Answered step by step

Verified Expert Solution

Question

1 Approved Answer

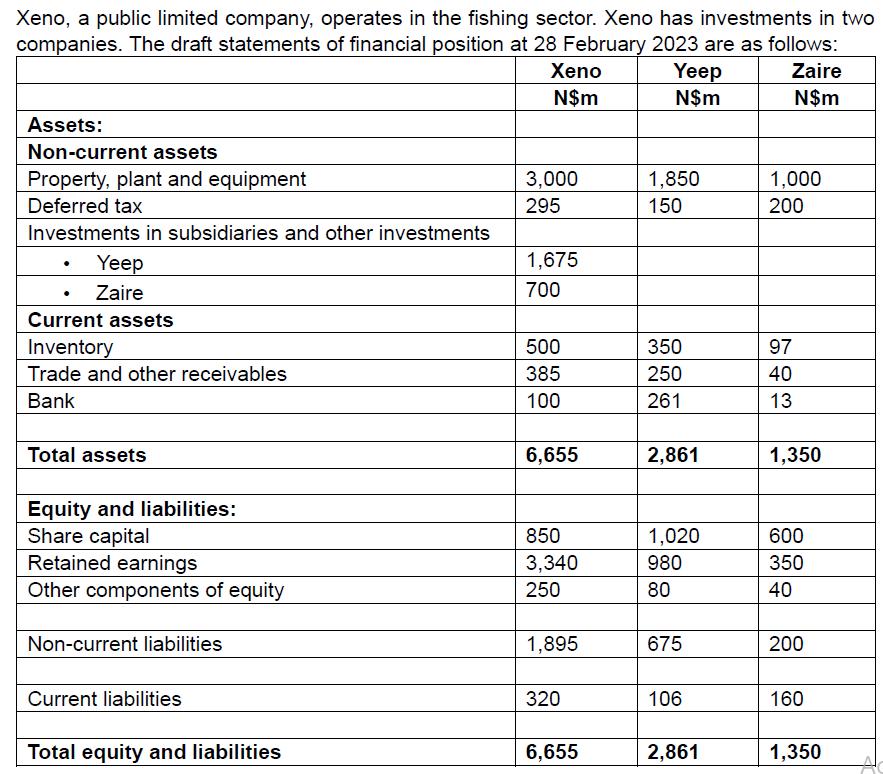

Xeno, a public limited company, operates in the fishing sector. Xeno has investments in two companies. The draft statements of financial position at 28

