Answered step by step

Verified Expert Solution

Question

1 Approved Answer

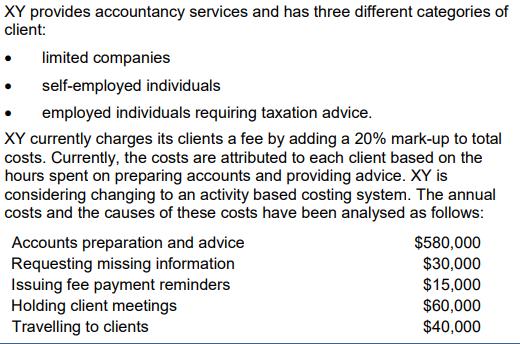

XY provides accountancy services and has three different categories of client: limited companies self-employed individuals employed individuals requiring taxation advice. XY currently charges its

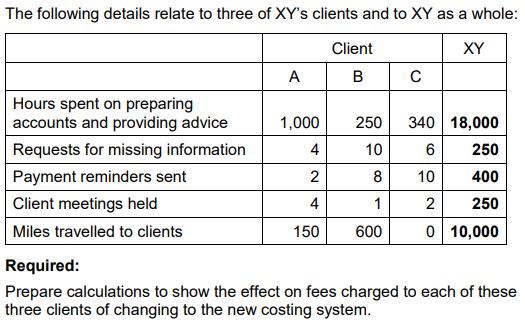

XY provides accountancy services and has three different categories of client: limited companies self-employed individuals employed individuals requiring taxation advice. XY currently charges its clients a fee by adding a 20% mark-up to total costs. Currently, the costs are attributed to each client based on the hours spent on preparing accounts and providing advice. XY is considering changing to an activity based costing system. The annual costs and the causes of these costs have been analysed as follows: $580,000 Accounts preparation and advice Requesting missing information Issuing fee payment reminders Holding client meetings Travelling to clients $30,000 $15,000 $60,000 $40,000 The following details relate to three of XY's clients and to XY as a whole: Client XY A B C Hours spent on preparing accounts and providing advice 1,000 250 340 18,000 Requests for missing information 4 10 250 Payment reminders sent 2 8 10 400 Client meetings held 4 1 250 Miles travelled to clients 150 600 0 10,000 Required: Prepare calculations to show the effect on fees charged to each of these three clients of changing to the new costing system. XY provides accountancy services and has three different categories of client: limited companies self-employed individuals employed individuals requiring taxation advice. XY currently charges its clients a fee by adding a 20% mark-up to total costs. Currently, the costs are attributed to each client based on the hours spent on preparing accounts and providing advice. XY is considering changing to an activity based costing system. The annual costs and the causes of these costs have been analysed as follows: $580,000 Accounts preparation and advice Requesting missing information Issuing fee payment reminders Holding client meetings Travelling to clients $30,000 $15,000 $60,000 $40,000 The following details relate to three of XY's clients and to XY as a whole: Client XY A B C Hours spent on preparing accounts and providing advice 1,000 250 340 18,000 Requests for missing information 4 10 250 Payment reminders sent 2 8 10 400 Client meetings held 4 1 250 Miles travelled to clients 150 600 0 10,000 Required: Prepare calculations to show the effect on fees charged to each of these three clients of changing to the new costing system.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Fees charged to clients as per the current costing system As per the current costing system costs ar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started