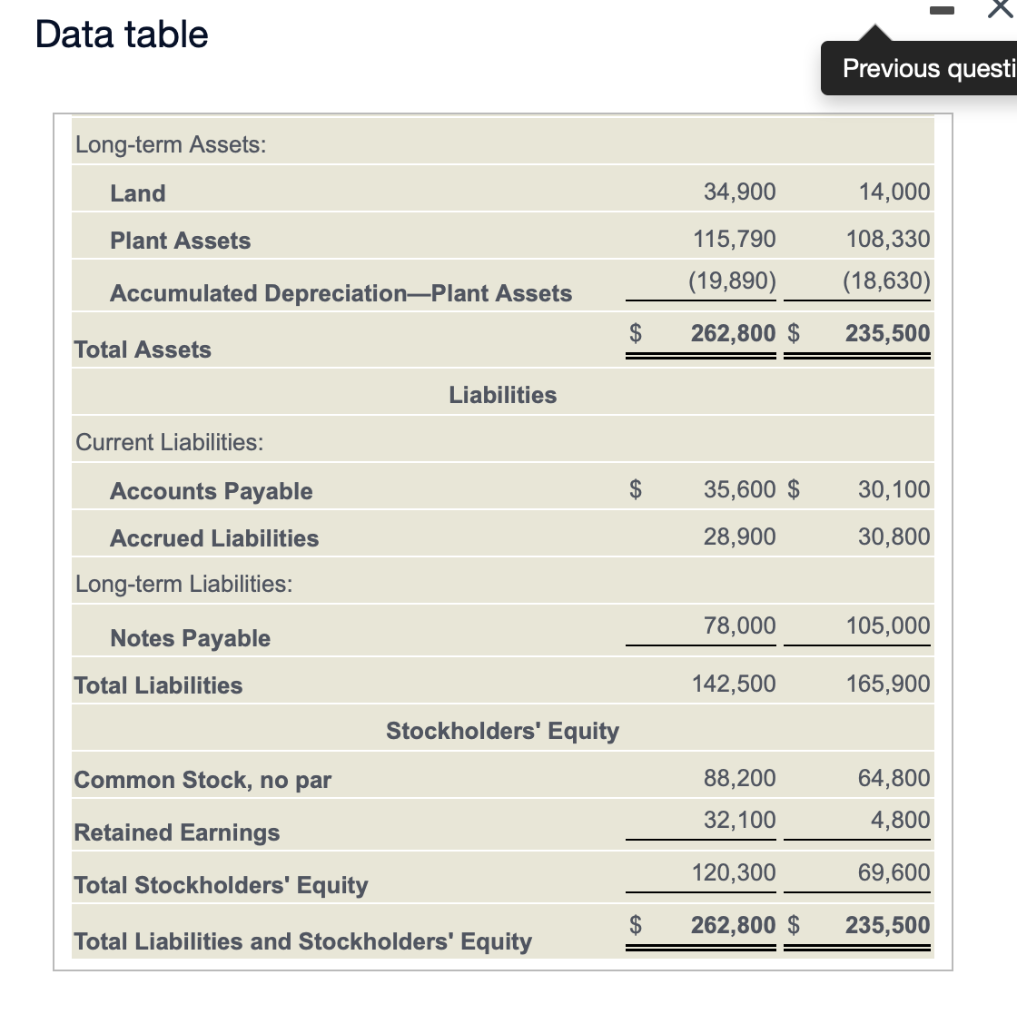

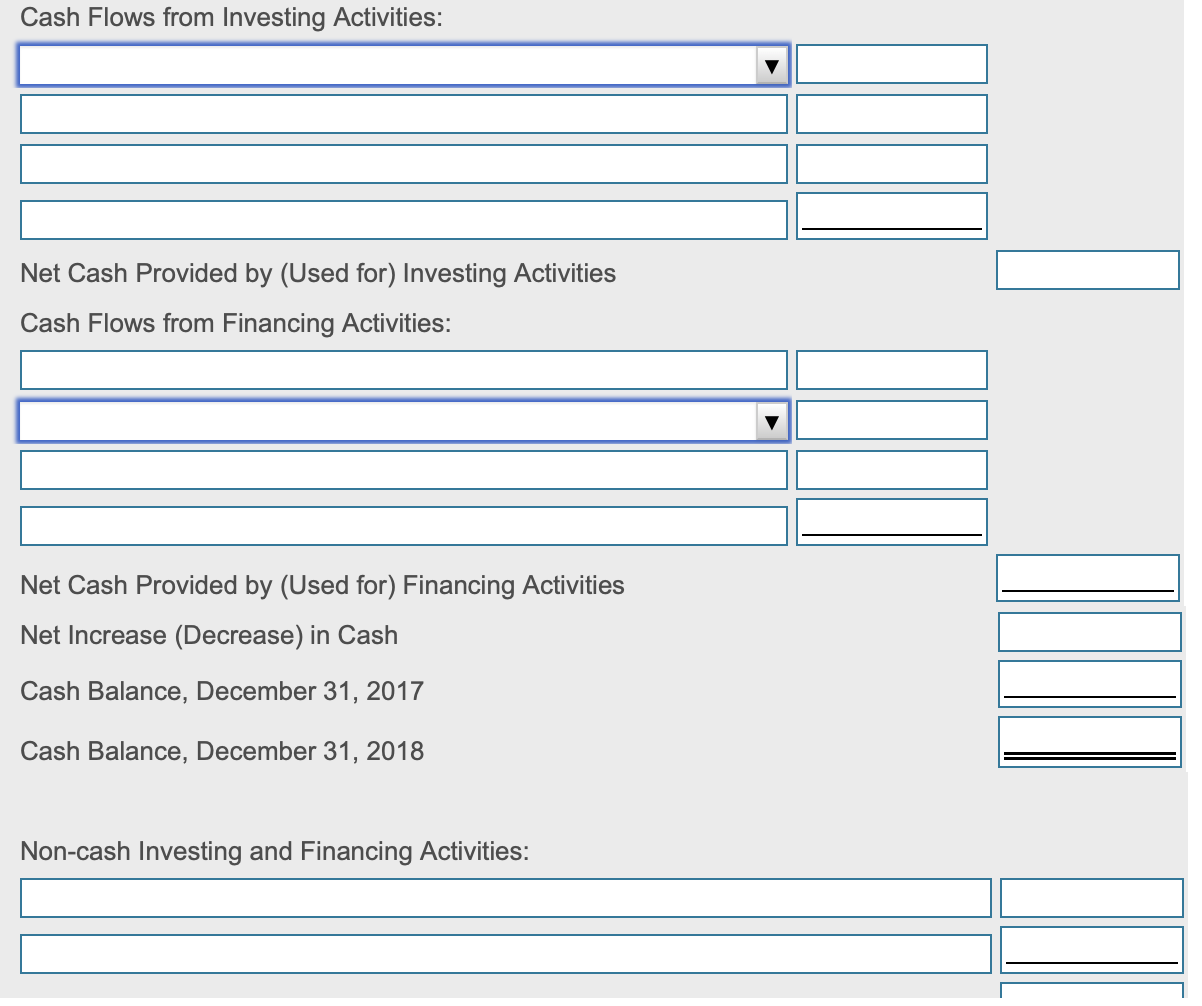

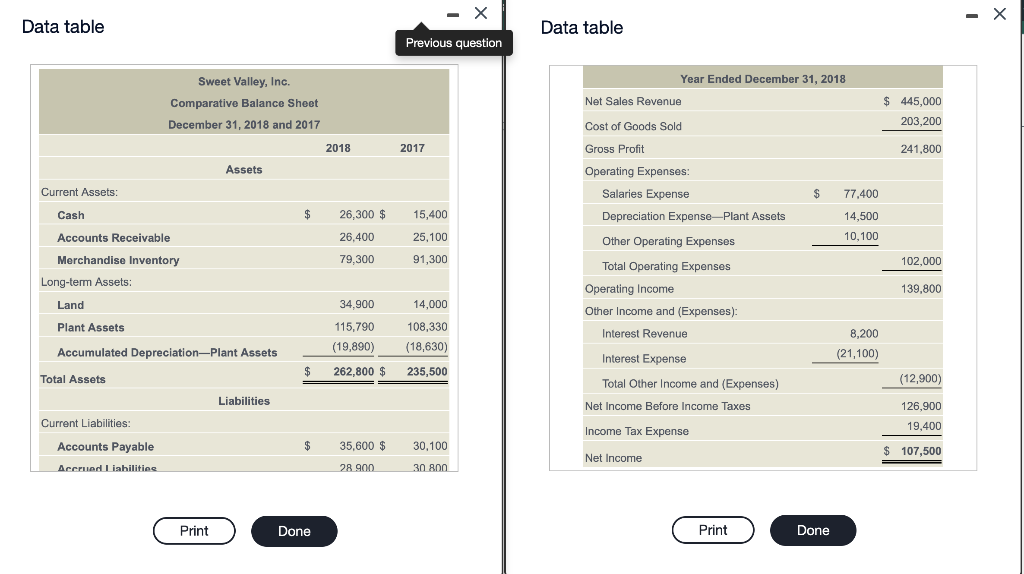

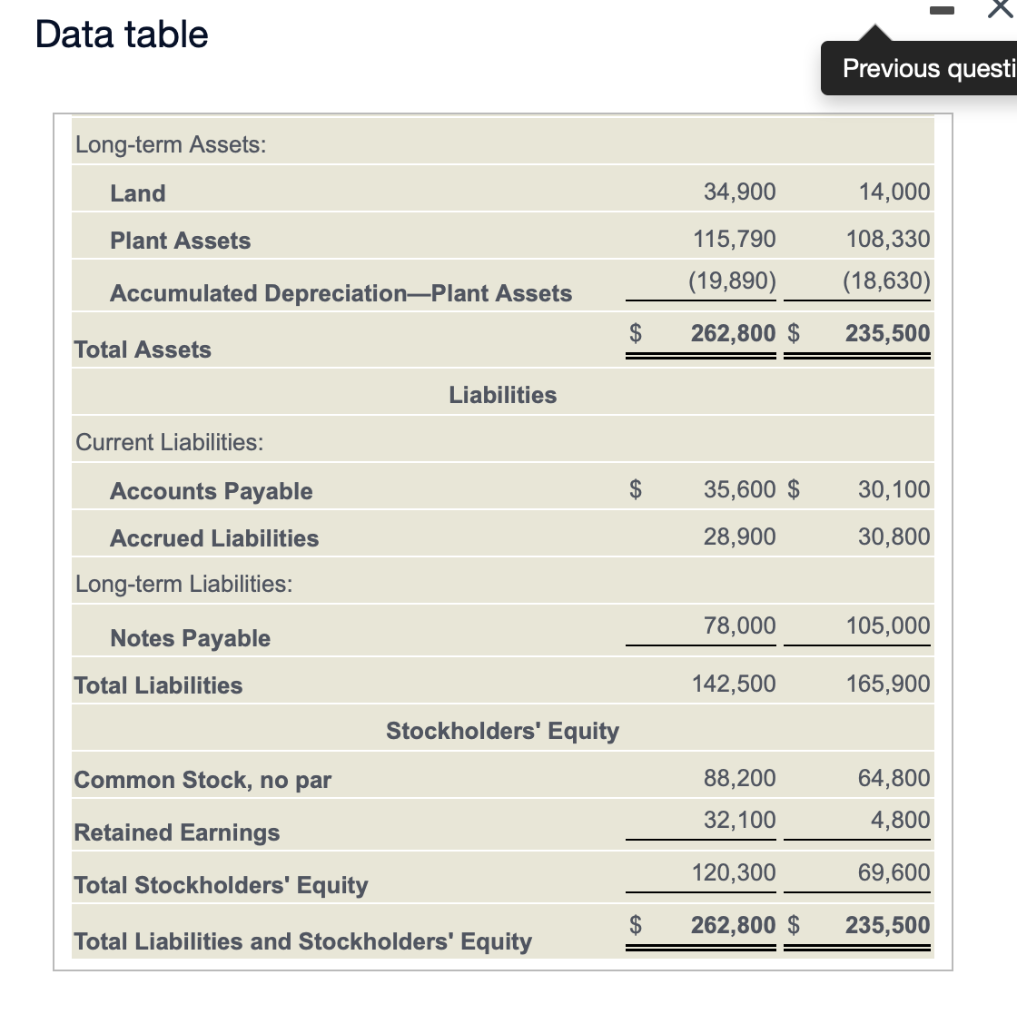

- X - X Data table Data table Previous question Sweet Valley, Inc. Comparative Balance Sheet December 31, 2018 and 2017 Year Ended December 31, 2018 Net Sales Revenue $ 445,000 203,200 2018 2017 241,800 Assets Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense Depreciation Expense-Plant Assets Current Assets: $ 77,400 Cash $ 26,300 $ 15,400 14,500 26,400 25,100 Other Operating Expenses 10,100 79,300 91,300 102,000 Accounts Receivable Merchandise Inventory Long-term Assets: Land 139,800 34,900 Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue Plant Assets 14,000 108,330 (18,630) 115,790 8,200 (21,100) Accumulated Depreciation-Plant Assets (19,890) Interest Expense $ 262,800 $ 235,500 Total Assets (12,900) Total