Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ Company was incorporated on March 1, 2021 with an initial capital of 200,000 shares of common stock having $10 par value. During the

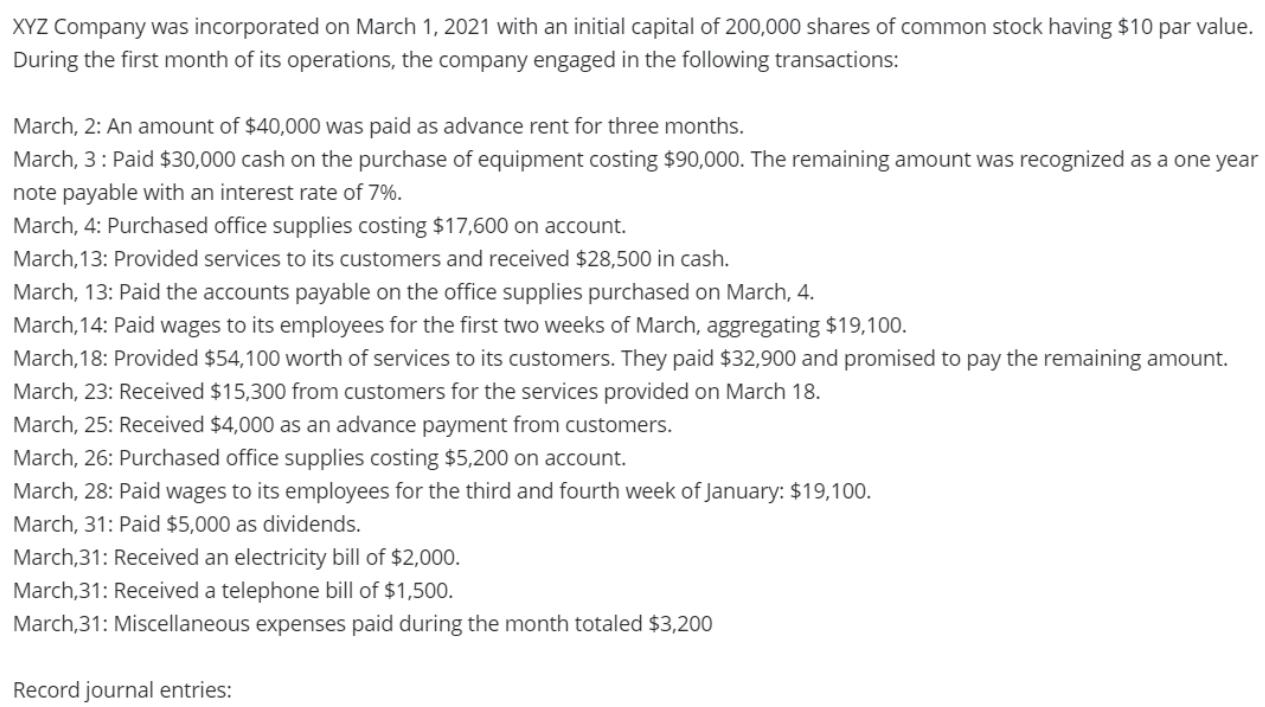

XYZ Company was incorporated on March 1, 2021 with an initial capital of 200,000 shares of common stock having $10 par value. During the first month of its operations, the company engaged in the following transactions: March, 2: An amount of $40,000 was paid as advance rent for three months. March, 3: Paid $30,000 cash on the purchase of equipment costing $90,000. The remaining amount was recognized as a one year note payable with an interest rate of 7%. March, 4: Purchased office supplies costing $17,600 on account. March, 13: Provided services to its customers and received $28,500 in cash. March, 13: Paid the accounts payable on the office supplies purchased on March, 4. March, 14: Paid wages to its employees for the first two weeks of March, aggregating $19,100. March,18: Provided $54,100 worth of services to its customers. They paid $32,900 and promised to pay the remaining amount. March, 23: Received $15,300 from customers for the services provided on March 18. March, 25: Received $4,000 as an advance payment from customers. March, 26: Purchased office supplies costing $5,200 on account. March, 28: Paid wages to its employees for the third and fourth week of January: $19,100. March, 31: Paid $5,000 as dividends. March,31: Received an electricity bill of $2,000. March,31: Received a telephone bill of $1,500. March,31: Miscellaneous expenses paid during the month totaled $3,200 Record journal entries:

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

March 2 R ent Exp ense 40 000 Cash 40 000 March 3 Equ ipment 60 000 Cash 30 00...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started