Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XP-4 Please do not copy other answers. This is a different question. If copied from other answers I will downvote and report your account .

XP-4 Please do not copy other answers. This is a different question. If copied from other answers I will downvote and report your account .

Q2.

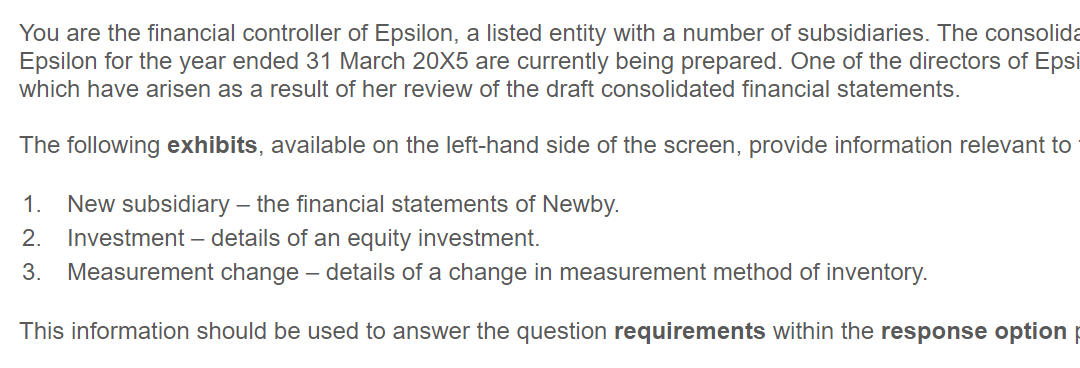

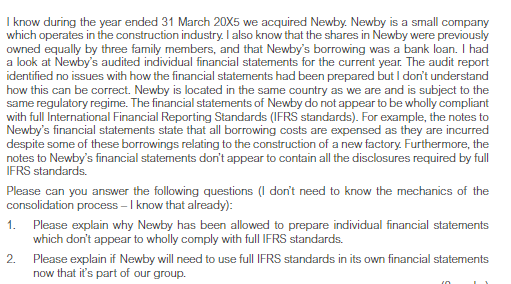

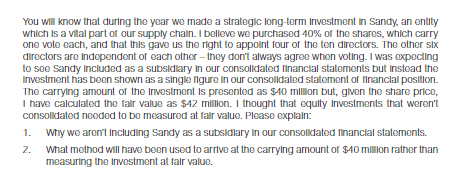

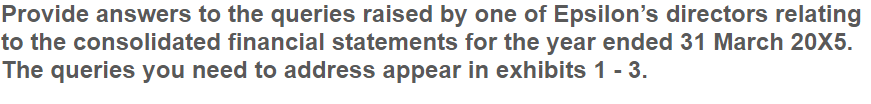

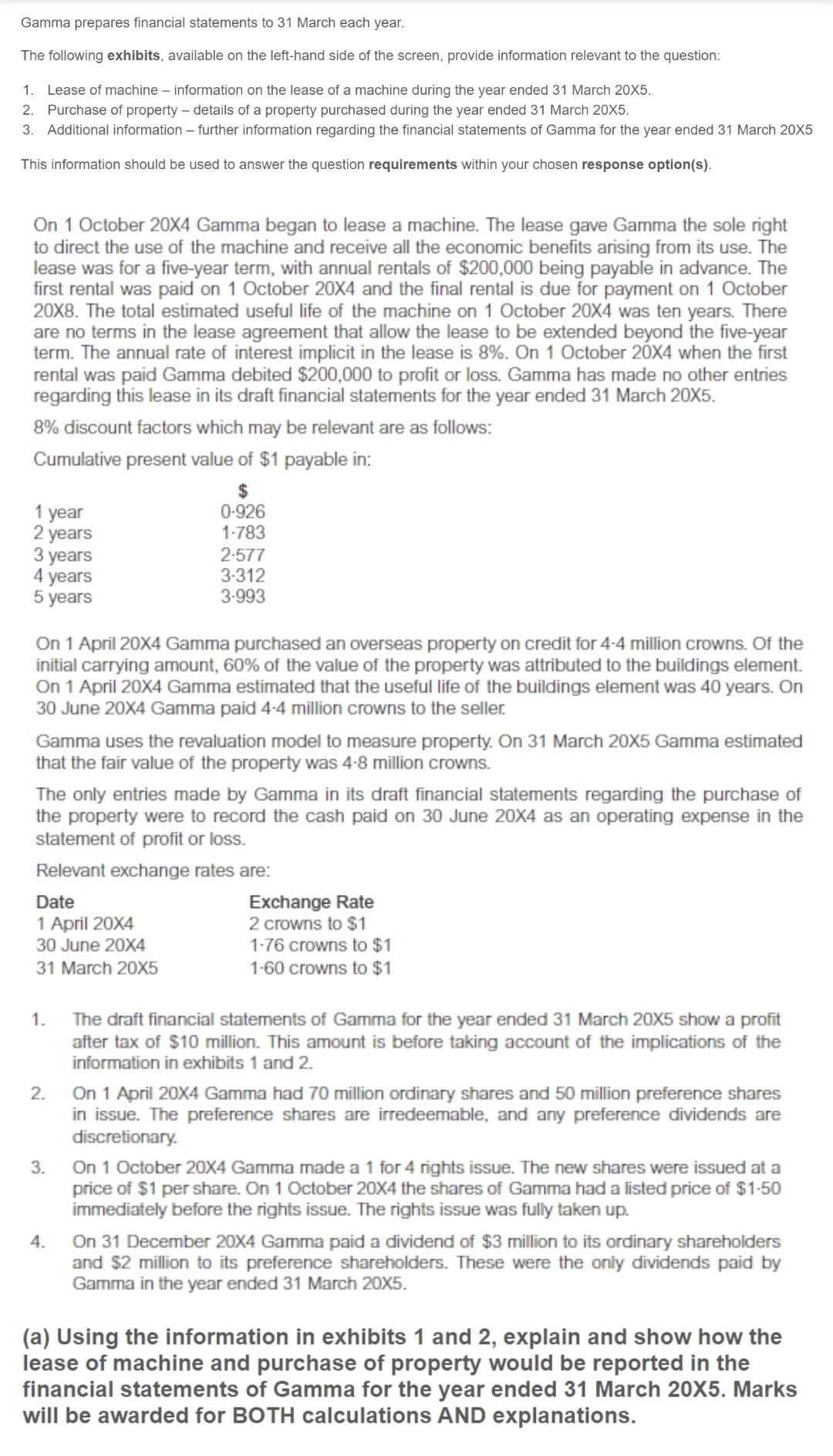

You are the financial controller of Epsilon, a listed entity with a number of subsidiaries. The consolida Epsilon for the year ended 31 March 20x5 are currently being prepared. One of the directors of Epsi which have arisen as a result of her review of the draft consolidated financial statements. The following exhibits, available on the left-hand side of the screen, provide information relevant to 1. New subsidiary the financial statements of Newby. 2. Investment - details of an equity investment. 3. Measurement change - details of a change in measurement method of inventory. This information should be used to answer the question requirements within the response option I know during the year ended 31 March 20X5 we acquired Newby. Newby is a small company which operates in the construction industry. I also know that the shares in Newby were previously owned equally by three family members, and that Newby's borrowing was a bank loan. I had a look at Newby's audited individual financial statements for the current year. The audit report identified no issues with how the financial statements had been prepared but I don't understand how this can be correct. Newby is located in the same country as we are and is subject to the same regulatory regime. The financial statements of Newby do not appear to be wholly compliant with full International Financial Reporting Standards (IFRS standards). For example, the notes to Newby's financial statements state that all borrowing costs are expensed as they are incurred despite some of these borrowings relating to the construction of a new factory. Furthermore, the notes to Newby's financial statements don't appear to contain all the disclosures required by full IFRS standards. Please can you answer the following questions (I don't need to know the mechanics of the consolidation process - I know that already): 1. Please explain why Newby has been allowed to prepare individual financial statements which don't appear to wholly comply with full IFRS standards. 