Other Income and (Expenses) Net Income Before Income Taxes Liabilities 126.900 Current Liabilities: 19,400 Income Tax Expense $ 35,600 $ 30.100 $ 107,500 Accounts Payable Accrued liabilities Net Income 28.900 30 800 Print Done Print Done Data table Previous questi Long-term Assets: Land 34,900 14,000 Plant Assets 108,330 115,790 (19,890) Accumulated DepreciationPlant Assets (18,630) $ 262,800 $ 235,500 Total Assets Liabilities $ 35,600 $ 30,100 Current Liabilities: Accounts Payable Accrued Liabilities Long-term Liabilities: 28,900 30,800 78,000 105,000 Notes Payable Total Liabilities 142,500 165,900 Stockholders' Equity Common Stock, no par 88,200 64,800 Retained Earnings 32,100 4,800 Total Stockholders' Equity 120,300 69,600 $ 262,800 $ 235,500 Total Liabilities and Stockholders' Equity Cash Flows from Investing Activities: Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 2017 Cash Balance, December 31, 2018 Non-cash Investing and Financing Activities: - X - X Data table Data table Previous question Sweet Valley, Inc. Comparative Balance Sheet December 31, 2018 and 2017 Year Ended December 31, 2018 Net Sales Revenue $ 445,000 203,200 2018 2017 241,800 Assets Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense Depreciation Expense-Plant Assets Current Assets: $ 77,400 Cash $ 26,300 $ 15,400 14,500 26,400 25,100 Other Operating Expenses 10,100 79,300 91,300 102,000 Accounts Receivable Merchandise Inventory Long-term Assets: Land 139,800 34,900 Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue Plant Assets 14,000 108,330 (18,630) 115,790 8,200 (21,100) Accumulated Depreciation-Plant Assets (19,890) Interest Expense $ 262,800 $ 235,500 Total Assets (12,900) Total Other Income and (Expenses) Net Income Before Income Taxes Liabilities 126.900 Current Liabilities: 19,400 Income Tax Expense $ 35,600 $ 30.100 $ 107,500 Accounts Payable Accrued liabilities Net Income 28.900 30 800 Print Done Print Done Data table Previous questi Long-term Assets: Land 34,900 14,000 Plant Assets 108,330 115,790 (19,890) Accumulated DepreciationPlant Assets (18,630) $ 262,800 $ 235,500 Total Assets Liabilities $ 35,600 $ 30,100 Current Liabilities: Accounts Payable Accrued Liabilities Long-term Liabilities: 28,900 30,800 78,000 105,000 Notes Payable Total Liabilities 142,500 165,900 Stockholders' Equity Common Stock, no par 88,200 64,800 Retained Earnings 32,100 4,800 Total Stockholders' Equity 120,300 69,600 $ 262,800 $ 235,500 Total Liabilities and Stockholders' Equity Cash Flows from Investing Activities: Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 2017 Cash Balance, December 31, 2018 Non-cash Investing and Financing Activities