Answered step by step

Verified Expert Solution

Question

1 Approved Answer

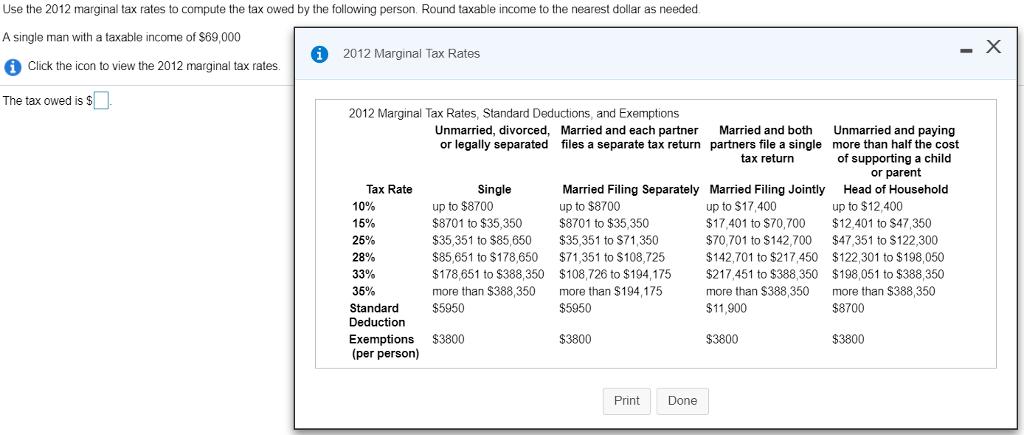

Use the 2012 marginal tax rates to compute the tax owed by the following person. Round taxable income to the nearest dollar as needed

Use the 2012 marginal tax rates to compute the tax owed by the following person. Round taxable income to the nearest dollar as needed A single man with a taxable income of $69,000 2012 Marginal Tax Rates Click the icon to view the 2012 marginal tax rates. The tax owed is $ 2012 Marginal Tax Rates, Standard Deductions, and Exemptions Married and each partner files a separate tax return Unmarried, divorced, or legally separated Tax Rate 10% 15% 25% 28% 33% 35% Single up to $8700 $8701 to $35,350 $35,351 to $85,650 $85,651 to $178,650 $178,651 to $388,350 more than $388,350 Married Filing Separately up to $8700 $8701 to $35,350 $35,351 to $71,350 $71,351 to $108,725 $108,726 to $194,175 more than $194,175 $5950 Standard $5950 Deduction Exemptions $3800 $3800 (per person) Print Done Married and both partners file a single tax return Married Filing Jointly up to $17,400 $17,401 to $70,700 $70,701 to $142,700 $142,701 to $217,450 $217,451 to $388,350 more than $388,350 $11.900 $3800 Unmarried and paying more than half the cost of supporting a child or parent Head of Household up to $12,400 $12,401 to $47,350 $47,351 to $122,300 $122,301 to $198,050 $198,051 to $388,350 more than $388,350 $8700 $3800 X

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Tax owed is the amount that the party is liable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started