Answered step by step

Verified Expert Solution

Question

1 Approved Answer

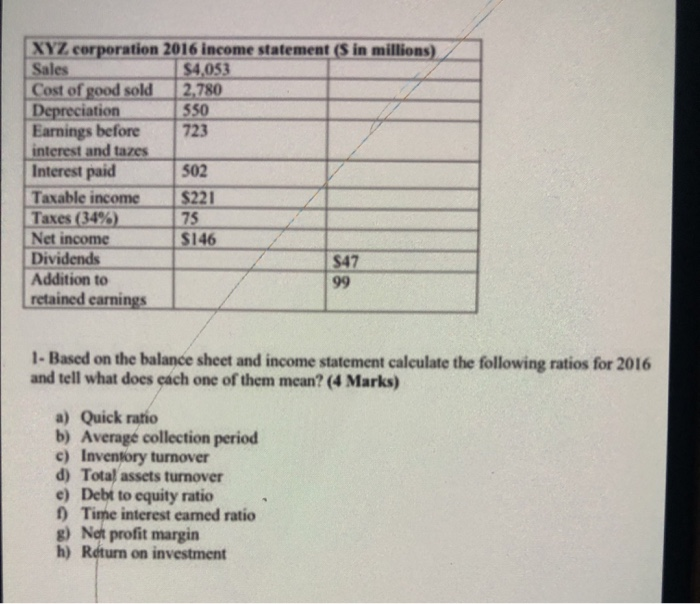

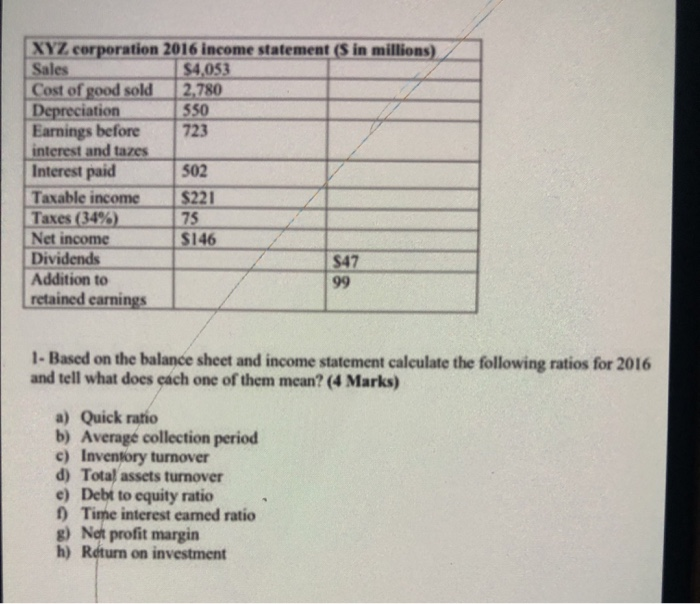

XYZ corporation 2016 income statement (S in millions) Sales $4,053 Cost of good sold 2,780 Depreciation 550 Earnings before 723 interest and tazes Interest paid

XYZ corporation 2016 income statement (S in millions) Sales $4,053 Cost of good sold 2,780 Depreciation 550 Earnings before 723 interest and tazes Interest paid 502 Taxable income $221 Taxes (34%) 75 Net income S146 Dividends S47 Addition to 99 retained earnings 1- Based on the balance sheet and income statement calculate the following ratios for 2016 and tell what does each one of them mean? (4 Marks) a) Quick ratio b) Average collection period c) Inventory turnover d) Total assets turnover e) Debt to equity ratio 1) Time interest eamed ratio g) Not profit margin h) Return on investment XYZ corporation 2016 income statement (S in millions) Sales $4,053 Cost of good sold 2,780 Depreciation 550 Earnings before 723 interest and tazes Interest paid 502 Taxable income $221 Taxes (34%) 75 Net income S146 Dividends S47 Addition to 99 retained earnings 1- Based on the balance sheet and income statement calculate the following ratios for 2016 and tell what does each one of them mean? (4 Marks) a) Quick ratio b) Average collection period c) Inventory turnover d) Total assets turnover e) Debt to equity ratio 1) Time interest eamed ratio g) Not profit margin h) Return on investment

XYZ corporation 2016 income statement (S in millions) Sales $4,053 Cost of good sold 2,780 Depreciation 550 Earnings before 723 interest and tazes Interest paid 502 Taxable income $221 Taxes (34%) 75 Net income S146 Dividends S47 Addition to 99 retained earnings 1- Based on the balance sheet and income statement calculate the following ratios for 2016 and tell what does each one of them mean? (4 Marks) a) Quick ratio b) Average collection period c) Inventory turnover d) Total assets turnover e) Debt to equity ratio 1) Time interest eamed ratio g) Not profit margin h) Return on investment XYZ corporation 2016 income statement (S in millions) Sales $4,053 Cost of good sold 2,780 Depreciation 550 Earnings before 723 interest and tazes Interest paid 502 Taxable income $221 Taxes (34%) 75 Net income S146 Dividends S47 Addition to 99 retained earnings 1- Based on the balance sheet and income statement calculate the following ratios for 2016 and tell what does each one of them mean? (4 Marks) a) Quick ratio b) Average collection period c) Inventory turnover d) Total assets turnover e) Debt to equity ratio 1) Time interest eamed ratio g) Not profit margin h) Return on investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started