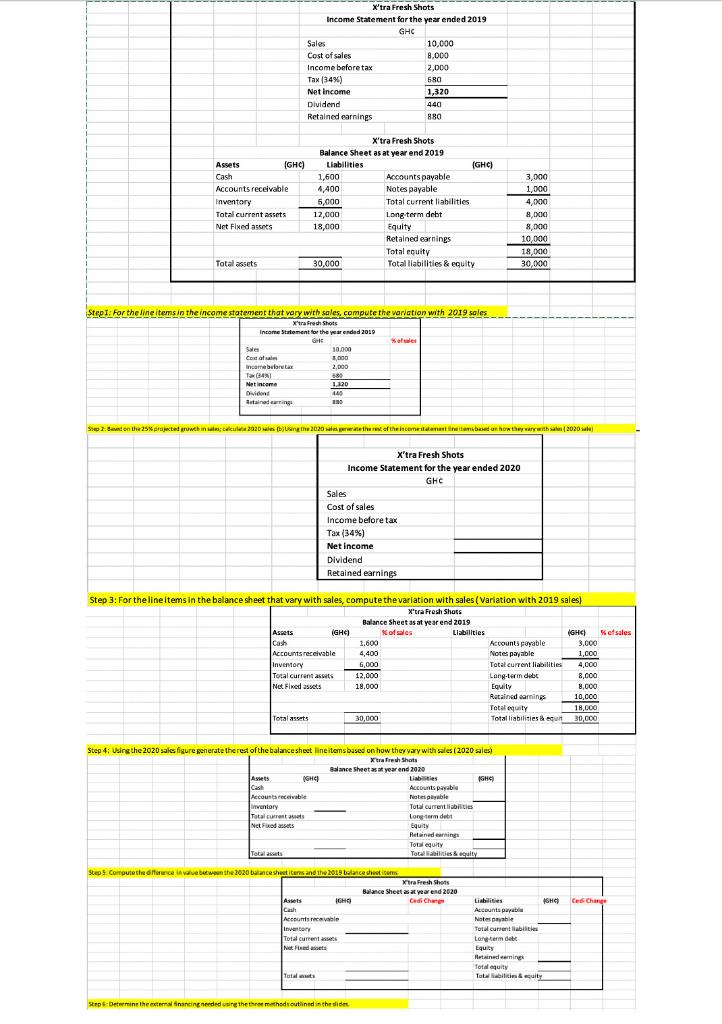

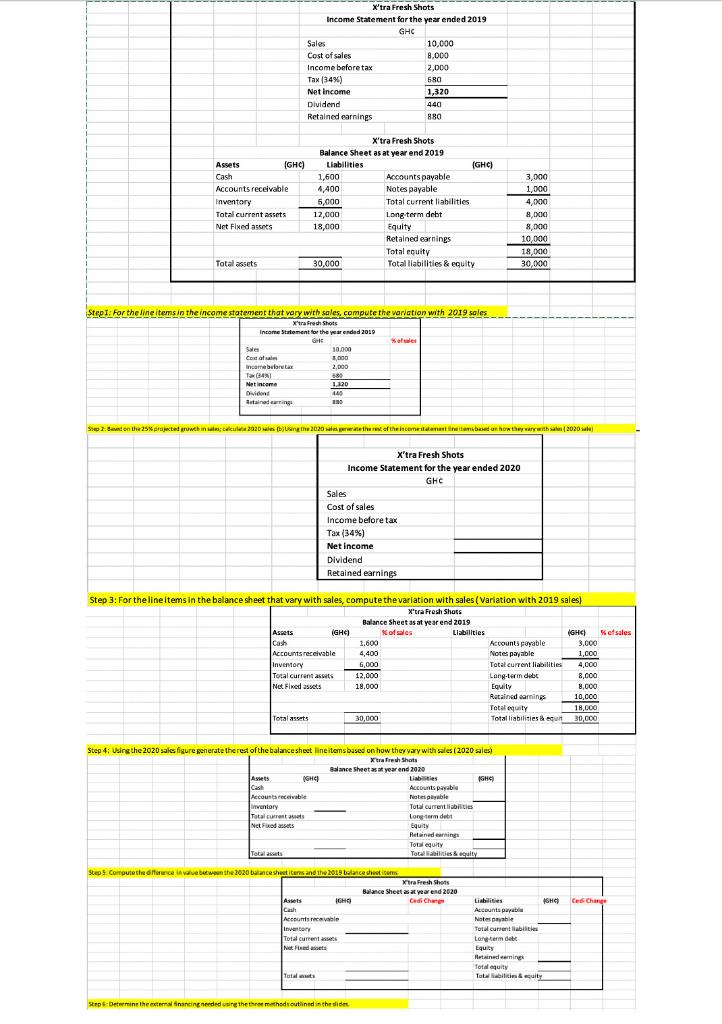

X'tra Fresh Shots Income Statement for the year ended 2019 GHC Sales 10,000 Cost of sales 8,000 Income before tax 2,000 Tax (34%) 680 Net Income 1,320 Dividend 440 Retained earnings 880 X'tra Fresh Shots Assets (GHC) Cash 3,000 Accounts receivable 1,000 Inventory 4,000 Balance sheet as at year end 2019 Liabilities (GHC) 1,600 Accounts payable 4,400 Notes payable 5,000 Total current liabilities 12,000 Long term debt 18,000 Equity Retained earnings Total equity 30,000 Total liabilities & equity Total current assets Net Fixed assets 8,000 8,000 10,000 18,000 30.000 Total assets Step1: For the line items in the income statement that vary with sales, compute the variation with 2019 sales Xtra Frech Shots Income Statement for the year ended 2019 GE Kate 10.000 Sales Costa Incarebeforetak 1,000 2.000 580 T: (341 nime Dividend 1.220 46 Buning 18 Sep 2.Sed on the 25 projected growth in 2020 jengthe 2020 persoftheincarne statement intens based on how they vary with a 2020 X'tra Fresh Shots Income Statement for the year ended 2020 GHC Sales Cost of sales Income before tax Tax (34%) Net Income Dividend Retained earnings Step 3: For the line items in the balance sheet that vary with sales, compute the variation with sales (Variation with 2019 sales) Yurare Balance Sheet us at year end 2019 Xof sales Liabilities of sales IGHCH 3.000 1.600 Assets (GHC) Cash Accounts receivable Inventory Note abil Accounts payable Notes payable 4,400 6,000 12,000 1,000 4.000 Total current liabilities Total current assets 8,000 Net Fixed assets 18,000 Long-term deb Equity Retained earnings Total equity Total liabilities & equit 8,000 10,000 Total assets 18,000 30,000 30,000 Step 4: Using the 2020 sales figure generate the rest of the balance sheet line items based on how they vary with sales (2020 sales) Wir fresh Shorts Balance Sheetasat year end 2020 IGHT Liabilities SH Accounts payable Account recevable Mabes payable orventory Total current liabilities liabilis Total current Long-term det Net Foods Equity Renderings Total arts Tot quity Total abilities & equity Ces Change Step 5 Computeste diference in value between the 2020 balance sheet items and the 2019 te lance sistem ha Fresh Shots Balance Sheets a year end 2020 Assets Cedi Cha Cash Account Inventory Total current Not Find Liabilities GH Accounts payable Nats payable Total current liabilities Long-term dat Equity Het windamine Totalegur Total Step-Determine the eternal financing needed