Question

Question #1 (1) Prepare an indirect cash flow statement for ABC Company for 2020. (2) What is the EBITDA based intrinsic value of ABC Company

Question #1

(1) Prepare an indirect cash flow statement for ABC Company for 2020.

(2) What is the EBITDA based intrinsic value of ABC Company using 2020 data and how does it compare to book equity? Why is book equity sometimes used as a guide to value?

(3) Give a reason why the company should maintain a minimum level of cash, the amount you would recommend (versus $9,300,000) and how this change would be implemented.

(4) Do you think ABC Company has met the XYZ Company’s CFO’s cash flow and value expectations, yes or no and why, and would you buy ABC Company.

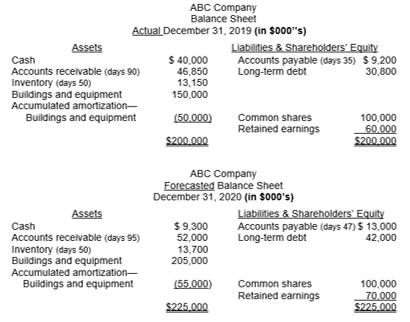

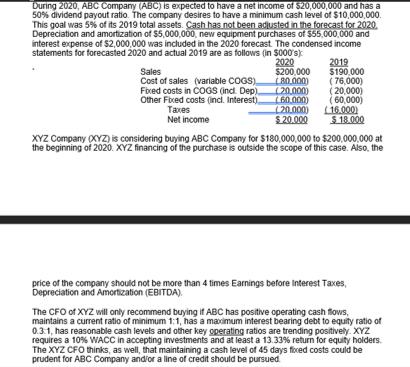

Assets ABC Company Balance Sheet Actual December 31, 2019 (in $000"s) Cash Accounts receivable (days 90) Inventory (days 50) Buildings and equipment Accumulated amortization- Buildings and equipment Assets Cash Accounts receivable (days 95) Inventory (days 50) Buildings and equipment Accumulated amortization- Buildings and equipment $ 40,000 46,850 13,150 150,000 (50,000) $200.000 $9.300 52,000 ABC Company Forecasted Balance Sheet December 31, 2020 (in $000's) 13,700 205,000 Liabilities & Shareholders' Equity Accounts payable (days 35) $9.200 Long-term debt 30,800 (55,000) $225.000 Common shares Retained earnings 100,000 60.000 $200.000 Liabilities & Shareholders' Equity Accounts payable (days 47) $ 13,000 Long-term debt 42,000 Common shares Retained earnings 100,000 70.000 $225.000

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Hello Student I ho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started