2. Please explain if Newby will need to use full IFRS standards in its own financial statements now that it's part of our group. You will know that during the year we made a strategic long-term Investment in Sandy, an entity which is a vital part of our supply chain. I believe we purchased 40% of the shares, which carry one vote cach, and that this gave us the right to appoint four of the ten directors. The other six directors are independent of each other, they don't always agree when voting. I was expecting to see Sandy Included as a subsidiary in our consolidated financial statements but instead the Investment has been shown as a single figure in our consolidated statement of financial position. The carrying amount of the investment is presented as $40 millon but, given the share price, I have calculated the fair value as $42 million. I thought that equity Investments that weren't consolidated needed to be measured at fair value. Please explain: 1. Why we aren't including Sandy as a subsidiary in our consolidated financial statements. 2. What method will have been used to arrive at the carrying amount of $40 milion rather than measuring the investment at talr value. The draft financial statements indicate that in the current period we began measuring our inventory of raw materials using the weighted average cost formula. In previous periods we measured all our inventories using the first in first out formula. I have a number of questions here: 1. Are we allowed to change the measurement method in this way? 2. If we do change the measurement method for our inventory of raw materials shouldn't we change it for all of our inventories? 3. How do we ensure that the financial statements for this year are comparable with those of last year given that a different measurement method has been used for raw materials inventory? Provide answers to the queries raised by one of Epsilon's directors relating to the consolidated financial statements for the year ended 31 March 20X5. The queries you need to address appear in exhibits 1 - 3. Gamma prepares financial statements to 31 March each year. The following exhibits, available on the left-hand side of the screen, provide information relevant to the question: 1. Lease of machine - information on the lease of a machine during the year ended 31 March 20X5. 2. Purchase of property - details of a property purchased during the year ended 31 March 20X5. 3. Additional information - further information regarding the financial statements of Gamma for the year ended 31 March 20X5 This information should be used to answer the question requirements within your chosen response option(s). On 1 October 20X4 Gamma began to lease a machine. The lease gave Gamma the sole right to direct the use of the machine and receive all the economic benefits arising from its use. The lease was for a five-year term, with annual rentals of $200,000 being payable in advance. The