Question

XYZ Company charges an initial franchise fee of P50,000 for a new franchise, providing the initial training, equipment and furnishings that have a stand-alone

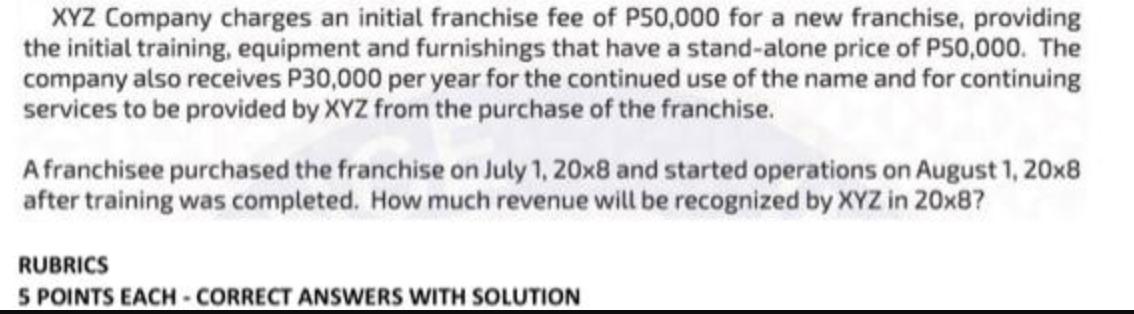

XYZ Company charges an initial franchise fee of P50,000 for a new franchise, providing the initial training, equipment and furnishings that have a stand-alone price of PS0,000. The company also receives P30,000 per year for the continued use of the name and for continuing services to be provided by XYZ from the purchase of the franchise. Afranchisee purchased the franchise on July 1, 20x8 and started operations on August 1, 20x8 after training was completed. How much revenue will be recognized by XYZ in 20x8? RUBRICS S POINTS EACH - CORRECT ANSWERS WITH SOLUTION

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Amount of Revenue to recognized for the ear 20X8 by the XYZ Company Intial franchise fee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

3rd edition

1119372933, 978-1119372936

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App