Answered step by step

Verified Expert Solution

Question

1 Approved Answer

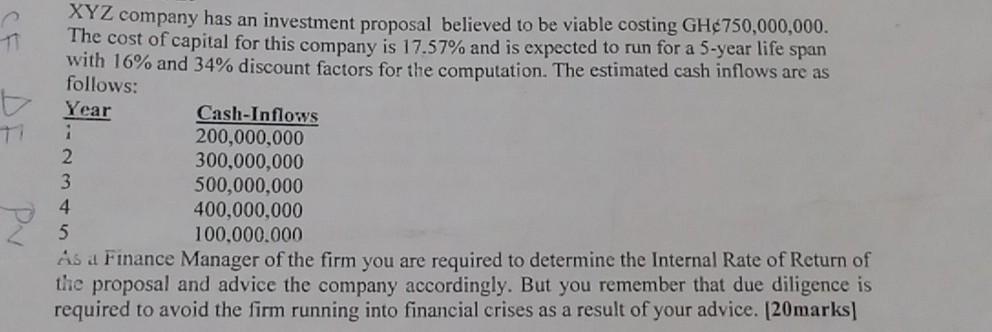

XYZ company has an investment proposal believed to be viable costing GH750,000,000. The cost of capital for this company is 17.57% and is expected to

XYZ company has an investment proposal believed to be viable costing GH750,000,000. The cost of capital for this company is 17.57% and is expected to run for a 5 -year life span with 16% and 34% discount factors for the computation. The estimated cash inflows are as follows: is a Finance Manager of the firm you are required to determine the Internal Rate of Return of the proposal and advice the company accordingly. But you remember that due diligence is required to avoid the firm running into financial crises as a result of your advice. [20marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started