Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XRX-4 Please do not copy other answers. This is a different question. If copied from other answers I will downvote and report your account .

XRX-4 Please do not copy other answers. This is a different question. If copied from other answers I will downvote and report your account .

Q1.

Q2.

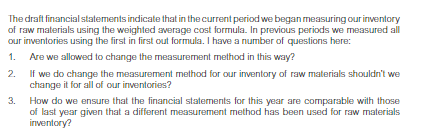

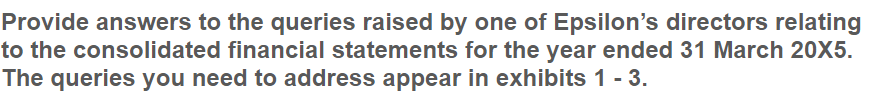

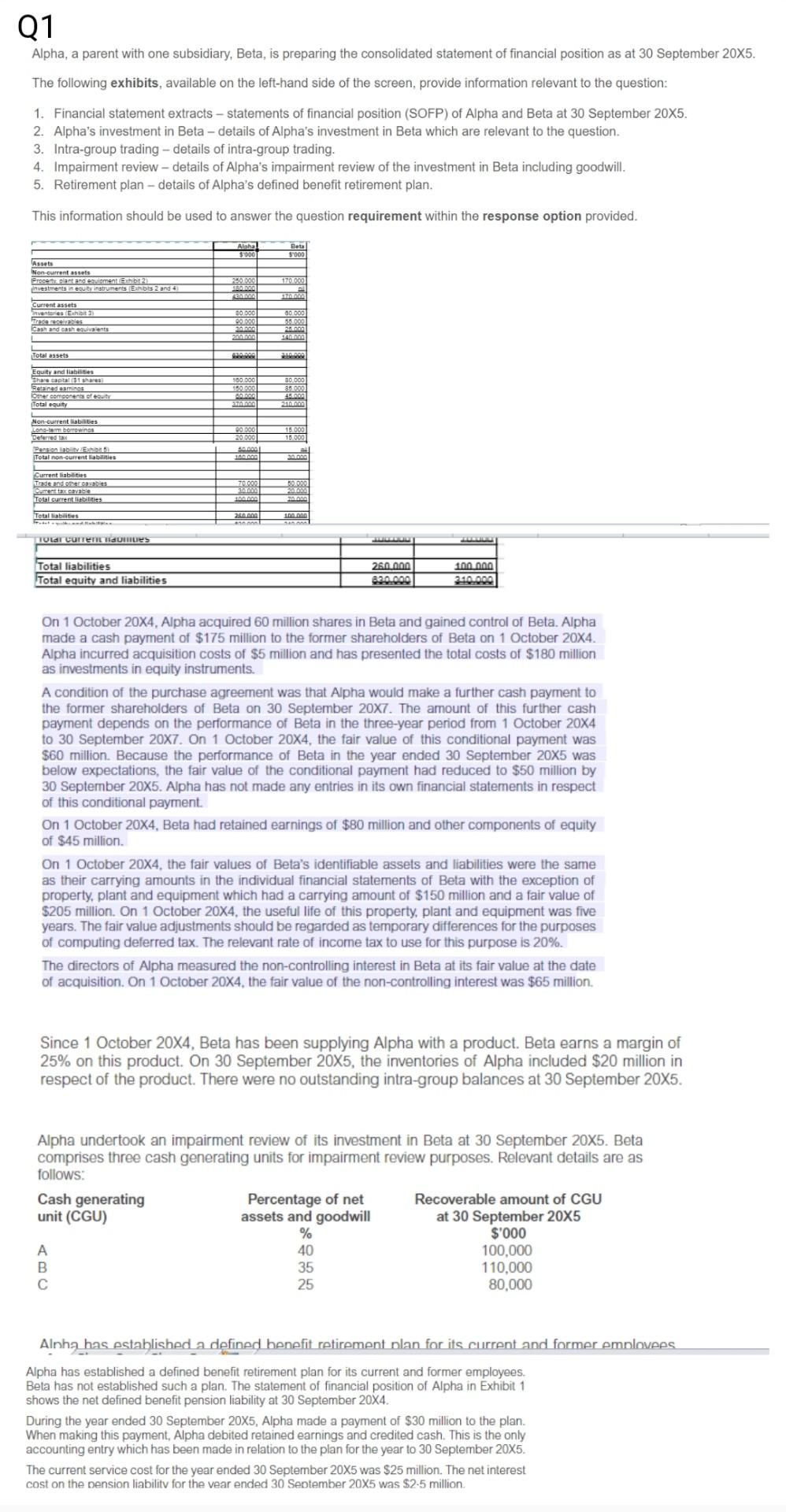

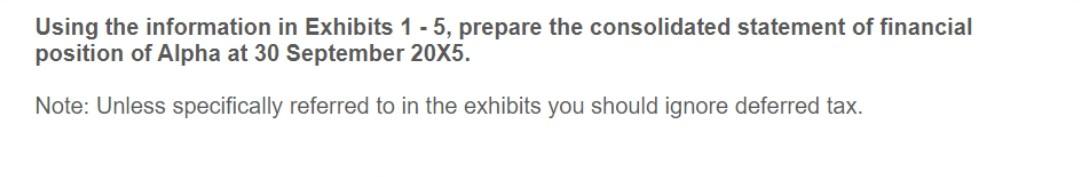

You are the financial controller of Epsilon, a listed entity with a number of subsidiaries. The consolida Epsilon for the year ended 31 March 20X5 are currently being prepared. One of the directors of Epsi which have arisen as a result of her review of the draft consolidated financial statements. The following exhibits, available on the left-hand side of the screen, provide information relevant to 1. New subsidiary the financial statements of Newby. 2. Investment - details of an equity investment. 3. Measurement change - details of a change in measurement method of inventory. This information should be used to answer the question requirements within the response option I know during the year ended 31 March 20X5 we acquired Newby. Newby is a small company which operates in the construction industry. I also know that the shares in Newby were previously owned equally by three family members, and that Newby's borrowing was a bank loan. I had a look at Newby's audited individual financial statements for the current year. The audit report identified no issues with how the financial statements had been prepared but I don't understand how this can be correct. Newby is located in the same country as we are and is subject to the same regulatory regime. The financial statements of Newby do not appear to be wholly compliant with full International Financial Reporting Standards (IFRS standards). For example, the notes to Newby's financial statements state that all borrowing costs are expensed as they are incurred despite some of these borrowings relating to the construction of a new factory. Furthermore, the notes to Newby's financial statements don't appear to contain all the disclosures required by full IFRS standards. Please can you answer the following questions (I don't need to know the mechanics of the consolidation process - I know that already): 1. Please explain why Newby has been allowed to prepare individual financial statements which don't appear to wholly comply with full IFRS standards. 2. Please explain if Newby will need to use full IFRS standards in its own financial statements now that it's part of our group. You will know that during the year we made a strategic long-term Investment in Sandy, an entity which is a vital part of our supply chain. I believe we purchased 40% of the shares, which carry one vote cach, and that this gave us the right to appoint four of the ten directors. The other six directors are independent of each other, they don't always agree when voting. I was expecting to see Sandy Included as a subsidiary in our consolidated financial statements but instead the Investment has been shown as a single figure in our consolidated statement of financial position. The carrying amount of the investment is presented as $40 millon but, given the share price, I have calculated the fair value as $42 million. I thought that equity Investments that weren't consolidated needed to be measured at fair value. Please explain: 1. Why we aren't including Sandy as a subsidiary in our consolidated financial statements. 