Question

Xpress-Oh Plc makes high-end coffee machines using proprietary new technology which significantly speeds up the brewing process. The machines retail at USD1,999 per unit. Business

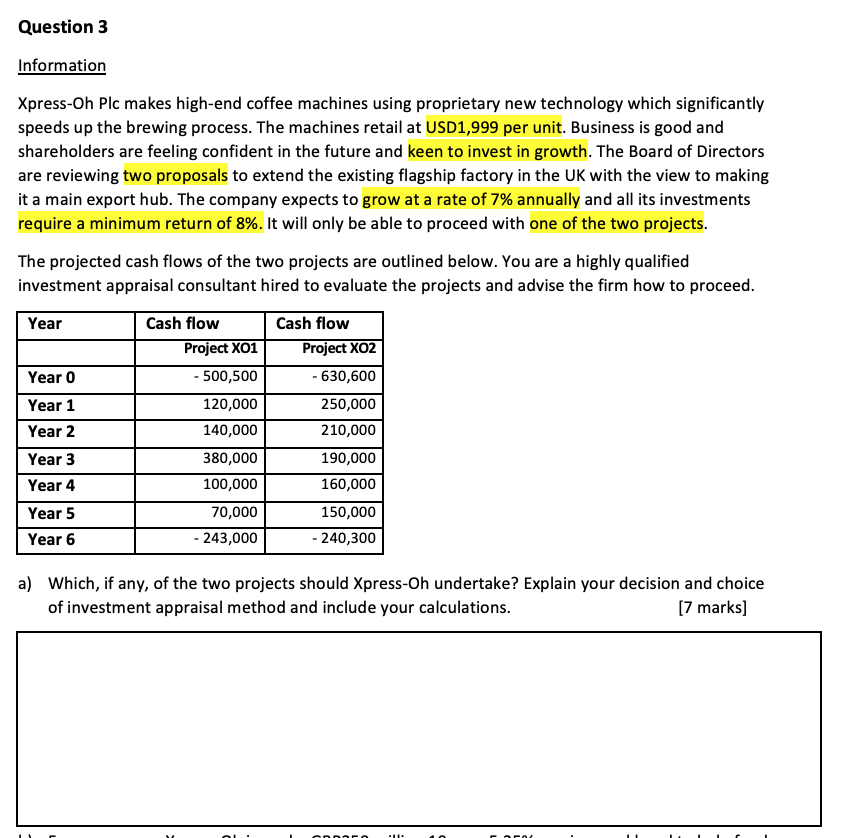

Xpress-Oh Plc makes high-end coffee machines using proprietary new technology which significantly speeds up the brewing process. The machines retail at USD1,999 per unit. Business is good and shareholders are feeling confident in the future and keen to invest in growth. The Board of Directors are reviewing two proposals to extend the existing flagship factory in the UK with the view to making it a main export hub. The company expects to grow at a rate of 7% annually and all its investments require a minimum return of 8%. It will only be able to proceed with one of the two projects.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started