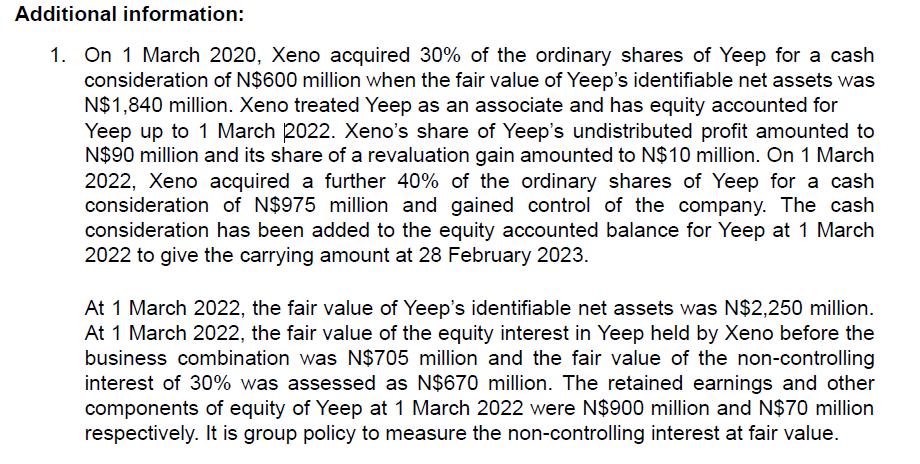

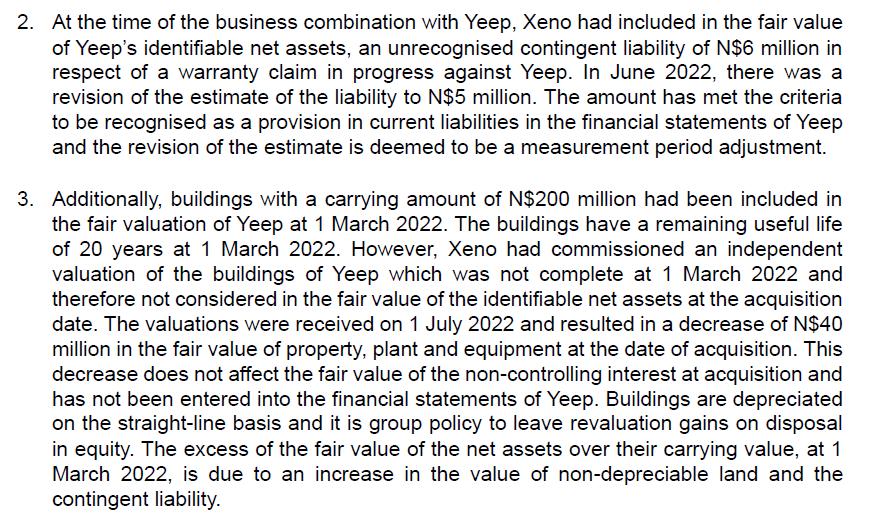

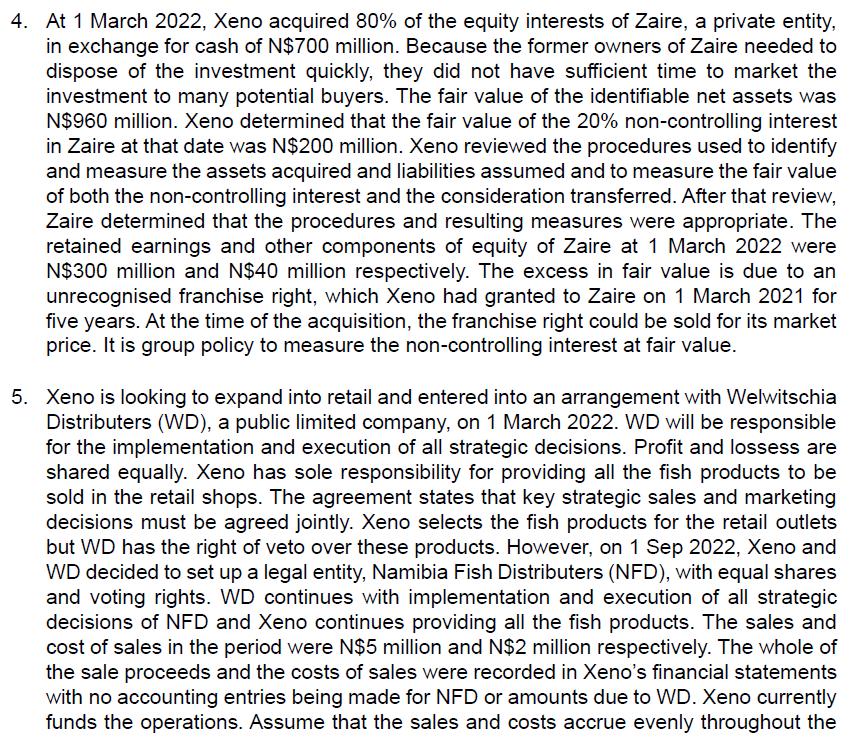

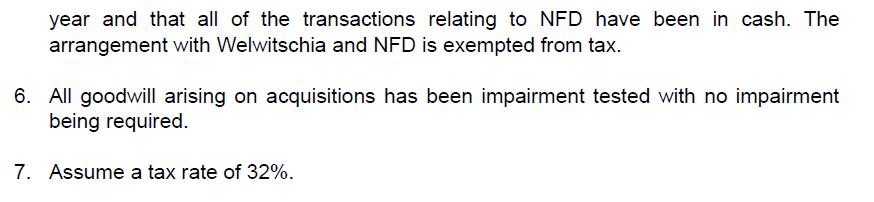

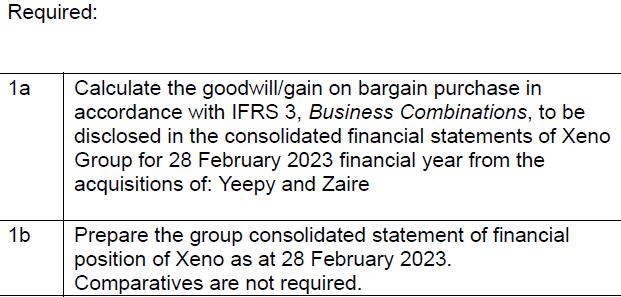

Xeno, a public limited company, operates in the fishing sector. Xeno has investments in two companies. The draft statements of financial position at 28 February 2023 are as follows: Xeno Yeep N$m N$m Zaire N$m Assets: Non-current assets Property, plant and equipment 3,000 1,850 1,000 Deferred tax 295 150 200 Investments in subsidiaries and other investments Yeep 1,675 Zaire 700 Current assets Inventory Trade and other receivables Bank Total assets 500 350 97 385 250 40 100 261 13 6,655 2,861 1,350 Equity and liabilities: Share capital 850 1,020 600 Retained earnings 3,340 980 350 Other components of equity 250 80 40 Non-current liabilities 1,895 675 200 Current liabilities 320 106 160 Total equity and liabilities 6,655 2,861 1,350 Additional information: 1. On 1 March 2020, Xeno acquired 30% of the ordinary shares of Yeep for a cash consideration of N$600 million when the fair value of Yeep's identifiable net assets was N$1,840 million. Xeno treated Yeep as an associate and has equity accounted for Yeep up to 1 March 2022. Xeno's share of Yeep's undistributed profit amounted to N$90 million and its share of a revaluation gain amounted to N$10 million. On 1 March 2022, Xeno acquired a further 40% of the ordinary shares of Yeep for a cash consideration of N$975 million and gained control of the company. The cash consideration has been added to the equity accounted balance for Yeep at 1 March 2022 to give the carrying amount at 28 February 2023. At 1 March 2022, the fair value of Yeep's identifiable net assets was N$2,250 million. At 1 March 2022, the fair value of the equity interest in Yeep held by Xeno before the business combination was N$705 million and the fair value of the non-controlling interest of 30% was assessed as N$670 million. The retained earnings and other components of equity of Yeep at 1 March 2022 were N$900 million and N$70 million respectively. It is group policy to measure the non-controlling interest at fair value. 2. At the time of the business combination with Yeep, Xeno had included in the fair value of Yeep's identifiable net assets, an unrecognised contingent liability of N$6 million in respect of a warranty claim in progress against Yeep. In June 2022, there was a revision of the estimate of the liability to N$5 million. The amount has met the criteria to be recognised as a provision in current liabilities in the financial statements of Yeep and the revision of the estimate is deemed to be a measurement period adjustment. 3. Additionally, buildings with a carrying amount of N$200 million had been included in the fair valuation of Yeep at 1 March 2022. The buildings have a remaining useful life of 20 years at 1 March 2022. However, Xeno had commissioned an independent valuation of the buildings of Yeep which was not complete at 1 March 2022 and therefore not considered in the fair value of the identifiable net assets at the acquisition date. The valuations were received on 1 July 2022 and resulted in a decrease of N$40 million in the fair value of property, plant and equipment at the date of acquisition. This decrease does not affect the fair value of the non-controlling interest at acquisition and has not been entered into the financial statements of Yeep. Buildings are depreciated on the straight-line basis and it is group policy to leave revaluation gains on disposal in equity. The excess of the fair value of the net assets over their carrying value, at 1 March 2022, is due to an increase in the value of non-depreciable land and the contingent liability. 