Question

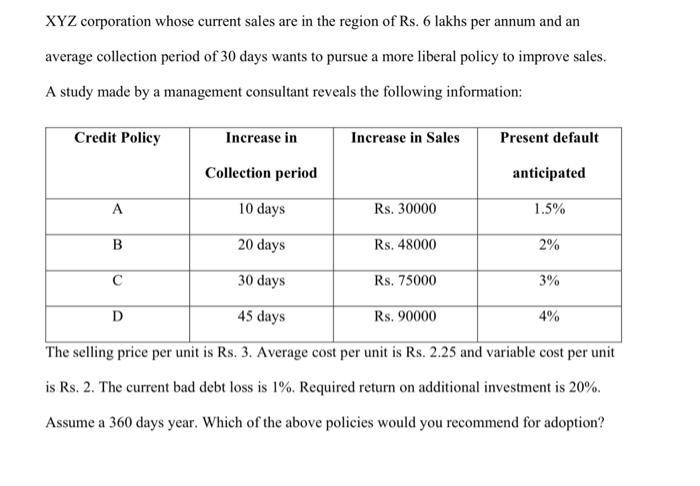

XYZ corporation whose current sales are in the region of Rs. 6 lakhs per annum and an average collection period of 30 days wants

XYZ corporation whose current sales are in the region of Rs. 6 lakhs per annum and an average collection period of 30 days wants to pursue a more liberal policy to improve sales. A study made by a management consultant reveals the following information: Credit Policy A B C Increase in D Collection period 10 days Increase in Sales Rs. 30000 20 days 30 days 45 days The selling price per unit is Rs. 3. Average cost per unit is Rs. 2.25 and variable cost per unit is Rs. 2. The current bad debt loss is 1%. Required return on additional investment is 20%. Assume a 360 days year. Which of the above policies would you recommend for adoption? Rs. 48000 Rs. 75000 Present default Rs. 90000 anticipated 1.5% 2% 3% 4%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Policy A Increase in collection period 10 days Increase in sales Rs 30000 Default anticipated 15 Add...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App