Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XX = 72 Question 7 (10 marks) You are interested in short selling 100 shares of Look Nice Company. The initial margin is 60% and

XX = 72

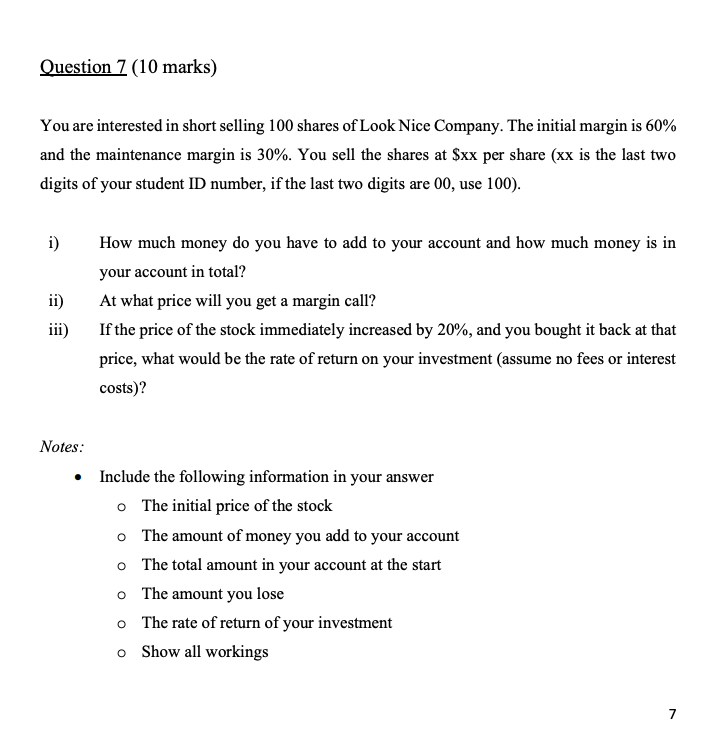

Question 7 (10 marks) You are interested in short selling 100 shares of Look Nice Company. The initial margin is 60% and the maintenance margin is 30%. You sell the shares at $xx per share ( xx is the last two digits of your student ID number, if the last two digits are 00 , use 100 ). i) How much money do you have to add to your account and how much money is in your account in total? ii) At what price will you get a margin call? iii) If the price of the stock immediately increased by 20%, and you bought it back at that price, what would be the rate of return on your investment (assume no fees or interest costs)? Notes: - Include the following information in your answer - The initial price of the stock - The amount of money you add to your account - The total amount in your account at the start - The amount you lose - The rate of return of your investment - Show all workings 7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started