Xavier and Shayna are married and have two young children. They accumulated a lot of debt while Shayna was off for two maternity leaves

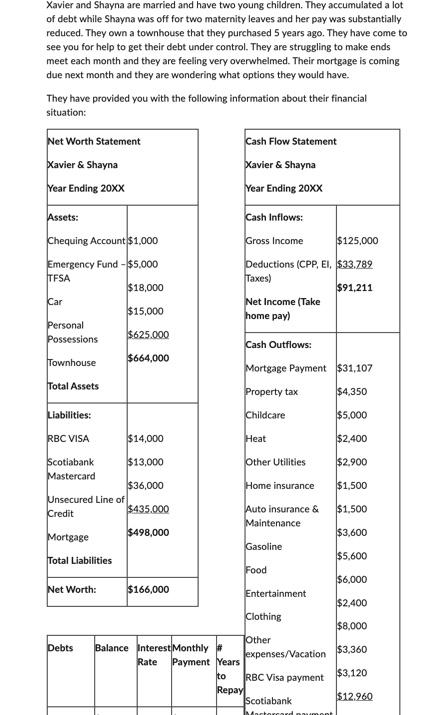

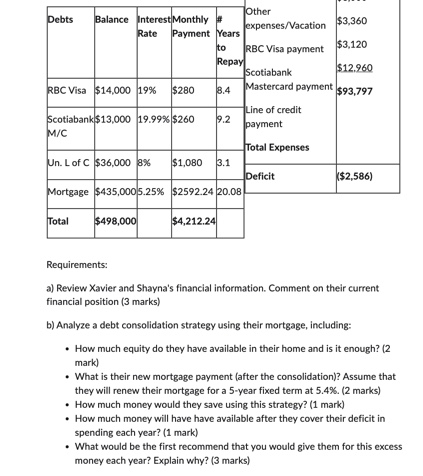

Xavier and Shayna are married and have two young children. They accumulated a lot of debt while Shayna was off for two maternity leaves and her pay was substantially reduced. They own a townhouse that they purchased 5 years ago. They have come to see you for help to get their debt under control. They are struggling to make ends meet each month and they are feeling very overwhelmed. Their mortgage is coming due next month and they are wondering what options they would have. They have provided you with the following information about their financial situation: Net Worth Statement Xavier & Shayna Year Ending 20XX Assets: Cash Flow Statement Xavier & Shayna Year Ending 20XX Cash Inflows: Chequing Account $1,000 Gross Income $125,000 Emergency Fund -$5,000 Deductions (CPP, EI, $33.789 TFSA Taxes) $18,000 $91,211 Car $15,000 Net Income (Take home pay) Personal Possessions $625,000 Cash Outflows: $664,000 Townhouse Mortgage Payment $31,107 Total Assets Property tax $4,350 Liabilities: Childcare $5,000 RBC VISA $14,000 Heat $2,400 Scotiabank $13,000 Other Utilities $2,900 Mastercard $36,000 Home insurance $1,500 Unsecured Line of $435.000 Auto insurance & Credit $1,500 Maintenance Mortgage $498,000 $3,600 Gasoline Total Liabilities $5,600 Food $6,000 Net Worth: $166,000 Entertainment $2,400 Clothing $8,000 Other Debts Balance Interest Monthly # Rate Payment Years expenses/Vacation $3,360 to $3,120 RBC Visa payment Repay Scotiabank $12.960 Mactorcard Other Debts Balance Interest Monthly # Rate expenses/Vacation $3,360 Payment Years to RBC Visa payment $3,120 Repay $12.960 Scotiabank RBC Visa $14,000 19% $280 8.4 Mastercard payment $93,797 Line of credit Scotiabank $13,000 19.99% $260 9.2 M/C Un. L of C $36,000 8% $1,080 3.1 payment Total Expenses Deficit ($2,586) Mortgage $435,000 5.25% $2592.24 20.08 Total $498,000 $4,212.24 Requirements: a) Review Xavier and Shayna's financial information. Comment on their current financial position (3 marks) b) Analyze a debt consolidation strategy using their mortgage, including: How much equity do they have available in their home and is it enough? (2 mark) What is their new mortgage payment (after the consolidation)? Assume that they will renew their mortgage for a 5-year fixed term at 5.4%. (2 marks) How much money would they save using this strategy? (1 mark) How much money will have have available after they cover their deficit in spending each year? (1 mark) What would be the first recommend that you would give them for this excess money each year? Explain why? (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started