Answered step by step

Verified Expert Solution

Question

1 Approved Answer

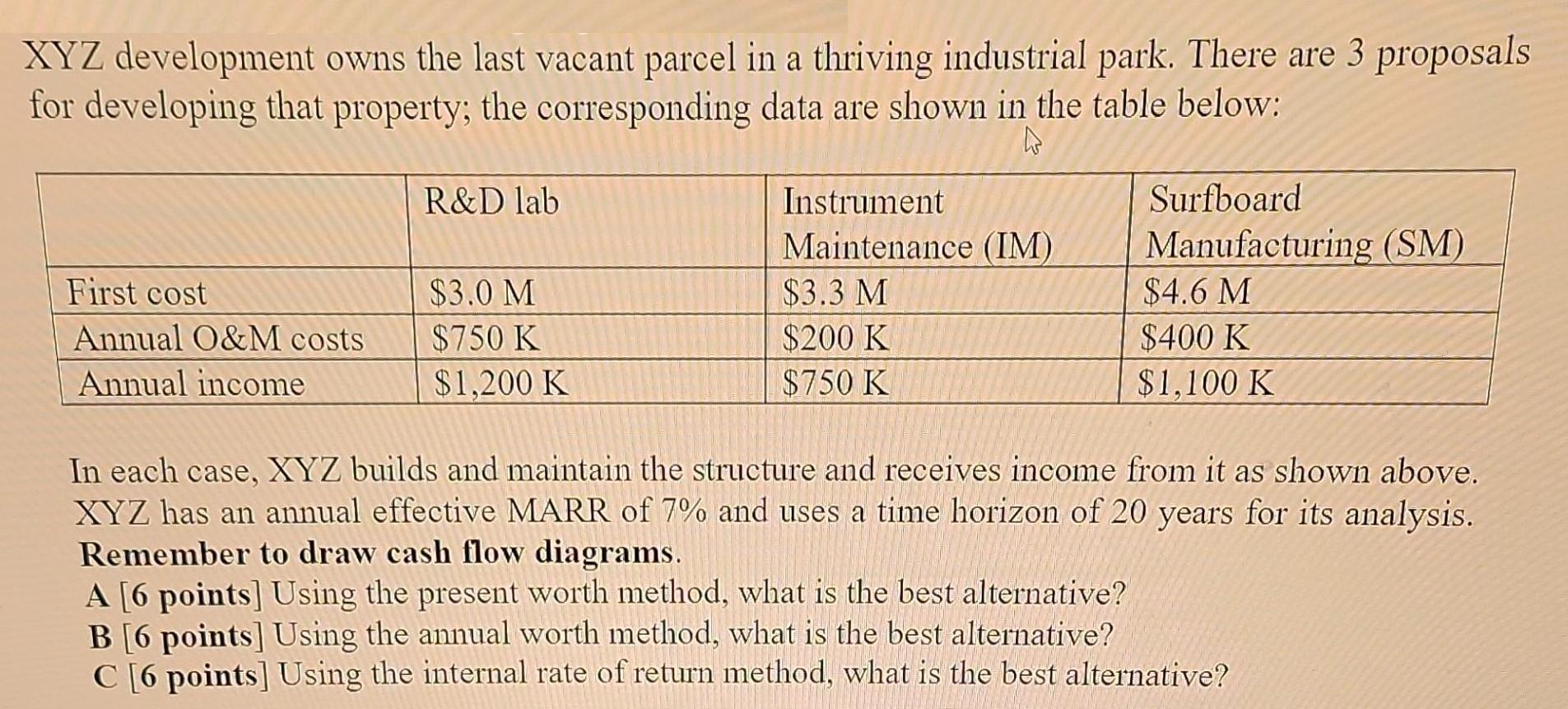

XYZ development owns the last vacant parcel in a thriving industrial park. There are 3 proposals for developing that property; the corresponding data are

XYZ development owns the last vacant parcel in a thriving industrial park. There are 3 proposals for developing that property; the corresponding data are shown in the table below: W First cost Annual O&M costs Annual income R&D lab $3.0 M $750 K $1,200 K Instrument Maintenance (IM) $3.3 M $200 K $750 K Surfboard Manufacturing (SM) $4.6 M $400 K $1,100 K In each case, XYZ builds and maintain the structure and receives income from it as shown above. XYZ has an annual effective MARR of 7% and uses a time horizon of 20 years for its analysis. Remember to draw cash flow diagrams. A [6 points] Using the present worth method, what is the best alternative? B [6 points] Using the annual worth method, what is the best alternative? C [6 points] Using the internal rate of return method, what is the best alternative?

Step by Step Solution

★★★★★

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A The best alternative is the research and development lab which has a present worth of 30 million T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started