Answered step by step

Verified Expert Solution

Question

1 Approved Answer

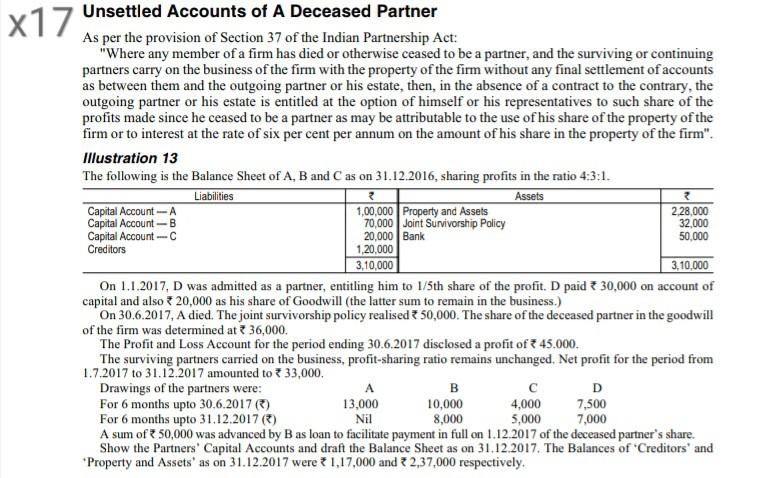

x17 Unsettled Accounts of A Deceased Partner 50,000 As per the provision of Section 37 of the Indian Partnership Act: Where any member of a

x17 Unsettled Accounts of A Deceased Partner 50,000 As per the provision of Section 37 of the Indian Partnership Act: "Where any member of a firm has died or otherwise ceased to be a partner, and the surviving or continuing partners carry on the business of the firm with the property of the firm without any final settlement of accounts as between them and the outgoing partner or his estate, then, in the absence of a contract to the contrary, the outgoing partner or his estate is entitled at the option of himself or his representatives to such share of the profits made since he ceased to be a partner as may be attributable to the use of his share of the property of the firm or to interest at the rate of six per cent per annum on the amount of his share in the property of the firm". Illustration 13 The following is the Balance Sheet of A, B and C as on 31.12.2016, sharing profits in the ratio 4:3:1. Liabilities Assets Capital Account - A 1,00,000 Property and Assets 2.28,000 Capital Account-B 70,000 Joint Survivorship Policy 32,000 Capital Account - 20,000 Bank Creditors 3,10,000 3.10,000 On 1.1.2017, D was admitted as a partner, entitling him to 1/5th share of the profit. D paid 30,000 on account of capital and also * 20,000 as his share of Goodwill (the latter sum to remain in the business.) On 30.6.2017, A died. The joint survivorship policy realised 50,000. The share of the deceased partner in the goodwill of the firm was determined at 36,000. The Profit and Loss Account for the period ending 30.6.2017 disclosed a profit of 3 45.000 The surviving partners carried on the business, profit-sharing ratio remains unchanged. Net profit for the period from 1.7.2017 to 31.12.2017 amounted to 33,000. Drawings of the partners were: A B D For 6 months upto 30.6.2017) 13,000 10,000 4,000 7,500 For 6 months upto 31.12.2017) Nil 8,000 7,000 A sum of 50,000 was advanced by B as loan to facilitate payment in full on 1.12.2017 of the deceased partner's share. Show the Partners' Capital Accounts and draft the Balance Sheet as on 31.12.2017. The Balances of 'Creditors' and * Property and Assets' as on 31.12.2017 were ? 1,17,000 and 2,37,000 respectively. 1,20,000 5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started