XYZ Corp. sells recreational equipment. One of the company's products, a small camp stove, sells for $140 per unit. Variable expenses are $98 per

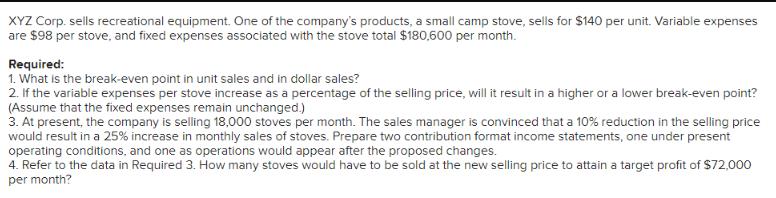

XYZ Corp. sells recreational equipment. One of the company's products, a small camp stove, sells for $140 per unit. Variable expenses are $98 per stove, and fixed expenses associated with the stove total $180,600 per month. Required: 1. What is the break-even point in unit sales and in dollar sales? 2. If the variable expenses per stove increase as a percentage of the selling price, will it result in a higher or a lower break-even point? (Assume that the fixed expenses remain unchanged.) 3. At present, the company is selling 18,000 stoves per month. The sales manager is convinced that a 10% reduction in the selling price would result in a 25% increase in monthly sales of stoves. Prepare two contribution format income statements, one under present operating conditions, and one as operations would appear after the proposed changes. 4. Refer to the data in Required 3. How many stoves would have to be sold at the new selling price to attain a target profit of $72,000 per month?

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Soln Page what is the break even Point in unit sales and in dollan Sales 140 Selling Price Per unit ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started