Answered step by step

Verified Expert Solution

Question

1 Approved Answer

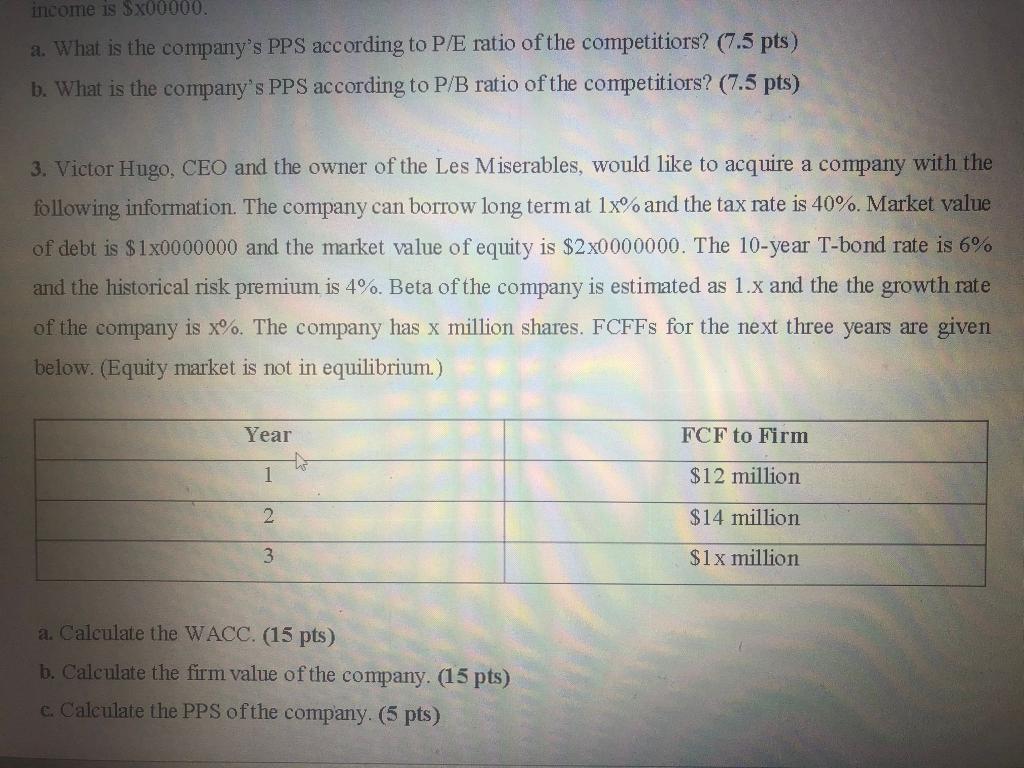

X:5 income is Sx00000. a. What is the company's PPS according to P/E ratio of the competitiors? (7.5 pts) b. What is the company's PPS

X:5

income is Sx00000. a. What is the company's PPS according to P/E ratio of the competitiors? (7.5 pts) b. What is the company's PPS according to P/B ratio of the competitiors? (7.5 pts) 3. Victor Hugo, CEO and the owner of the Les Miserables, would like to acquire a company with the following information. The company can borrow long term at 1x% and the tax rate is 40%. Market value of debt is $1x0000000 and the market value of equity is $2x0000000. The 10-year T-bond rate is 6% and the historical risk premium is 4%. Beta of the company is estimated as 1.x and the the growth rate of the company is x%. The company has x million shares. FCFFs for the next three years are given below. (Equity market is not in equilibrium) Year FCF to Firm 1 $12 million 2. $14 million 3 $1x million a. Calculate the WACC. (15 pts) b. Calculate the firm value of the company. (15 pts) c. Calculate the PPS of the company. (5 pts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started