Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Xtreme Ltd is seeking to open a new production line to replace the current raincoat production. The management team has forecasted that the company

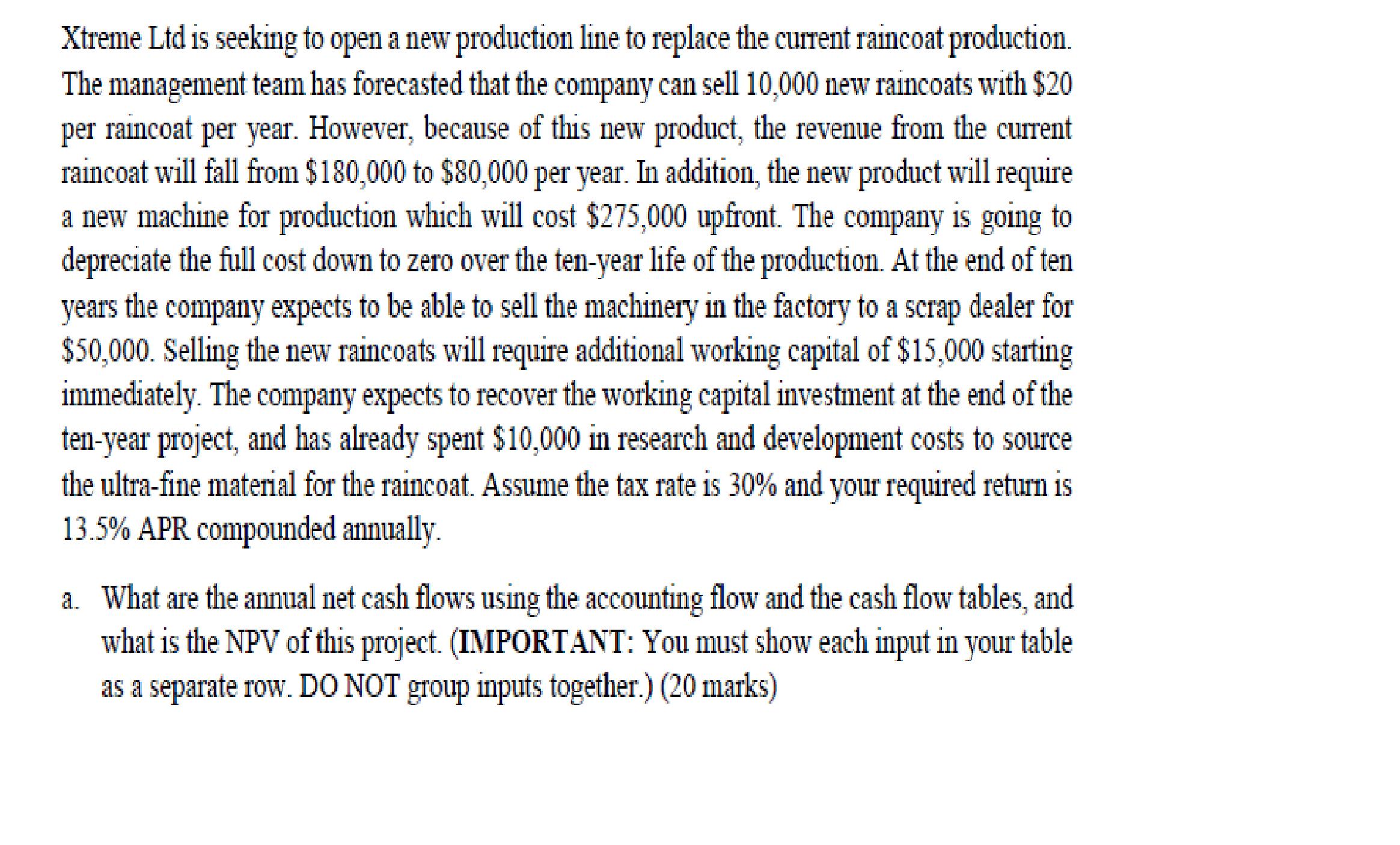

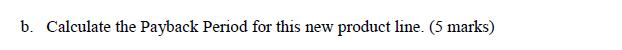

Xtreme Ltd is seeking to open a new production line to replace the current raincoat production. The management team has forecasted that the company can sell 10,000 new raincoats with $20 per raincoat per year. However, because of this new product, the revenue from the current raincoat will fall from $180,000 to $80,000 per year. In addition, the new product will require a new machine for production which will cost $275,000 upfront. The company is going to depreciate the full cost down to zero over the ten-year life of the production. At the end of ten years the company expects to be able to sell the machinery in the factory to a scrap dealer for $50,000. Selling the new raincoats will require additional working capital of $15,000 starting immediately. The company expects to recover the working capital investment at the end of the ten-year project, and has already spent $10,000 in research and development costs to source the ultra-fine material for the raincoat. Assume the tax rate is 30% and your required return is 13.5% APR compounded annually. a. What are the annual net cash flows using the accounting flow and the cash flow tables, and what is the NPV of this project. (IMPORTANT: You must show each input in your table as a separate row. DO NOT group inputs together.) (20 marks) b. Calculate the Payback Period for this new product line. (5 marks)

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the annual net cash flows using the accounting flow and cash flow tables we need to con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started