Answered step by step

Verified Expert Solution

Question

1 Approved Answer

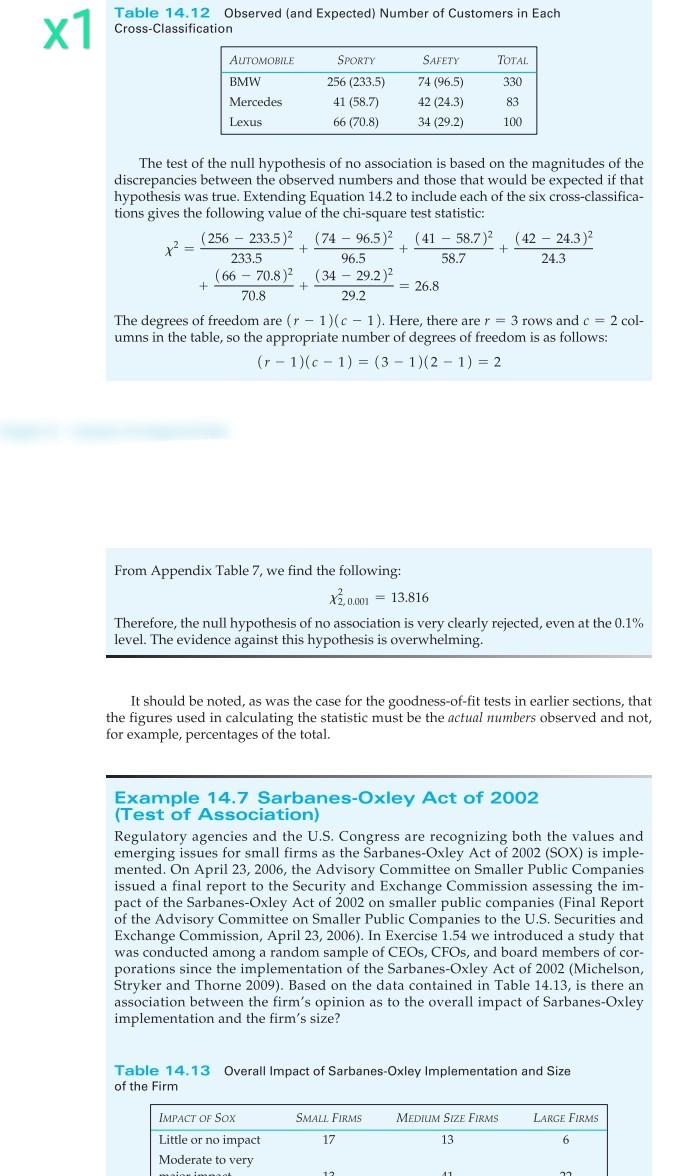

X1 Table 14.12 Observed (and Expected) Number of Customers in Each Cross-Classification SAFETY TOTAL 330 AUTOMOBILE BMW Mercedes Lexus SPORTY 256 (233.5) 41 (58.7) 66

X1 Table 14.12 Observed (and Expected) Number of Customers in Each Cross-Classification SAFETY TOTAL 330 AUTOMOBILE BMW Mercedes Lexus SPORTY 256 (233.5) 41 (58.7) 66 (70.8) 74 (96.5) 42 (24.3) 34 (29.2) 83 100 + + 233.5 The test of the null hypothesis of no association is based on the magnitudes of the discrepancies between the observed numbers and those that would be expected if that hypothesis was true. Extending Equation 14.2 to include each of the six cross-classifica- tions gives the following value of the chi-square test statistic: (256 - 233,5)2 (74 - 96.5) ( 41 - 58.7) (42 - 24.3)2 96.5 58.7 24.3 (66 - 70.8) (34 - 29.2) = 26.8 70.8 29.2 The degrees of freedom are (1 - 1)(c - 1). Here, there are r = 3 rows and c = 2 col- umns in the table, so the appropriate number of degrees of freedom is as follows: (r - 1)(0 - 1) = (3-1)(2-1) = 2 + + From Appendix Table 7, we find the following: X2,0.001 = 13.816 Therefore, the null hypothesis of no association is very clearly rejected, even at the 0.1% level. The evidence against this hypothesis is overwhelming. It should be noted, as was the case for the goodness-of-fit tests in earlier sections, that the figures used in calculating the statistic must be the actual numbers observed and not, for example, percentages of the total. Example 14.7 Sarbanes-Oxley Act of 2002 (Test of Association) Regulatory agencies and the U.S. Congress are recognizing both the values and emerging issues for small firms as the Sarbanes-Oxley Act of 2002 (SOX) is imple- mented. On April 23, 2006, the Advisory Committee on Smaller Public Companies issued a final report to the Security and Exchange Commission assessing the im- pact of the Sarbanes-Oxley Act of 2002 on smaller public companies (Final Report of the Advisory Committee on Smaller Public Companies to the U.S. Securities and Exchange Commission, April 23, 2006). In Exercise 1.54 we introduced a study that was conducted among a random sample of CEOs, CFOs, and board members of cor- porations since the implementation of the Sarbanes-Oxley Act of 2002 (Michelson, Stryker and Thorne 2009). Based on the data contained in Table 14.13, is there an association between the firm's opinion as to the overall impact of Sarbanes-Oxley implementation and the firm's size? Table 14.13 Overall Impact of Sarbanes-Oxley Implementation and Size of the Firm MEDIUM SIZE FIRMS LARGE FIRMS IMPACT OF Sox Little or no impact Moderate to very SMALL FIRMS 17 13 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started