Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Xoma, a transportation company, has substantial investments in property, plant and equipment. In 2020, the company exchanged some of these assets with other companies.

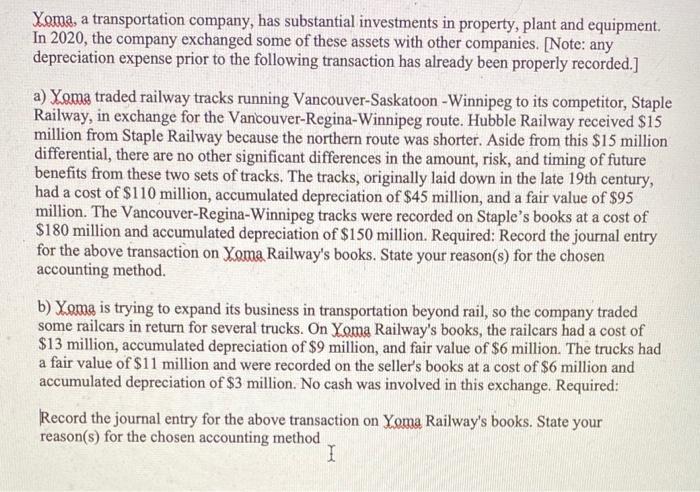

Xoma, a transportation company, has substantial investments in property, plant and equipment. In 2020, the company exchanged some of these assets with other companies. [Note: any depreciation expense prior to the following transaction has already been properly recorded.] a) Xoma traded railway tracks running Vancouver-Saskatoon -Winnipeg to its competitor, Staple Railway, in exchange for the Vancouver-Regina-Winnipeg route. Hubble Railway received $15 million from Staple Railway because the northern route was shorter. Aside from this $15 million differential, there are no other significant differences in the amount, risk, and timing of future benefits from these two sets of tracks. The tracks, originally laid down in the late 19th century, had a cost of $110 million, accumulated depreciation of $45 million, and a fair value of $95 million. The Vancouver-Regina-Winnipeg tracks were recorded on Staple's books at a cost of $180 million and accumulated depreciation of $150 million. Required: Record the journal entry for the above transaction on Xoma Railway's books. State your reason(s) for the chosen accounting method. b) Xoma is trying to expand its business in transportation beyond rail, so the company traded some railcars in return for several trucks. On Yoma Railway's books, the railcars had a cost of $13 million, accumulated depreciation of $9 million, and fair value of $6 million. The trucks had a fair value of $11 million and were recorded on the seller's books at a cost of $6 million and accumulated depreciation of $3 million. No cash was involved in this exchange. Required: Record the journal entry for the above transaction on Yoma Railway's books. State your reason(s) for the chosen accounting method I

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

A B There is no commercial substance involved in the transactionsSo there is no gain ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started