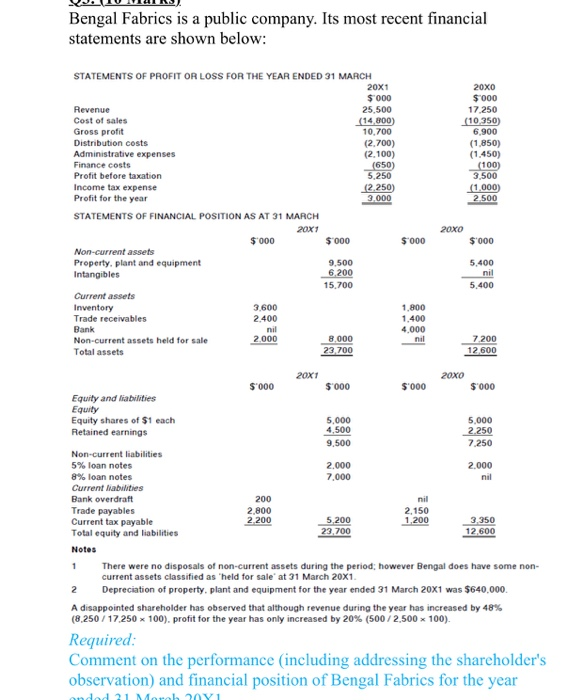

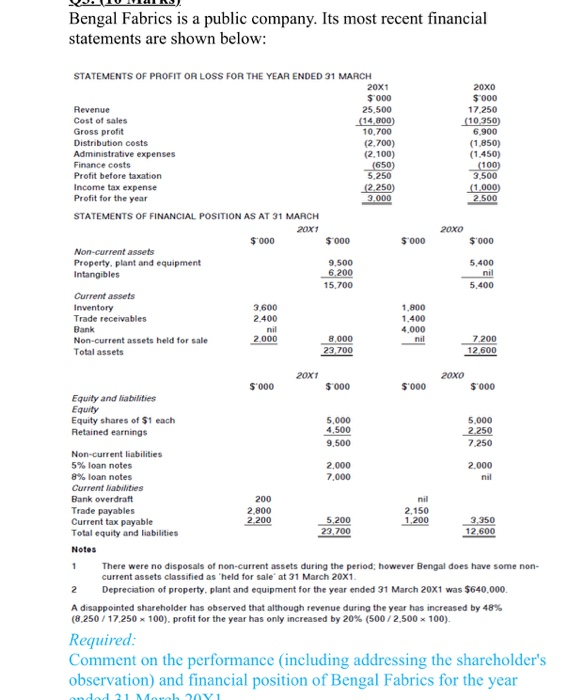

XJ10 WHIRL Bengal Fabrics is a public company. Its most recent financial statements are shown below: 20x0 $ 000 17.250 (10 350) 6.900 (1.850) (1.450) (100) 3.500 (1,000) 2.500 STATEMENTS OF PROFIT OR LOSS FOR THE YEAR ENDED 31 MARCH 20X1 $ 000 Revenue 25.500 Cost of sales (14 800) Gross profit 10.700 Distribution costs (2.700) Administrative expenses (2.100) Finance costs (650) Profit before taxation 5.250 Income tax expense (2.250) Profit for the year 3.000 STATEMENTS OF FINANCIAL POSITION AS AT 31 MARCH 20X1 $ 000 $ 000 Non-current assets Property, plant and equipment 9.500 Intangibles 6.200 15,700 Current assets Inventory 3,600 1.800 Trade receivables 2.400 1.400 Bank 4.000 Non-current assets held for sale 2.000 8.000 Total assets 23 700 2oxo $ 000 5.400 nil 5.400 ni 7 200 12 600 20x0 S'000 20X1 $ 000 $ 000 $ 000 Equity and liabilities Equity Equity shares of $1 each Retained earnings 5,000 4,500 9,500 5,000 2 250 7.250 2.000 7,000 2.000 nal Non-current liabilities 5% loan notes 8% loan notes Current liabilities Bank overdraft Trade payables Current tax payable Total equity and liabilities 200 2.800 2.200 5.200 2.150 1,200 3.350 23,700 12.600 Notes There were no disposals of non-current assets during the period; however Bengal does have some non- current assets classified as "held for sale at 31 March 20X1. 2 Depreciation of property, plant and equipment for the year ended 31 March 20X1 was $640,000 A disappointed shareholder has observed that although revenue during the year has increased by 48% (8.250 / 17.250 x 100). profit for the year has only increased by 20% (500 / 2.500 x 100). Required: Comment on the performance (including addressing the shareholder's observation) and financial position of Bengal Fabrics for the year dod 21 Mb XJ10 WHIRL Bengal Fabrics is a public company. Its most recent financial statements are shown below: 20x0 $ 000 17.250 (10 350) 6.900 (1.850) (1.450) (100) 3.500 (1,000) 2.500 STATEMENTS OF PROFIT OR LOSS FOR THE YEAR ENDED 31 MARCH 20X1 $ 000 Revenue 25.500 Cost of sales (14 800) Gross profit 10.700 Distribution costs (2.700) Administrative expenses (2.100) Finance costs (650) Profit before taxation 5.250 Income tax expense (2.250) Profit for the year 3.000 STATEMENTS OF FINANCIAL POSITION AS AT 31 MARCH 20X1 $ 000 $ 000 $ 000 Non-current assets Property, plant and equipment 9.500 Intangibles 6.200 15,700 Current assets Inventory 3,600 1.800 Trade receivables 2.400 1.400 Bank 4.000 Non-current assets held for sale 2.000 8.000 Total assets 23 700 2oxo $ 000 5.400 nil 5.400 ni 7 200 12 600 20x0 S'000 20X1 $ 000 $ 000 $ 000 Equity and liabilities Equity Equity shares of $1 each Retained earnings 5,000 4,500 9,500 5,000 2 250 7.250 2.000 7,000 2.000 nal Non-current liabilities 5% loan notes 8% loan notes Current liabilities Bank overdraft Trade payables Current tax payable Total equity and liabilities 200 2.800 2.200 5.200 2.150 1,200 3.350 23,700 12.600 Notes There were no disposals of non-current assets during the period; however Bengal does have some non- current assets classified as "held for sale at 31 March 20X1. 2 Depreciation of property, plant and equipment for the year ended 31 March 20X1 was $640,000 A disappointed shareholder has observed that although revenue during the year has increased by 48% (8.250 / 17.250 x 100). profit for the year has only increased by 20% (500 / 2.500 x 100). Required: Comment on the performance (including addressing the shareholder's observation) and financial position of Bengal Fabrics for the year dod 21 Mb