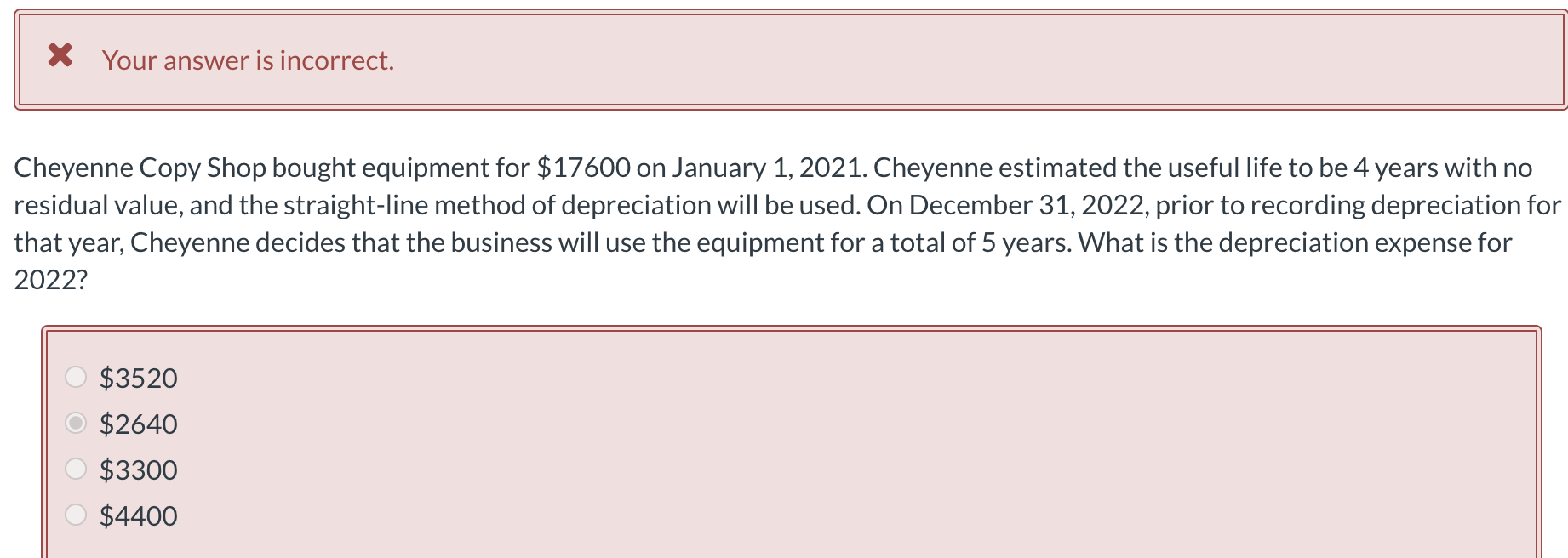

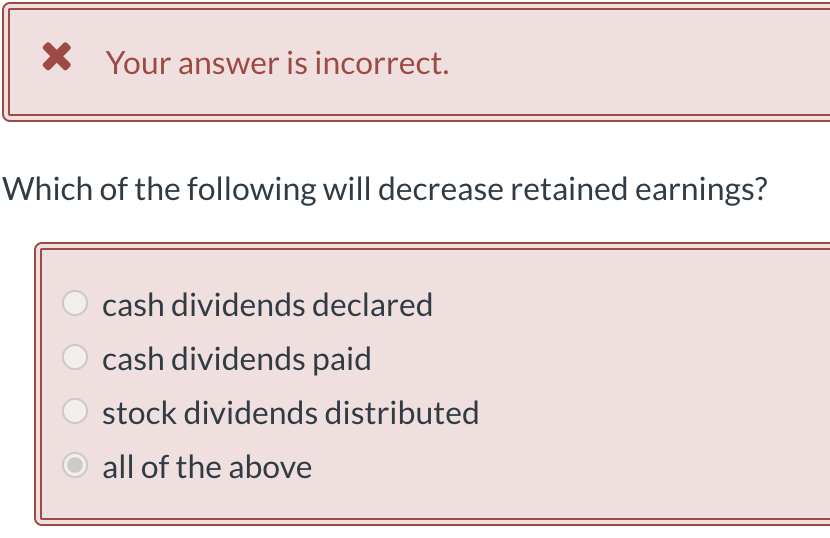

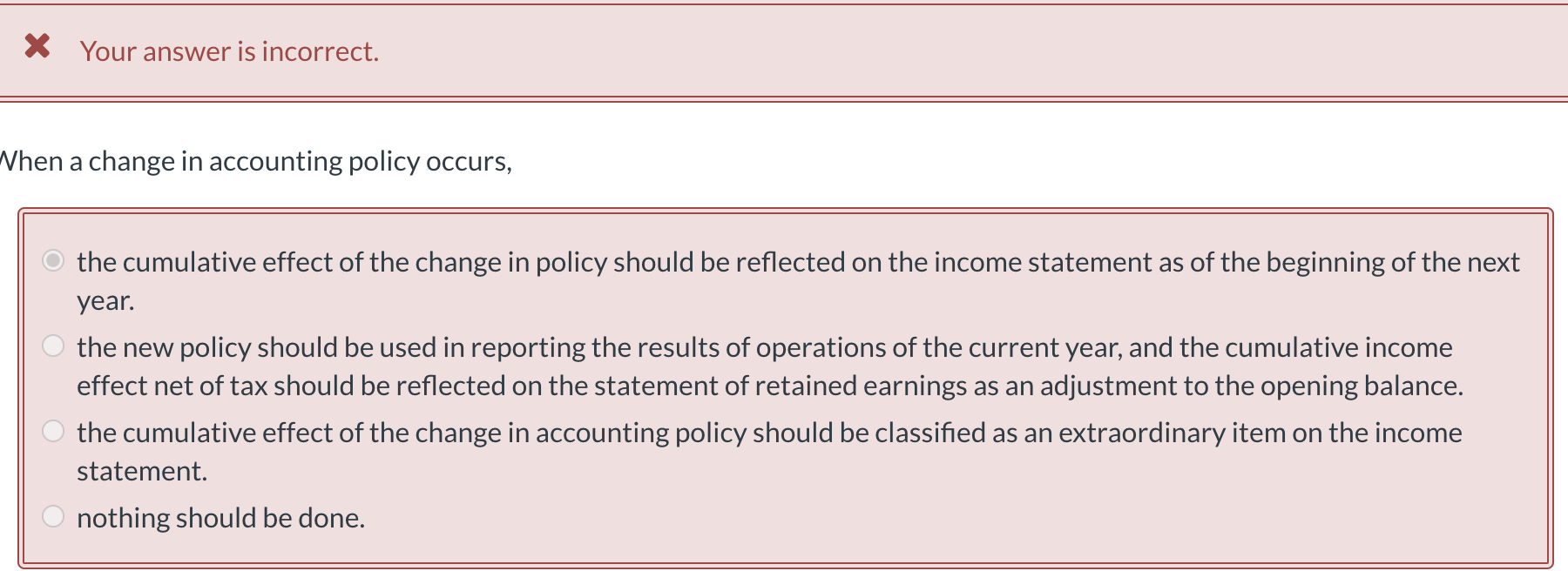

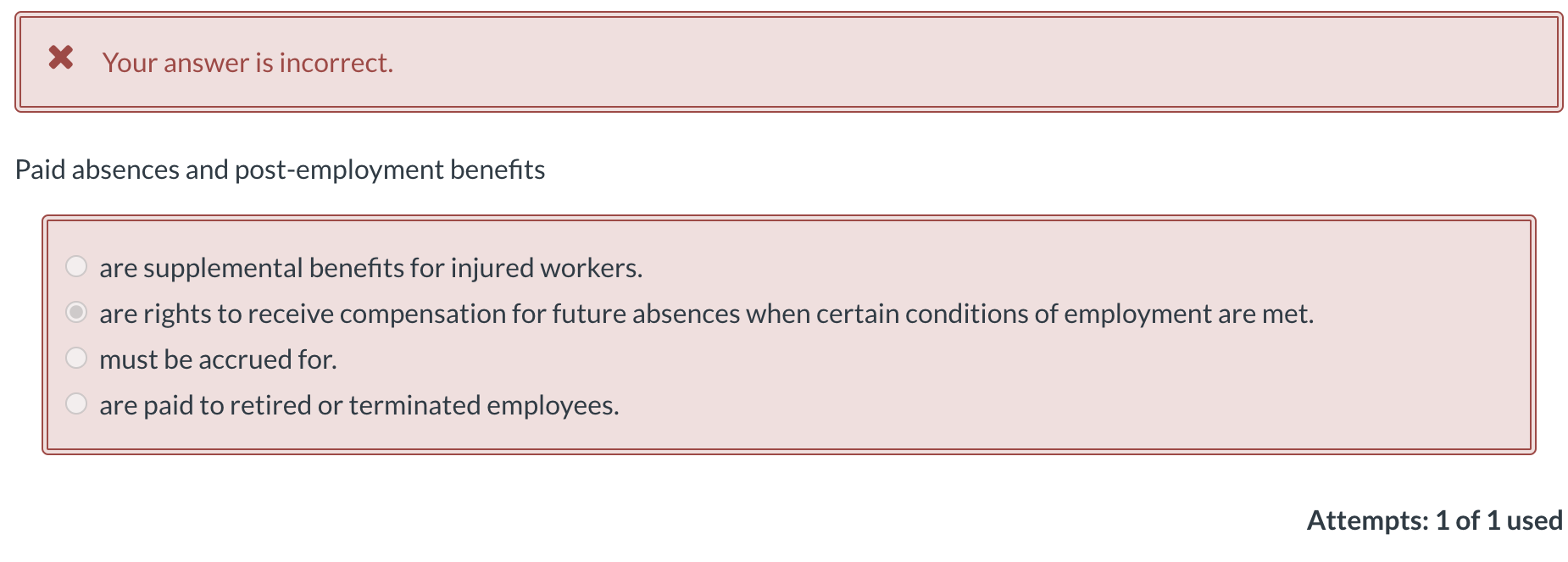

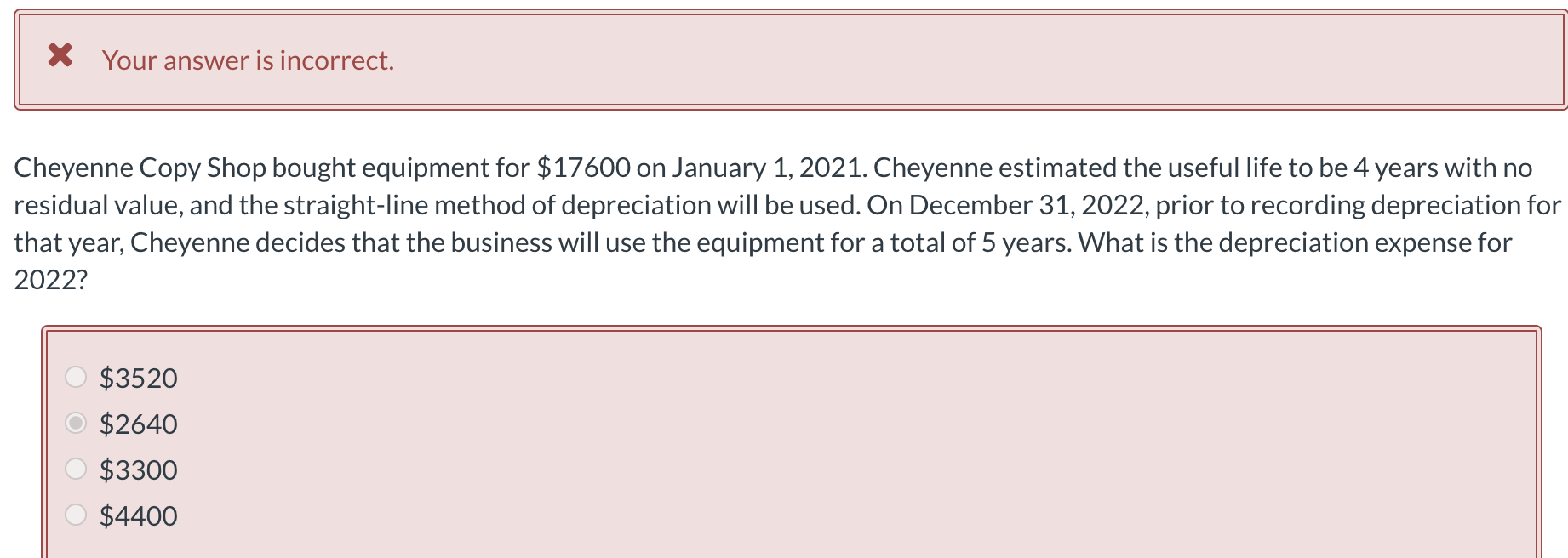

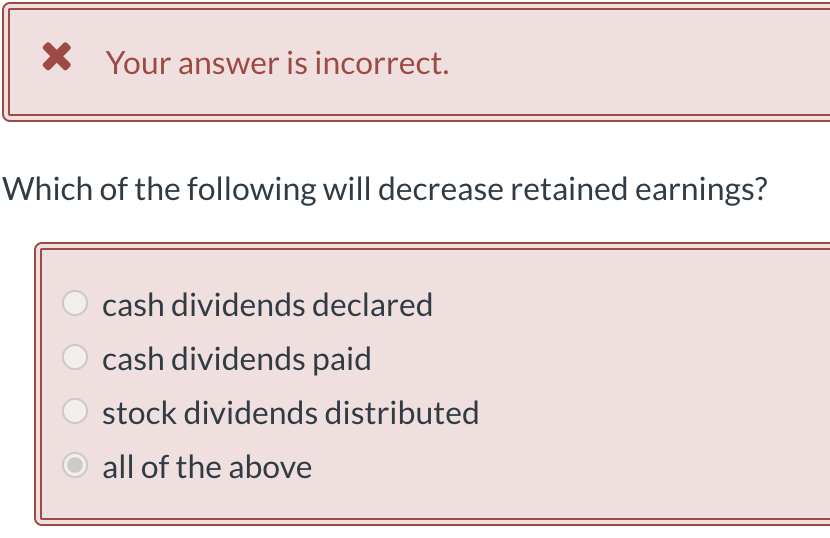

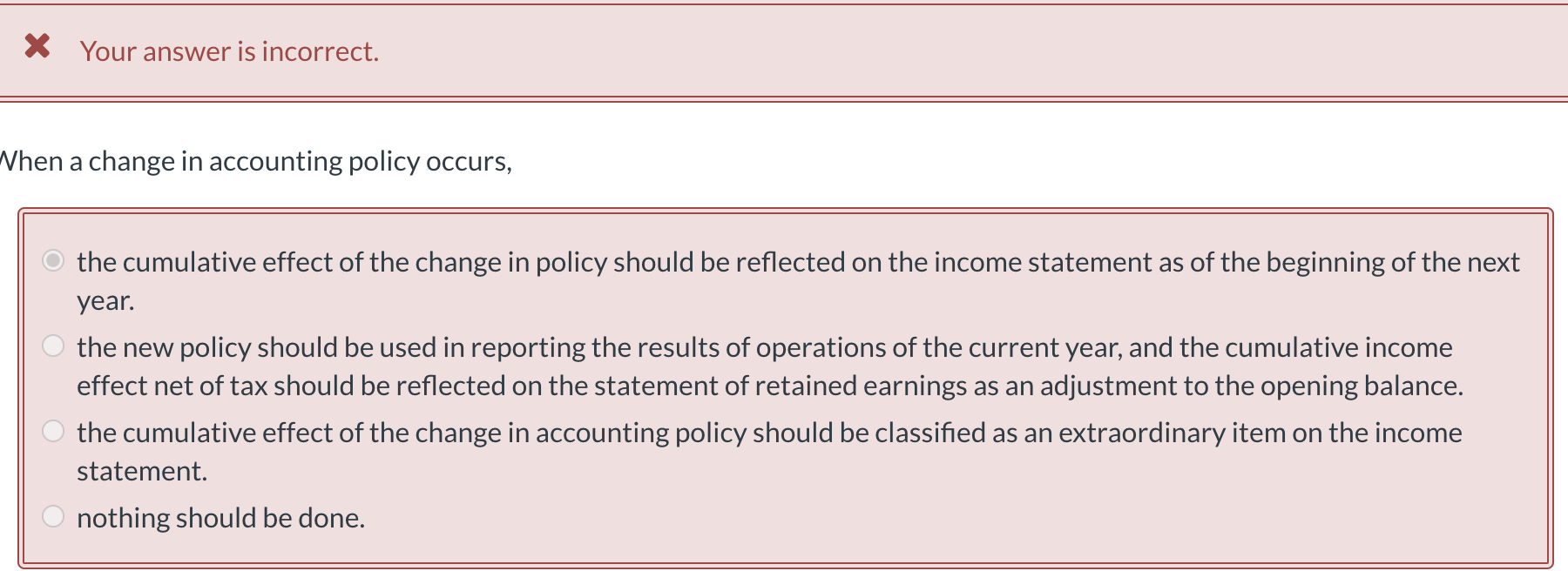

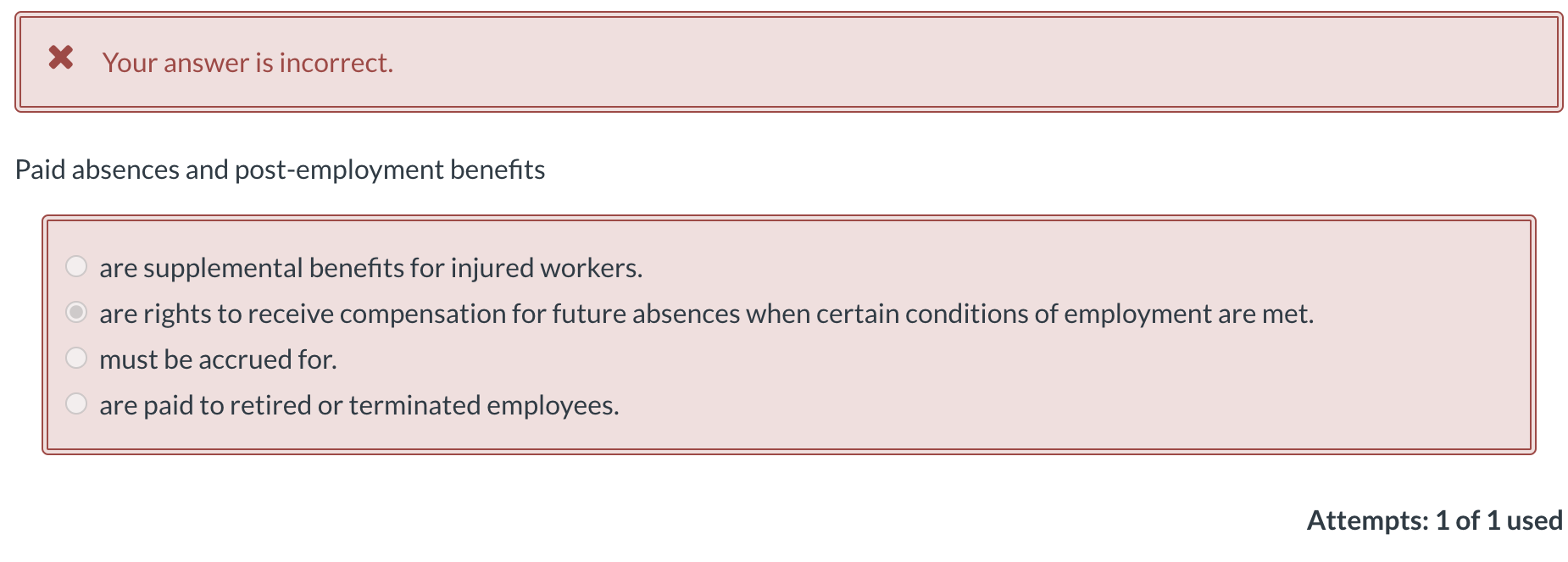

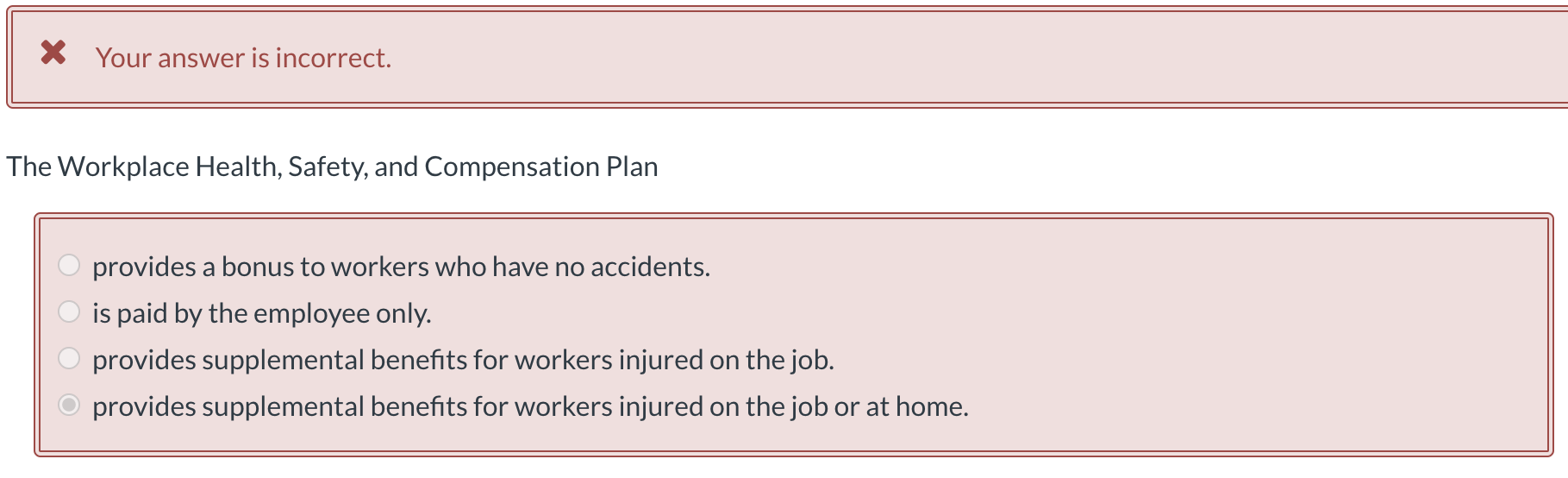

X Your answer is incorrect. Cheyenne Copy Shop bought equipment for $17600 on January 1, 2021. Cheyenne estimated the useful life to be 4 years