Question

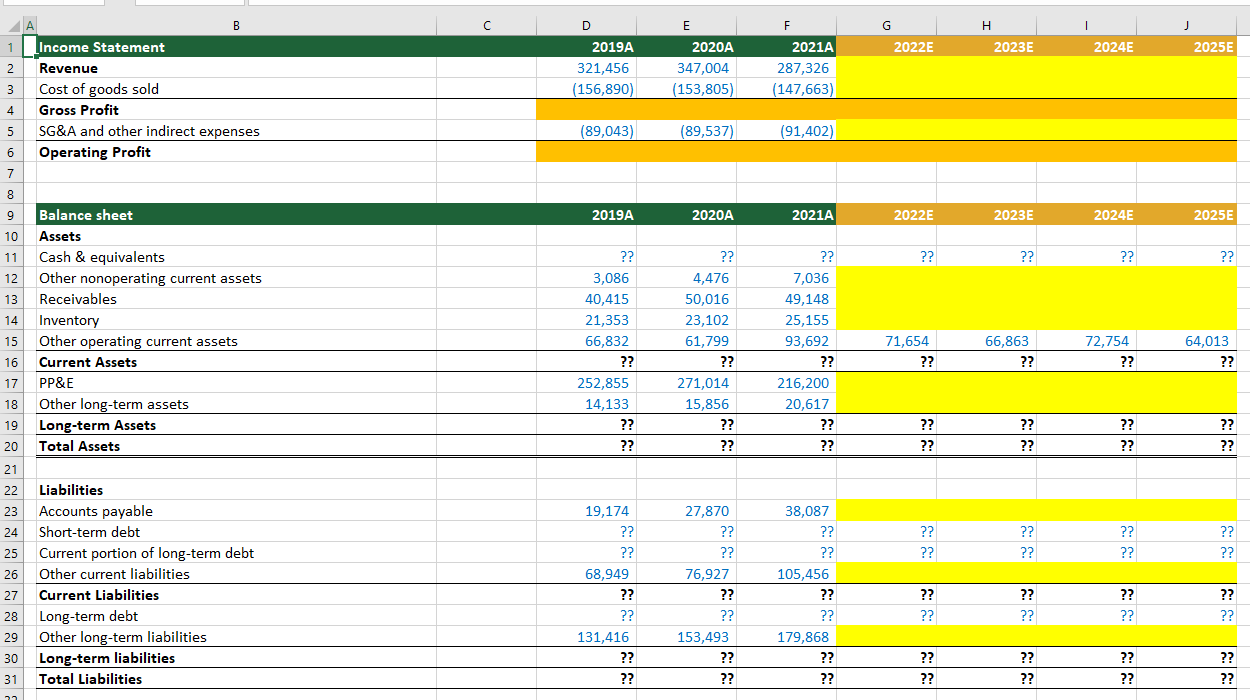

X4. Use the assumptions described in the table when modeling items that are not computed as totals or subtotals, or that are not computed using

X4. Use the assumptions described in the table when modeling items that are not computed as totals or subtotals, or that are not computed using information available from the model.

| Variable | Modeling assumptions |

| Revenue | Annual revenue growth in each forecast year equals the compound annual growth rate from the historical period |

| Cost of goods sold | Cost of goods sold to revenue in each forecast year is 1.47 percentage points better the average ratio from the historical period |

| SG&A and other indirect expenses | SG&A and other indirect expenses to revenue in the first forecast year equals the average annual ratio from the historical period. In all subsequent years, the ratio is 0.95 percentage points worse than the ratio from the previous year |

| Other nonoperating current assets | Other nonoperating current assets to revenue in each forecast year equals the average annual ratio from the last 2 years of the historical period |

| Receivables | Receivables to sales in each forecast year equals the weighted average ratio of receivables to sales from the historical period, where the last year of the historical period is weighted at 51%, the year before that is weighted at 33%, and the year before that is weighted at 16% |

| Inventory | Inventory to COGS in each forecast year equals the average ratio from the historical period |

| PP&E | PP&E to revenue in each forecast year equals the ratio from the previous year |

| Other long-term assets | Other long-term assets to revenue in each forecast year is 1.38 percentage points greater than the average ratio from the historical period |

| Accounts payable | Accounts payable to direct costs in each year of the forecast period equals the average annual ratio from the last 2 years of the historical period |

| Other current liabilities | Other operating current liabilities to sales in each year of the forecast period equals the ratio from the second last year of the historical period (the year immediately before the last year of the historical period) |

| Other long-term liabilities | Other long-term liabilities to sales in each forecast year equals the ratio from the previous year |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started