Question

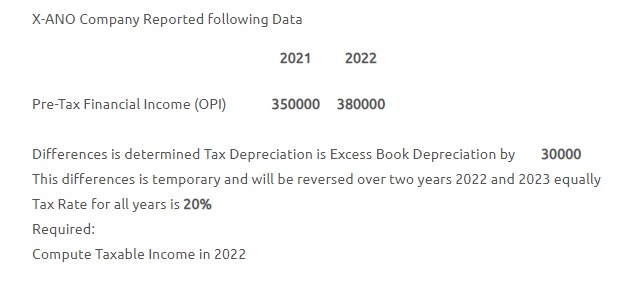

X-ANO Company Reported following Data 2021 2022 Pre-Tax Financial Income (OPI) 350000 380000 Required: Compute Taxable Income in 2022 Differences is determined Tax Depreciation

X-ANO Company Reported following Data 2021 2022 Pre-Tax Financial Income (OPI) 350000 380000 Required: Compute Taxable Income in 2022 Differences is determined Tax Depreciation is Excess Book Depreciation by 30000 This differences is temporary and will be reversed over two years 2022 and 2023 equally Tax Rate for all years is 20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The question is asking to compute the taxable income for XANo Company in 2022 Based on the provided ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Loren A Nikolai, D. Bazley and Jefferson P. Jones

10th Edition

324300980, 978-0324300987

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App