Answered step by step

Verified Expert Solution

Question

1 Approved Answer

X=9 Y=0 You are asked to calculate: a. Cash Flow From Assets 2019 b. Cash Flow to Creditors 2019 c. Cash Flow to Stockholder 2019

X=9 Y=0

You are asked to calculate:

a. Cash Flow From Assets 2019

b. Cash Flow to Creditors 2019

c. Cash Flow to Stockholder 2019

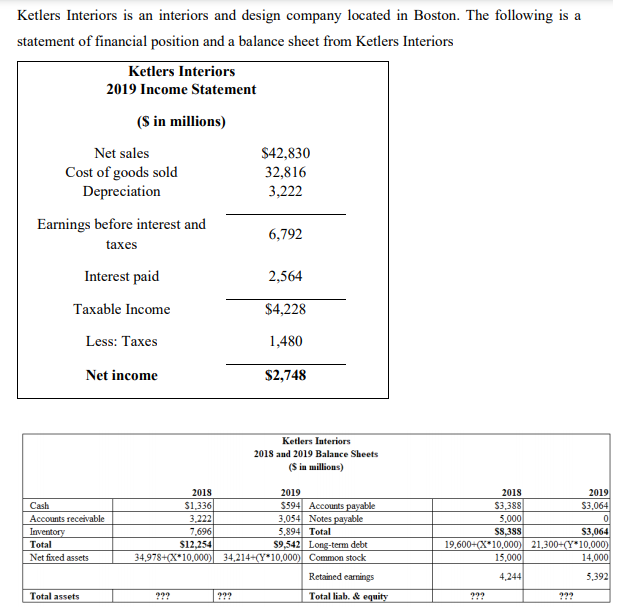

Ketlers Interiors is an interiors and design company located in Boston. The following is a statement of financial position and a balance sheet from Ketlers Interiors Ketlers Interiors 2019 Income Statement (S in millions) Net sales $42,830 Cost of goods sold 32,816 Depreciation 3,222 Earnings before interest and 6,792 taxes Interest paid 2,564 $4,228 Taxable Income Less: Taxes 1,480 Net income $2,748 Ketlers Interiors 2018 and 2019 Balance Sheets ($ in millions) 2018 Cash Accounts receivable Inventory Total Net fixed assets 2018 2019 $1,336 $594 Accounts payable 3.222 3,054 Notes payable 7.696 5,894 Total $12,254 $9,542 Long-term debt 34,978+(X*10,000) 34,214-(Y*10.000) Common stock 2019 S3,388 $3,064 5,000 0 58,388 $3,064 19,600+(X*10.000) 21,300-(Y*10.000) 15.000 14,000 4,244 5,392 Retained earnings Total assets ??? ??? Total liab. & equity Ketlers Interiors is an interiors and design company located in Boston. The following is a statement of financial position and a balance sheet from Ketlers Interiors Ketlers Interiors 2019 Income Statement (S in millions) Net sales $42,830 Cost of goods sold 32,816 Depreciation 3,222 Earnings before interest and 6,792 taxes Interest paid 2,564 $4,228 Taxable Income Less: Taxes 1,480 Net income $2,748 Ketlers Interiors 2018 and 2019 Balance Sheets ($ in millions) 2018 Cash Accounts receivable Inventory Total Net fixed assets 2018 2019 $1,336 $594 Accounts payable 3.222 3,054 Notes payable 7.696 5,894 Total $12,254 $9,542 Long-term debt 34,978+(X*10,000) 34,214-(Y*10.000) Common stock 2019 S3,388 $3,064 5,000 0 58,388 $3,064 19,600+(X*10.000) 21,300-(Y*10.000) 15.000 14,000 4,244 5,392 Retained earnings Total assets ??? ??? Total liab. & equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started