4. At 1 March 2022, Xeno acquired 80% of the equity interests of Zaire, a private entity, in exchange for cash of N$700 million. Because the former owners of Zaire needed to dispose of the investment quickly, they did not have sufficient time to market the investment to many potential buyers. The fair value of the identifiable net assets was N$960 million. Xeno determined that the fair value of the 20% non-controlling interest in Zaire at that date was N$200 million. Xeno reviewed the procedures used to identify and measure the assets acquired and liabilities assumed and to measure the fair value of both the non-controlling interest and the consideration transferred. After that review, Zaire determined that the procedures and resulting measures were appropriate. The retained earnings and other components of equity of Zaire at 1 March 2022 were N$300 million and N$40 million respectively. The excess in fair value is due to an unrecognised franchise right, which Xeno had granted to Zaire on 1 March 2021 for five years. At the time of the acquisition, the franchise right could be sold for its market price. It is group policy to measure the non-controlling interest at fair value. 5. Xeno is looking to expand into retail and entered into an arrangement with Welwitschia Distributers (WD), a public limited company, on 1 March 2022. WD will be responsible for the implementation and execution of all strategic decisions. Profit and lossess are shared equally. Xeno has sole responsibility for providing all the fish products to be sold in the retail shops. The agreement states that key strategic sales and marketing decisions must be agreed jointly. Xeno selects the fish products for the retail outlets but WD has the right of veto over these products. However, on 1 Sep 2022, Xeno and WD decided to set up a legal entity, Namibia Fish Distributers (NFD), with equal shares and voting rights. WD continues with implementation and execution of all strategic decisions of NFD and Xeno continues providing all the fish products. The sales and cost of sales in the period were N$5 million and N$2 million respectively. The whole of the sale proceeds and the costs of sales were recorded in Xeno's financial statements with no accounting entries being made for NFD or amounts due to WD. Xeno currently funds the operations. Assume that the sales and costs accrue evenly throughout the year and that all of the transactions relating to NFD have been in cash. The arrangement with Welwitschia and NFD is exempted from tax. 6. All goodwill arising on acquisitions has been impairment tested with no impairment being required. 7. Assume a tax rate of 32%. Required: 1a Calculate the goodwill/gain on bargain purchase in 1b accordance with IFRS 3, Business Combinations, to be disclosed in the consolidated financial statements of Xeno Group for 28 February 2023 financial year from the acquisitions of: Yeepy and Zaire Prepare the group consolidated statement of financial position of Xeno as at 28 February 2023. Comparatives are not required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started