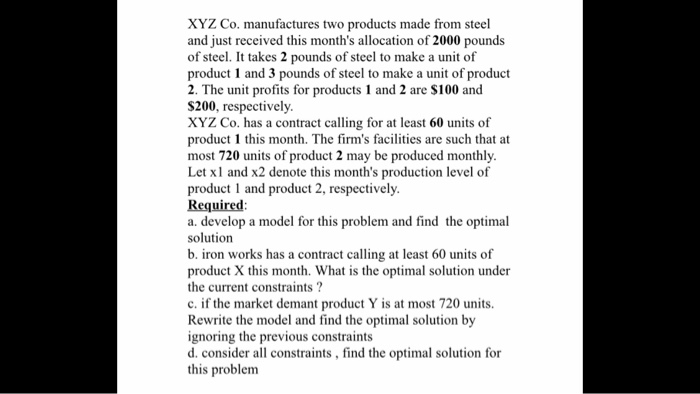

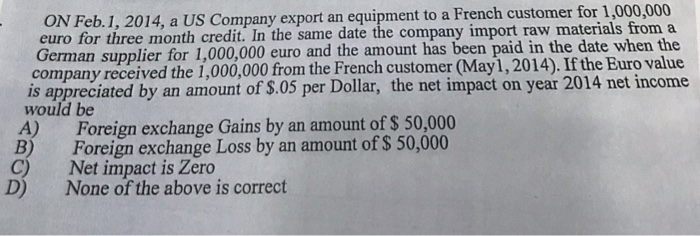

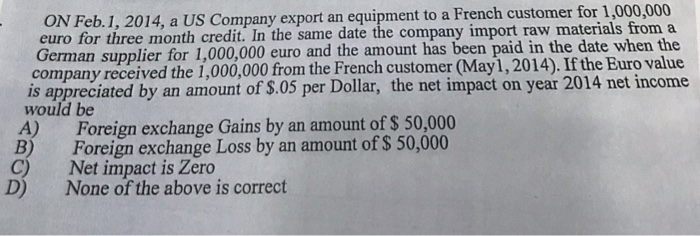

XYZ Co. manufactures two products made from steel and just received this month's allocation of 2000 pounds of steel. It takes 2 pounds of steel to make a unit of product 1 and 3 pounds of steel to make a unit of product 2. The unit profits for products 1 and 2 are $100 and $200, respectively. XYZ Co. has a contract calling for at least 60 units of product 1 this month. The firm's facilities are such that at most 720 units of product 2 may be produced monthly. Let xl and x2 denote this month's production level of product 1 and product 2, respectively. Required: a. develop a model for this problem and find the optimal solution b. iron works has a contract calling at least 60 units of product X this month. What is the optimal solution under the current constraints ? c. if the market demant product Y is at most 720 units. Rewrite the model and find the optimal solution by ignoring the previous constraints d. consider all constraints, find the optimal solution for this problem ON Feb. 1. 2014, a US Company export an equipment to a French customer for 1,000,000 euro for three month credit. In the same date the company import raw materials from a German supplier for 1,000,000 euro and the amount has been paid in the date when the company received the 1,000,000 from the French customer (May 1, 2014). If the Euro value is appreciated by an amount of $.05 per Dollar, the net impact on year 2014 net income would be A) Foreign exchange Gains by an amount of $ 50,000 Foreign exchange Loss by an amount of $ 50,000 Net impact is Zero None of the above is correct C) XYZ Co. manufactures two products made from steel and just received this month's allocation of 2000 pounds of steel. It takes 2 pounds of steel to make a unit of product 1 and 3 pounds of steel to make a unit of product 2. The unit profits for products 1 and 2 are $100 and $200, respectively. XYZ Co. has a contract calling for at least 60 units of product 1 this month. The firm's facilities are such that at most 720 units of product 2 may be produced monthly. Let xl and x2 denote this month's production level of product 1 and product 2, respectively. Required: a. develop a model for this problem and find the optimal solution b. iron works has a contract calling at least 60 units of product X this month. What is the optimal solution under the current constraints ? c. if the market demant product Y is at most 720 units. Rewrite the model and find the optimal solution by ignoring the previous constraints d. consider all constraints, find the optimal solution for this problem ON Feb. 1. 2014, a US Company export an equipment to a French customer for 1,000,000 euro for three month credit. In the same date the company import raw materials from a German supplier for 1,000,000 euro and the amount has been paid in the date when the company received the 1,000,000 from the French customer (May 1, 2014). If the Euro value is appreciated by an amount of $.05 per Dollar, the net impact on year 2014 net income would be A) Foreign exchange Gains by an amount of $ 50,000 Foreign exchange Loss by an amount of $ 50,000 Net impact is Zero None of the above is correct C)