Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ company is considring the purchase of a project. the next year's NOI and cash flow is expected to be $3,000,000. and based on XYZ's

XYZ company is considring the purchase of a project. the next year's NOI and cash flow is expected to be $3,000,000. and based on XYZ's economic forecast. Market supply and demand and vacancy levels appear to be in balance. As a result. NOI should increase 4% each year and grows by 5% to infinty XYZ beleife at least 12% return on invistment

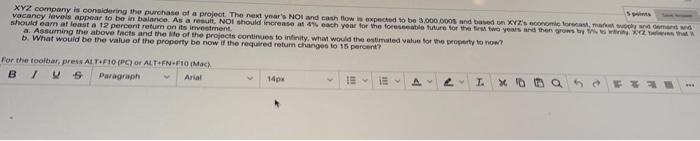

XYZ company is considering the purchase of a project. The next year's NOT and cash flow is expected to be 3,000,000 and based on XYZ's come to me vacancy levels appear to be in balance. As a result, NOI should increase at 4% each you for the foreseeable future for the two years and then grows by WSZ a. Assuming the above facts and the Ne of the projects continues to infinity, what would the estimated value for the property to now? b. What would be the value of the property be now if the required return changes to 15 percent? For the toolbar, pres ALT F10 (PC) O ALT+FN F10 Mac) 6 Paragraph Arial 14px TA x Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started