first rental was paid on 1 October 20X4 and the final rental is due for payment on 1 October 20X8. The total estimated useful life of the machine on 1 October 20X4 was ten years. There are no terms in the lease agreement that allow the lease to be extended beyond the five-year term. The annual rate of interest implicit in the lease is 8%. On 1 October 20X4 when the first rental was paid Gamma debited $200,000 to profit or loss. Gamma has made no other entries regarding this lease in its draft financial statements for the year ended 31 March 20X5. 8% discount factors which may be relevant are as follows: Cumulative present value of $1 payable in: $ 1 year 0.926 2 years 1.783 2.577 years 3-312 3.993 3 years 4 5 years On 1 April 20X4 Gamma purchased an overseas property on credit for 4-4 million crowns. Of the initial carrying amount, 60% of the value of the property was attributed to the buildings element. On 1 April 20X4 Gamma estimated that the useful life of the buildings element was 40 years. On 30 June 20X4 Gamma paid 4-4 million crowns to the seller. Gamma uses the revaluation model to measure property. On 31 March 2005 Gamma estimated that the fair value of the property was 4-8 million crowns. The only entries made by Gamma in its draft financial statements regarding the purchase of the property were to record the cash paid on 30 June 20X4 as an operating expense in the statement of profit or loss. Relevant exchange rates are: Date Exchange Rate 1 April 20X4 2 crowns to $1 30 June 2004 1.76 crowns to $1 31 March 20X5 1-60 crowns to $1 1. 2. The draft financial statements of Gamma for the year ended 31 March 20x5 show a profit after tax of $10 million. This amount is before taking account of the implications of the information in exhibits 1 and 2. On 1 April 20X4 Gamma had 70 million ordinary shares and 50 million preference shares in issue. The preference shares are irredeemable, and any preference dividends are discretionary. On 1 October 20X4 Gamma made a 1 for 4 rights issue. The new shares were issued at a price of $1 per share. On 1 October 20X4 the shares of Gamma had a listed price of $1-50 immediately before the rights issue. The rights issue was fully taken up. On 31 December 20X4 Gamma paid a dividend of $3 million to its ordinary shareholders and $2 million to its preference shareholders. These were the only dividends paid by Gamma in the year ended 31 March 20X5. 3. 4. (a) Using the information in exhibits 1 and 2, explain and show how the lease of machine and purchase of property would be reported in the financial statements of Gamma for the year ended 31 March 20X5. Marks will be awarded for BOTH calculations AND explanations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started