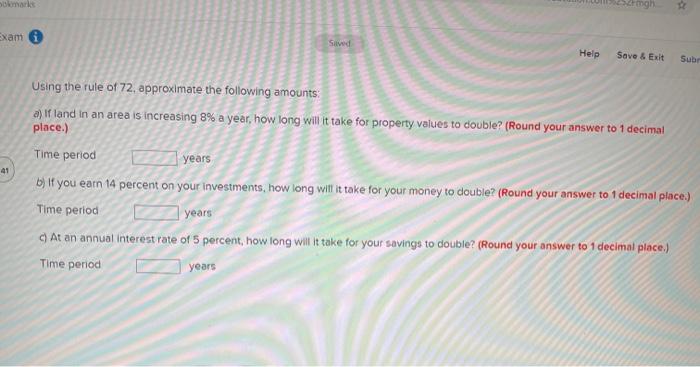

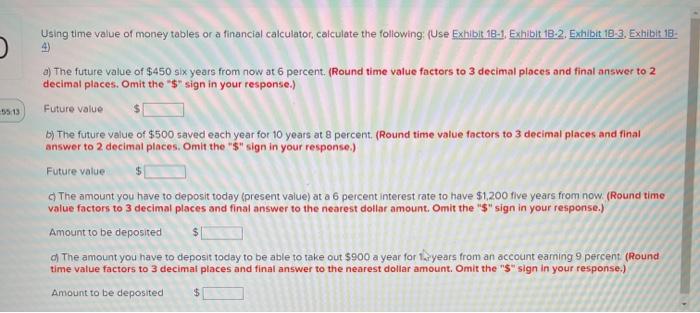

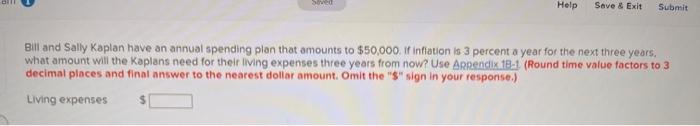

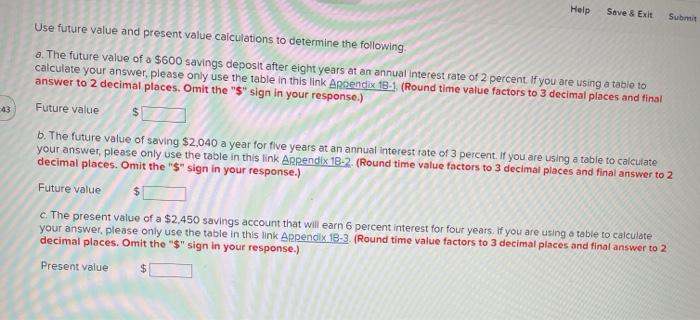

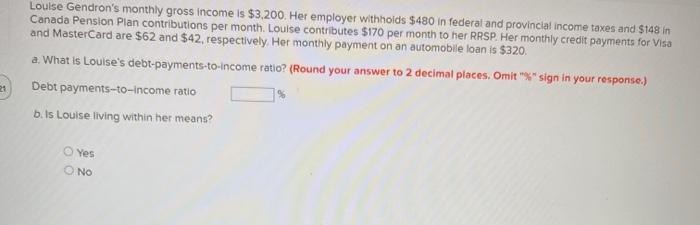

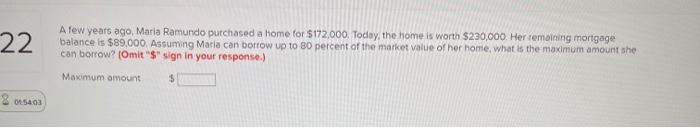

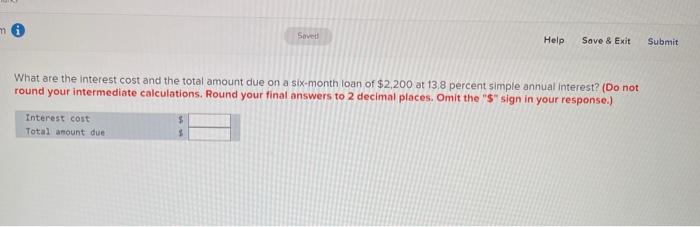

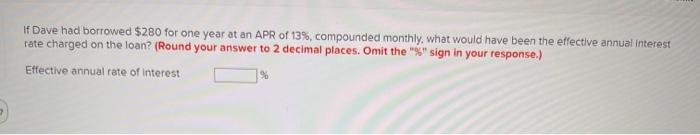

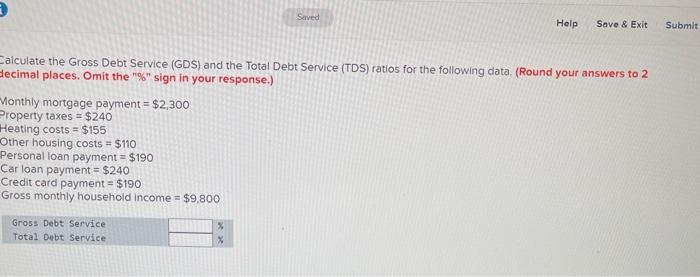

xam 6 Slived Help Save & Exit Sub Using the rule of 72, approximate the following amounts: a) If land in an area is increasing 8% a year, how long will it take for property values to double? (Round your answer to 1 decimal place.) years 41 Time period b) If you earn 14 percent on your investments, how long with it take for your money to double? (Round your answer to 1 decimal place.) Time period years At an annual interest rate of 5 percent, how long will it take for your savings to double? (Round your answer to 1 decimal place.) Time period years Using time value of money tables or a financial calculator, calculate the following (Use Exhibit 18-1. Exhibit 18-2. Exhibit 18-3. Exhibit 13- -55:13 a) The future value of $450 six years from now at 6 percent. (Round time value factors to 3 decimal places and final answer to 2 decimal places. Omit the "$" sign in your response.) Future value b) The future value of $500 saved each year for 10 years at 8 percent. (Round time value factors to 3 decimal places and final answer to 2 decimal places. Omit tho "$" sign in your response.) Future value $ The amount you have to deposit today (present value) at a 6 percent interest rate to have $1.200 five years from now (Round time value factors to 3 decimal places and final answer to the nearest dotlar amount. Omit the "S" sign in your response.) Amount to be deposited $ The amount you have to deposit today to be able to take out $900 a year for 1.7years from an account eaming 9 percent (Round time value factors to 3 decimal places and final answer to the nearest dollar amount. Omit the "$" sign in your response.) Amount to be deposited $ Sea Help Save & Exit Submit Bill and Sally Kaplan have an annual spending plan that amounts to $50,000. If inflation is 3 percent a year for the next three years, what amount will the Kaplans need for their living expenses three years from now? Use Argendix 18-1 (Round time value factors to 3 decimal places and final answer to the nearest dollar amount. Omit the "S" sign in your response.) Living expenses Help Save & Exit Submit Use future value and present value calculations to determine the following 43 a. The future value of a $600 savings deposit after eight years at an annual interest rate of 2 percent. If you are using a table to calculate your answer, please only use the table in this link Arpendix 