Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Xtinct Artifacts has not paid a dividend during the past 10 years. However, at the end of this year, the company plans to pay a

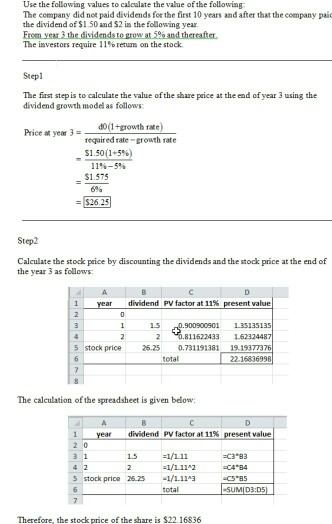

Xtinct Artifacts has not paid a dividend during the past 10 years. However, at the end of this year, the company plans to pay a $1.50 dividend and a $2 dividend the following year (Year 2). Starting in three years, the dividend will begin to grow by 5 percent each year for as long as the firm is in business. If investors require an 11 percent rate of return to purchase Xtinct's common stock, what should be the market value of its stock today?

Use the following values to calculate the value of the following The company did not paid dividends for the first 10 years and after that the company paic the dividend of $150and $2 in the following year The investors require 11% return on the stock Stepl The first step is to calculate the value of the share paice at the end of year 3 using the dividend growth modedl as follows do(1+rowth rae) reqaired rate-growth rate $1.50(1+5%) Price at year 3- 11%-5% 1.575 $2625 Step2 Calculate the stock paice by discounting the dividends and the stock price at the end of the year 3 as follows dividend PV factor at 11% 11622433 162324487 5 stock price25 0.731191381 19.1937737 total 22-1683 The calculation of the spreadsheet is given below dividend PV factor at 11% 2 0 1.5 stock price 26.251/1113 total Therefore, the stock price of the share is $22 16836Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started