Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ company manufactures office chairs. The company applies manufacturing overhead on the basis of direct-labor hours. The company's budget for the current year: Estimated

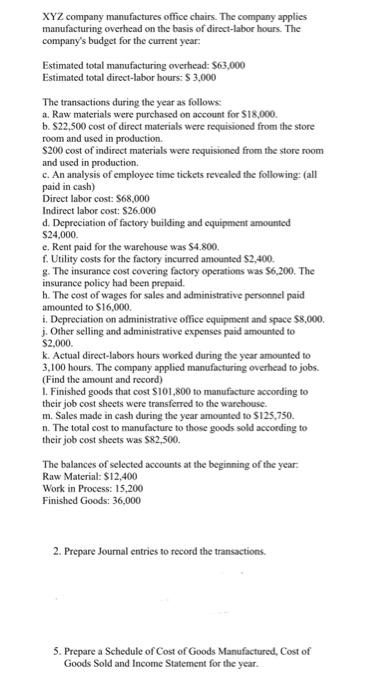

XYZ company manufactures office chairs. The company applies manufacturing overhead on the basis of direct-labor hours. The company's budget for the current year: Estimated total manufacturing overhead: $63,000 Estimated total direct-labor hours: $ 3,000 The transactions during the year as follows: a. Raw materials were purchased on account for $18,000. b. $22,500 cost of direct materials were requisioned from the store room and used in production. $200 cost of indirect materials were requisioned from the store room and used in production. c. An analysis of employee time tickets revealed the following: (all paid in cash) Direct labor cost: $68,000 Indirect labor cost: $26.000 d. Depreciation of factory building and equipment amounted $24,000. e. Rent paid for the warehouse was $4.800. f. Utility costs for the factory incurred amounted $2,400. g. The insurance cost covering factory operations was $6,200. The insurance policy had been prepaid. h. The cost of wages for sales and administrative personnel paid amounted to $16,000. i. Depreciation on administrative office equipment and space $8,000. j. Other selling and administrative expenses paid amounted to $2,000. k. Actual direct-labors hours worked during the year amounted to 3,100 hours. The company applied manufacturing overhead to jobs. (Find the amount and record) 1. Finished goods that cost $101,800 to manufacture according to their job cost sheets were transferred to the warehouse. m. Sales made in cash during the year amounted to $125,750. n. The total cost to manufacture to those goods sold according to their job cost sheets was $82,500. The balances of selected accounts at the beginning of the year: Raw Material: $12,400 Work in Process: 15,200 Finished Goods: 36,000 2. Prepare Journal entries to record the transactions. 5. Prepare a Schedule of Cost of Goods Manufactured, Cost of Goods Sold and Income Statement for the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started