x=6 ,z=9

x=6 ,z=9

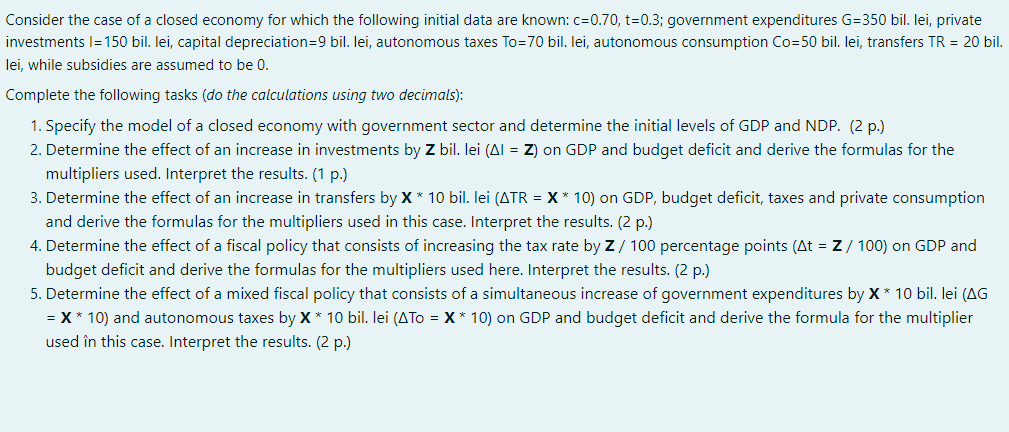

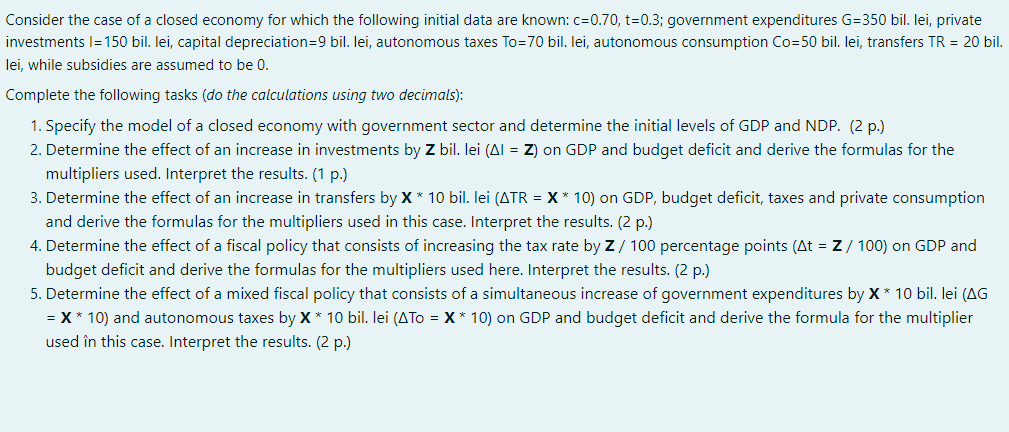

Consider the case of a closed economy for which the following initial data are known: C=0.70, t=0.3; government expenditures G=350 bil. lei, private investments I= 150 bil. lei, capital depreciation=9 bil. lei, autonomous taxes To=70 bil. lei, autonomous consumption Co=50 bil. lei, transfers TR = 20 bil. lei, while subsidies are assumed to be 0. Complete the following tasks (do the calculations using two decimals): 1. Specify the model of a closed economy with government sector and determine the initial levels of GDP and NDP. (2 p.) 2. Determine the effect of an increase in investments by Z bil. lei (41 = Z) on GDP and budget deficit and derive the formulas for the multipliers used. Interpret the results. (1 p.) 3. Determine the effect of an increase in transfers by X* 10 bil. lei (ATR = X* 10) on GDP, budget deficit, taxes and private consumption and derive the formulas for the multipliers used in this case. Interpret the results. (2 p.) 4. Determine the effect of a fiscal policy that consists of increasing the tax rate by Z/ 100 percentage points (At = 2 / 100) on GDP and budget deficit and derive the formulas for the multipliers used here. Interpret the results. (2 p.) 5. Determine the effect of a mixed fiscal policy that consists of a simultaneous increase of government expenditures by X * 10 bil. lei (AG = X* 10) and autonomous taxes by X* 10 bil. lei (ATO = X* 10) on GDP and budget deficit and derive the formula for the multiplier used in this case. Interpret the results. (2 p.) Consider the case of a closed economy for which the following initial data are known: C=0.70, t=0.3; government expenditures G=350 bil. lei, private investments I= 150 bil. lei, capital depreciation=9 bil. lei, autonomous taxes To=70 bil. lei, autonomous consumption Co=50 bil. lei, transfers TR = 20 bil. lei, while subsidies are assumed to be 0. Complete the following tasks (do the calculations using two decimals): 1. Specify the model of a closed economy with government sector and determine the initial levels of GDP and NDP. (2 p.) 2. Determine the effect of an increase in investments by Z bil. lei (41 = Z) on GDP and budget deficit and derive the formulas for the multipliers used. Interpret the results. (1 p.) 3. Determine the effect of an increase in transfers by X* 10 bil. lei (ATR = X* 10) on GDP, budget deficit, taxes and private consumption and derive the formulas for the multipliers used in this case. Interpret the results. (2 p.) 4. Determine the effect of a fiscal policy that consists of increasing the tax rate by Z/ 100 percentage points (At = 2 / 100) on GDP and budget deficit and derive the formulas for the multipliers used here. Interpret the results. (2 p.) 5. Determine the effect of a mixed fiscal policy that consists of a simultaneous increase of government expenditures by X * 10 bil. lei (AG = X* 10) and autonomous taxes by X* 10 bil. lei (ATO = X* 10) on GDP and budget deficit and derive the formula for the multiplier used in this case. Interpret the results. (2 p.)

x=6 ,z=9

x=6 ,z=9