2. What method will have been used to arrive at the carrying amount of $40 milion rather than measuring the investment at talr value. The draft financial statements indicate that in the current period we began measuring our inventory of raw materials using the weighted average cost formula. In previous periods we measured all our inventories using the first in first out formula. I have a number of questions here: 1. Are we allowed to change the measurement method in this way? 2. If we do change the measurement method for our inventory of raw materials shouldn't we change it for all of our inventories? 3. How do we ensure that the financial statements for this year are comparable with those of last year given that a different measurement method has been used for raw materials inventory? Provide answers to the queries raised by one of Epsilon's directors relating to the consolidated financial statements for the year ended 31 March 20X5. The queries you need to address appear in exhibits 1 - 3. Q1 Alpha, a parent with one subsidiary, Beta, is preparing the consolidated statement of financial position as at 30 September 20X5. The following exhibits, available on the left-hand side of the screen, provide information relevant to the question: 1. Financial statement extracts - statements of financial position (SOFP) of Alpha and Beta at 30 September 20X5. 2. Alpha's investment in Beta - details of Alpha's investment in Beta which are relevant to the question. 3. Intra-group trading - details of intra-group trading. 4. Impairment review - details of Alpha's impairment review of the investment in Beta including goodwill. 5. Retirement plan - details of Alpha's defined benefit retirement plan. This information should be used to answer the question requirement within the response option provided. Ainha $000 Bata 5000 Non current assets Frecent plant and enviaments investments in equity instruments Ets 2 and 4 EMAI 30.000 99.000 Current assets Inventores EHR Tables Cash and cash equivalents 30 000 25.000 SAMO Total assets Z.COM Equity and liabilities Share captal 31 shares Serained caminos Other components of boty Total equity 500.000 150.000 20 80.000 85000 45.00 2016 Non-current liabilities Lons-am boomines Deferred to Peason behin Total non-current stabilities 157000 131000 00 000 30 000 0.0001 ORT 2001 Current liabilities Trade and me Current avane Total current liabilities 70.000 100 TADO Total liabilities 10. SA | TOLGT Current Tidores Total liabilities Total equity and liabilities 260.000 220.000 100 000 2410.000 On 1 October 20X4, Alpha acquired 60 million shares in Beta and gained control of Beta. Alpha made a cash payment of $175 million to the former shareholders of Beta on 1 October 20X4. Alpha incurred acquisition costs of $5 million and has presented the total costs of $180 million as investments in equity instruments. A