Question

XYZ Inc. considers an investment project that requires $250,000 in new equipment and requires a $30,000 investment in NWC that will be returned at

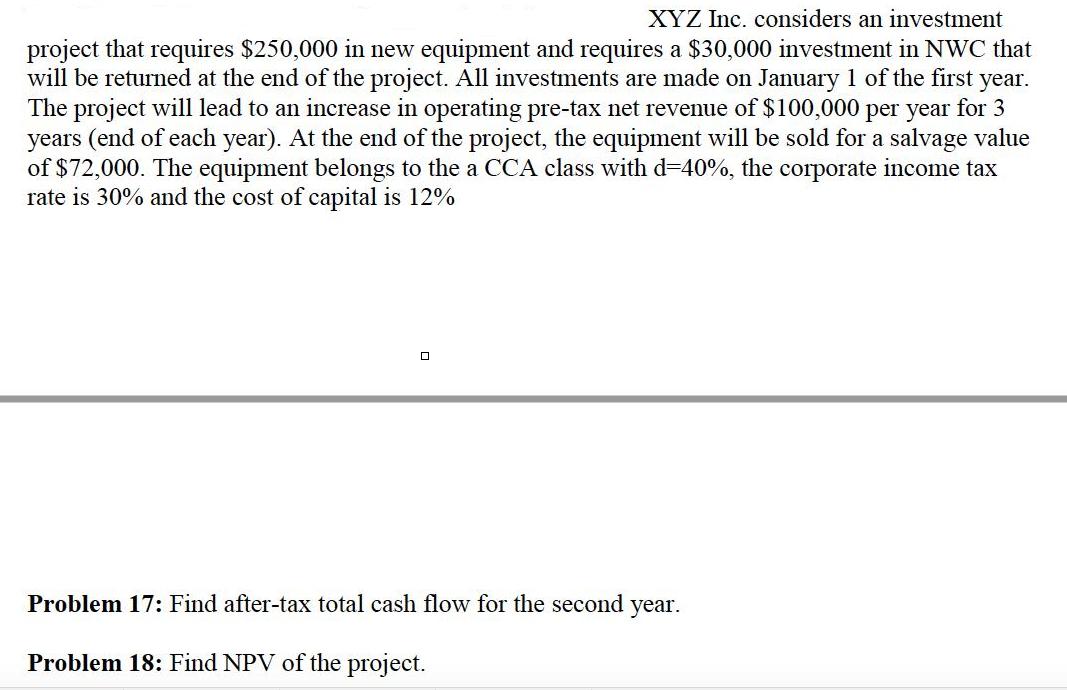

XYZ Inc. considers an investment project that requires $250,000 in new equipment and requires a $30,000 investment in NWC that will be returned at the end of the project. All investments are made on January 1 of the first year. The project will lead to an increase in operating pre-tax net revenue of $100,000 per year for 3 years (end of each year). At the end of the project, the equipment will be sold for a salvage value of $72,000. The equipment belongs to the a CCA class with d=40%, the corporate income tax rate is 30% and the cost of capital is 12% Problem 17: Find after-tax total cash flow for the second year. Problem 18: Find NPV of the project.

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Note Negative sign indicates cash outflow Here our primary aim to find NPV NPV is equal to discounte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of economics

Authors: N. Gregory Mankiw

6th Edition

978-0538453059, 9781435462120, 538453052, 1435462122, 978-0538453042

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App