Answered step by step

Verified Expert Solution

Question

1 Approved Answer

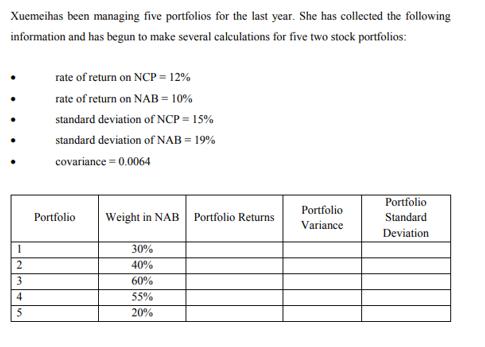

Xuemeihas been managing five portfolios for the last year. She has collected the following information and has begun to make several calculations for five

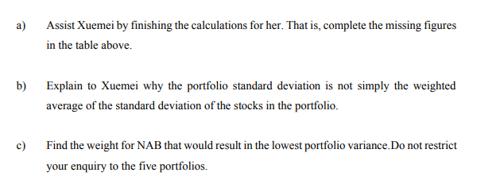

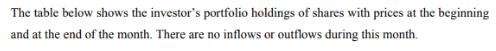

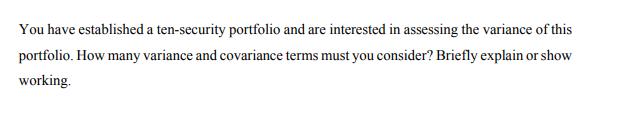

Xuemeihas been managing five portfolios for the last year. She has collected the following information and has begun to make several calculations for five two stock portfolios: 1 12345 rate of return on NCP = 12% rate of return on NAB = 10% standard deviation of NCP = 15% standard deviation of NAB = 19% covariance = 0.0064 Portfolio Weight in NAB Portfolio Returns. 30% 40% 60% 55% 20% Portfolio Variance Portfolio Standard Deviation. a) Assist Xuemei by finishing the calculations for her. That is, complete the missing figures in the table above. b) Explain to Xuemei why the portfolio standard deviation is not simply the weighted average of the standard deviation of the stocks in the portfolio. c) Find the weight for NAB that would result in the lowest portfolio variance. Do not restrict your enquiry to the five portfolios. The table below shows the investor's portfolio holdings of shares with prices at the beginning and at the end of the month. There are no inflows or outflows during this month. a) Stock A B C D Shares 1000 1500 300 600 Price begin month $15.00 $36.00 $12.50 $10.00 Price end month $13.30 $34.00 $14.75 $21.00 Determine the portfolio's discrete rate of return for the month. b) Determine the portfolio's annualised rate of return. You have established a ten-security portfolio and are interested in assessing the variance of this portfolio. How many variance and covariance terms must you consider? Briefly explain or show working.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations for Xuemei 5 a Portfolio 1 Weight in NAB 30 Portfolio Returns 03 10 07 12 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started