condition of the purchase agreement was that Alpha would make a further cash payment to the former shareholders of Beta on 30 September 20X7. The amount of this further cash payment depends on the performance of Beta in the three-year period from 1 October 20X4 to 30 September 20X7. On 1 October 20X4, the fair value of this conditional payment was $60 million. Because the performance of Beta in the year ended 30 September 20X5 was below expectations, the fair value of the conditional payment had reduced to $50 million by 30 September 20X5. Alpha has not made any entries in its own financial statements in respect of this conditional payment. On 1 October 20X4, Beta had retained earnings of $80 million and other components of equity of $45 million. On 1 October 20X4, the fair values of Bela's identifiable assets and liabilities were the same as their carrying amounts in the individual financial statements of Beta with the exception of property, plant and equipment which had a carrying amount of $150 million and a fair value of $205 million. On 1 October 20X4, the useful life of this property, plant and equipment was five years. The fair value adjustments should be regarded as temporary differences for the purposes of computing deferred lax. The relevant rate of income tax to use for this purpose is 20%. The directors of Alpha measured the non-controlling interest in Beta at its fair value at the date of acquisition. On 1 October 20X4, the fair value of the non-controlling interest was $65 million. Since 1 October 20X4, Beta has been supplying Alpha with a product. Beta earns a margin of 25% on this product. On 30 September 20X5, the inventories of Alpha included $20 million in respect of the product. There were no outstanding intra-group balances at 30 September 20X5. Alpha undertook an impairment review of its investment in Beta at 30 September 2005. Beta comprises three cash generating units for impairment review purposes. Relevant details are as follows: Cash generating Percentage of net Recoverable amount of CGU unit (CGU) assets and goodwill at 30 September 20X5 % $'000 A 40 100,000 B 35 110,000 25 80,000 Alpha has established a defined benefit retirement plan for its current and former emplovees Alpha has established a defined benefit retirement plan for its current and former employees. Beta has not established such a plan. The statement of financial position of Alpha in Exhibit 1 shows the net defined benefit pension liability at 30 September 20X4. During the year ended 30 September 20X5, Alpha made a payment of $30 million to the plan. When making this payment, Alpha debited retained earnings and credited cash. This is the only accounting entry which has been made in relation to the plan for the year to 30 September 20X5. The current service cost for the year ended 30 September 20X5 was $25 million. The net interest cost on the pension liability for the vear ended 30 September 20X5 was $2.5 million Using the information in Exhibits 1 - 5, prepare the consolidated statement of financial position of Alpha at 30 September 20X5. Note: Unless specifically referred to in the exhibits you should ignore deferred tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started