Question

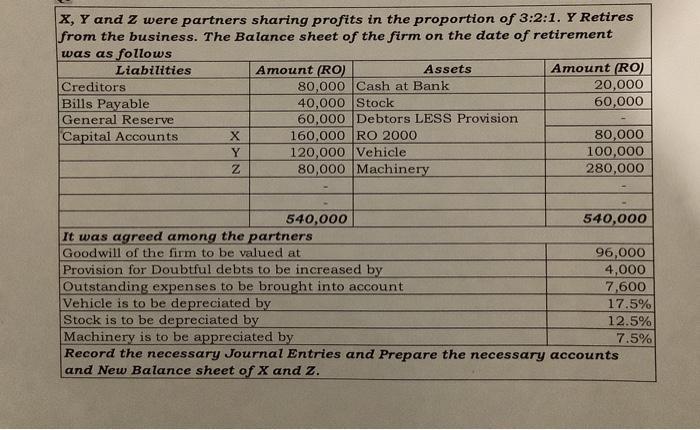

X, Y and Z were partners sharing profits in the proportion of 3:2:1. Y Retires from the business. The Balance sheet of the firm

X, Y and Z were partners sharing profits in the proportion of 3:2:1. Y Retires from the business. The Balance sheet of the firm on the date of retirement was as follows Liabilities Creditors Bills Payable General Reserve Capital Accounts X Y Z Amount (RO) 80,000 Cash at Bank 40,000 Stock 60,000 Debtors LESS Provision 160,000 RO 2000 120,000 Vehicle 80,000 540,000 Assets Machinery It was agreed among the partners Goodwill of the firm to be valued at Provision for Doubtful debts to be increased by Outstanding expenses to be brought into account Vehicle is to be depreciated by Stock is to be depreciated by Machinery is to be appreciated by Amount (RO) 20,000 60,000 80,000 100,000 280,000 540,000 96,000 4,000 7,600 17.5% 12.5% 7.5% Record the necessary Journal Entries and Prepare the necessary accounts and New Balance sheet of X and Z.

Step by Step Solution

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started