Question

XYZ Inc. is a telecom company for phone products and services that is studying a 10 year investment opportunity. XYZ Inc. has just conducted a

XYZ Inc. is a telecom company for phone products and services that is studying a 10 year investment opportunity. XYZ Inc. has just conducted a $20 million feasibility study that considers introducing a new line of products, that will include 5G enabled devices. To do so, XYZ Inc. will need to invest in technology and equipment of $48 million. In addition, they will require development expenses that have to be paid upfront. Precisely, a sum of $5.5 million for R&D and $3.5 million for marketing expenses. During the first 4 years, the marketing group expects annual sales to grow my 4 percent. They forecast the initial year to witness $110 million in sales. However, after the fourth year, they expect sales to drop by 7% annually due to 5G network changes and modifications. Hence, it expects to acquire additional equipments with an expense of $30 million for its products with the expected change of the network.

The costs of manufacturing these products are expected to be $50 million in the initial year with a 5% expected annual increase for the first four years and a 8% increase afterwards. Operating expenses are expected to be $9.5 million per year. Net working capital is predicted to be 20% of manufacturing costs. The company pays a corporate tax rate of 20% and follows a straight-line depreciation method.

XYZ Inc. current Market Balance sheet and Cost of Capital is as follows:

| Assets | Liabilities | Cost of Capital | |||||

| Cash | 100 | Debt | 400 | Debt | 6% | ||

| inventory | 300 | Equity | 600 | Equity | 10% | ||

| LT Asset | 600 | ||||||

| Total A | 1000 | Total L & E | 1000 | ||||

Considering that XYZ Inc. maintains a constant debt to equity ratio, using excel prepare the following:

A- Generate the forecasted incremental earnings statements for this project and estimate the free cash flow statement.

B- Evaluate the project using two capital budgeting methods.

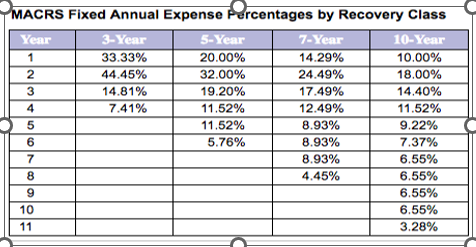

C- If the firm follows the Marcs 10-year depreciation method, will the decision change? Explain.

MACRS Fixed Annual Expense Percentages by Recovery Class Year 3-Year 5-Year 7-Year 10-Year 1 33.33% 20.00% 14.29% 10.00% 2 44.45% 32.00% 24.49% 18.00% 3 14.81% 19.20% 17.49% 14.40% 4 7.41% 11.52% 12.49% 11.52% 5 11.52% 8.93% 9.22% 6 5.76% 8.93% 7.37% 7 8.93% 6.55% 8 4.45% 6.55% 9 6.55% 6.55% 3.28% 10 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started