in the three methods outlined in the side . X'tra Fresh Shots Income Statement for the year ended 2019 GHC Sales 10,000 Cost of sales 8,000 Income before tax 2,000 Tax (34%) 680 Net Income 1,320 Dividend 440 Retained earnings 880 X'tra Fresh Shots Assets (GHC) Cash 3,000 Accounts receivable 1,000 Inventory 4,000 Balance sheet as at year end 2019 Liabilities (GHC) 1,600 Accounts payable 4,400 Notes payable 5,000 Total current liabilities 12,000 Long term debt 18,000 Equity Retained earnings Total equity 30,000 Total liabilities & equity Total current assets Net Fixed assets 8,000 8,000 10,000 18,000 30.000 Total assets Step1: For the line items in the income statement that vary with sales, compute the variation with 2019 sales Xtra Frech Shots Income Statement for the year ended 2019 GE Kate 10.000 Sales Costa Incarebeforetak 1,000 2.000 580 T: (341 nime Dividend 1.220 46 Buning 18 Sep 2.Sed on the 25 projected growth in 2020 jengthe 2020 persoftheincarne statement intens based on how they vary with a 2020 X'tra Fresh Shots Income Statement for the year ended 2020 GHC Sales Cost of sales Income before tax Tax (34%) Net Income Dividend Retained earnings Step 3: For the line items in the balance sheet that vary with sales, compute the variation with sales (Variation with 2019 sales) Yurare Balance Sheet us at year end 2019 Xof sales Liabilities of sales IGHCH 3.000 1.600 Assets (GHC) Cash Accounts receivable Inventory Note abil Accounts payable Notes payable 4,400 6,000 12,000 1,000 4.000 Total current liabilities Total current assets 8,000 Net Fixed assets 18,000 Long-term deb Equity Retained earnings Total equity Total liabilities & equit 8,000 10,000 Total assets 18,000 30,000 30,000 Step 4: Using the 2020 sales figure generate the rest of the balance sheet line items based on how they vary with sales (2020 sales) Wir fresh Shorts Balance Sheetasat year end 2020 IGHT Liabilities SH Accounts payable Account recevable Mabes payable orventory Total current liabilities liabilis Total current Long-term det Net Foods Equity Renderings Total arts Tot quity Total abilities & equity Ces Change Step 5 Computeste diference in value between the 2020 balance sheet items and the 2019 te lance sistem ha Fresh Shots Balance Sheets a year end 2020 Assets Cedi Cha Cash Account Inventory Total current Not Find Liabilities GH Accounts payable Nats payable Total current liabilities Long-term dat Equity Het windamine Totalegur Total Step-Determine the eternal financing needed in the three methods outlined in the side