18.1 (Round time value factors to 3 decimal places and final answer to 2 decimal places. Omit the "s" sign in your response.) Future value b. The future value of saving $2,040 a year for five years at an annual interest rate of 3 percent. If you are using a table to calculate your answer, please only use the table in this link Aprendix 18-2 (Round time value factors to 3 decimal places and final answer to 2 decimal places. Omit the "s" sign in your response.) Future value c The present value of a $2.450 savings account that will earn 6 percent interest for four years. If you are using a table to calculate your answer, please only use the table in this link Arpendix 18-3. (Round time value factors to 3 decimal places and final answer to 2 decimal places. Omit the "$" sign in your response.) Present value $ Louise Gendron's monthly gross income is $3,200. Her employer withholds $480 in federal and provincial income taxes and $148 in Canada Pension Plan contributions per month. Louise contributes $170 per month to her RRSP. Her monthly credit payments for Visa and MasterCard are $62 and $42, respectively. Her monthly payment on an automobile loan is $320. a. What is Louise's debt-payments-to-income ratio? (Round your answer to 2 decimal places. Omit"%" sign in your response.) Debt payments-to-Income ratio b. Is Louise living within her means? 23 Yes NO 22 A few years ago, Maria Ramundo purchased a home for S172,000. Today, the home is worth $230,000. Her remaining mortgage balance is $89,000 Assuming Marla con borrow up to 80 percent of the market value of her home. what is the maximum amount she can borrow? (Omit"$" sign in your response.) Maximum amount $ 805403 m Saved Help Save & Exit Submit What are the interest cost and the total amount due on a six-month loan of $2,200 at 13.8 percent simple annual Interest? (Do not round your intermediate calculations. Round your final answers to 2 decimal places. Omit the "S" sign in your response.) Interest cost Total amount due If Dave had borrowed $280 for one year at an APR of 13%, compounded monthly, what would have been the effective annual interest rate charged on the loan? (Round your answer to 2 decimal places. Omit the "%" sign in your response.) Effective annual rate of interest 90 Saved Help Save & Exit Submit Calculate the Gross Debt Service (GDS) and the Total Debt Service (TDS) ratios for the following data (Round your answers to 2 Decimal places. Omit the "%" sign in your response.) Monthly mortgage payment = $2,300 Property taxes = $240 Heating costs = $155 Other housing costs = $110 Personal loan payment = $190 Car loan payment = $240 Credit card payment = $190 Gross monthly household income = $9,800 Gross Debt Service Total Debt Service %