Answered step by step

Verified Expert Solution

Question

1 Approved Answer

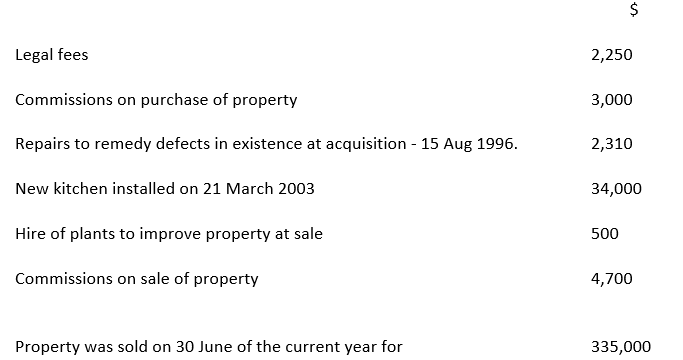

Xiao Fui bought a holiday house for $165,000 on 7 July 1996. She incurred the following expenses in relation to the property. Required Calculate the

Xiao Fui bought a holiday house for $165,000 on 7 July 1996. She incurred the following expenses in relation to the property.

Required

Calculate the capital gain or loss in respect of the property.

Legal fees Commissions on purchase of property Repairs to remedy defects in existence at acquisition - 15 Aug 1996. New kitchen installed on 21 March 2003 Hire of plants to improve property at sale Commissions on sale of property Property was sold on 30 June of the current year for $ 2,250 3,000 2,310 34,000 500 4,700 335,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Total Cost Base can be determined as Purchase Price Legal Fees Commis...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started