with no residual value, and the straight-line method of depreciation will be used. On December 31, 2022, prior to recording depreciation for that year, Cheyenne decides that the business will use the equipment for a total of 5 years. What is the depreciation expense for 2022? $3520 $2640 $3300 $4400 X Your answer is incorrect. Which of the following will decrease retained earnings? cash dividends declared cash dividends paid stock dividends distributed all of the above X Your answer is incorrect. When a change in accounting policy occurs, the cumulative effect of the change in policy should be reflected on the income statement as of the beginning of the next year. the new policy should be used in reporting the results of operations of the current year, and the cumulative income effect net of tax should be reflected on the statement of retained earnings as an adjustment to the opening balance. the cumulative effect of the change in accounting policy should be classified as an extraordinary item on the income statement. nothing should be done. X Your answer is incorrect. Paid absences and post-employment benefits are supplemental benefits for injured workers. are rights to receive compensation for future absences when certain conditions of employment are met. must be accrued for. are paid to retired or terminated employees. Attempts: 1 of 1 used X Your answer is incorrect. The Workplace Health, Safety, and Compensation Plan provides a bonus to workers who have no accidents. is paid by the employee only. provides supplemental benefits for workers injured on the job. provides supplemental benefits for workers injured on the job or at home. X Your answer is incorrect. In a limited liability partnership only the general partner has unlimited liability. one or more partners have limited liability for the debts of the partnership. partners liability is limited to their investment. partners have limited liability for other partners' negligence. X Your answer is incorrect. A partner contributes, as part of her initial investment, accounts receivable with an allowance for doubtful accounts. Which of the following reflects a proper treatment? The allowance account should not be carried onto the books of the partnership. The allowance for doubtful accounts should be recorded at its fair value. 61 The accounts receivable and allowance should not be recorded on the books of the partnership because a partner must invest cash in the business. The allowance account may be set up on the books of the partnership because it relates to the existing accounts that are being contributed