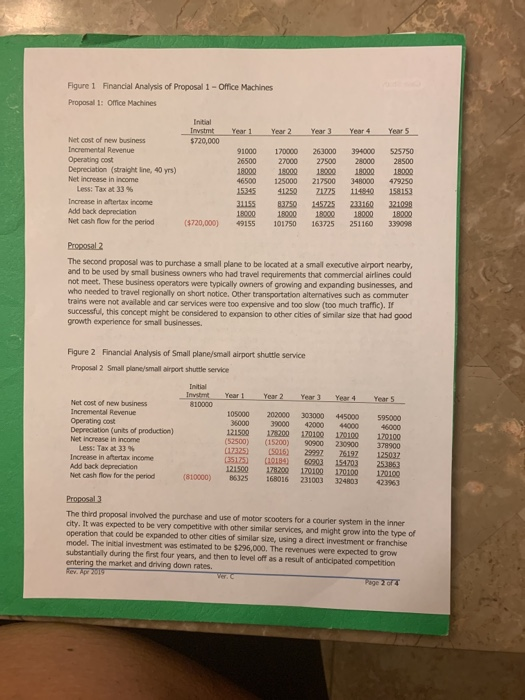

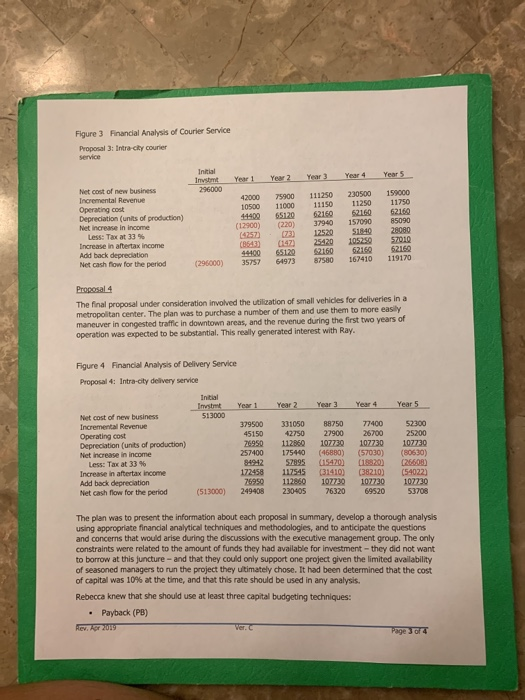

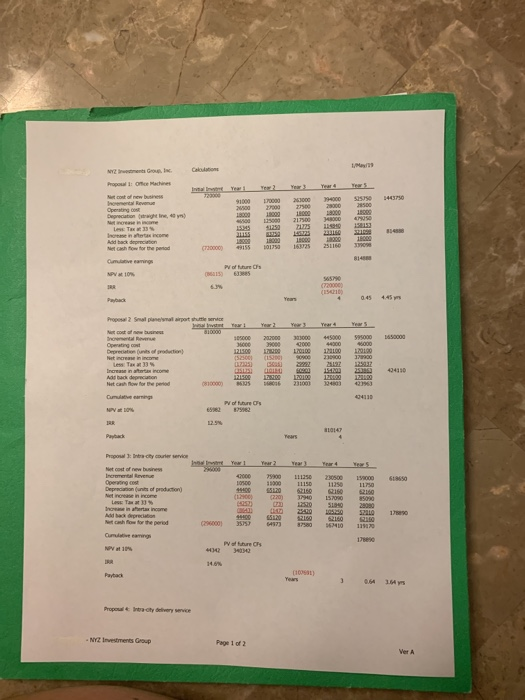

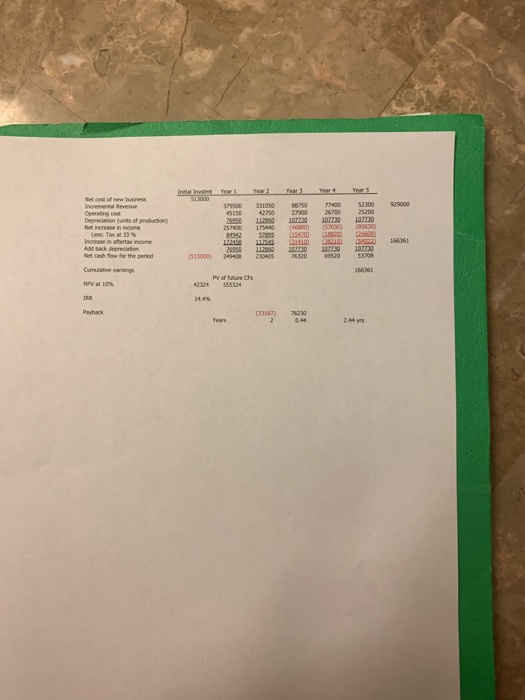

XYZ Investments Group, Inc. management company that hrough 2018. They were XYZ Investments Group, Inc. is a successful hedge fund and investment had a good track record of investments during the past number of years, t concerned about the stock market's volatility and wanted to begin diversifying so they would not be as susceptible to swings in the market as they had been in the past, and to hedge ageinst the uncertainty they faced several long term investors and traders in the market, but two of them had not had much formal education and training in financial analytical techniques that were being employed in the industry to support investment decision-making-one of them frequently referred to his "gut" as the source of inspiration for making important decislions as in "my gut is telling me... However, they look at a number of direct investment opportunities, one of which they would purchase outright, to nitiate the diversification strategy during 2019. The top managers were a competent group that consisted of Rebecca Moneybags, one of the primary financial analysts at XYZ Investments Group, Inc, knew her education, training, and experience had put her in a good position t concerning potential investments for the company's portfolio, but now she had to utilize some skills that she had not used since her finance courses in graduate school. Executive management at XYz decided to make direct investments in a venture, rather than just purchasing stock or providing capital n other forms. They were looking at four different target acquisitions, and had to make decisions in the next several weeks. It was up to Rebecca to complete the analysis, share her work papers and lead discussions and analysis justify her recommendations. This was going to be a challenge for her, because two of the top managers were "street sawy" but no formail training or education conceming a number of the financial analytical techniques that Rebecca was going to utilize. One of them, Ray Johns, focused almost entirely on net income gains and rates of increase, and would be difficult to convince if she were to use other analytical techniques, which he sometimes referred to as financial "hocus pocus" and often would not listen to the rationale supporting the methodology. She had pulled together the basic information about the four proposals that were under consideration, and summarized them as follows This proposal was to purchase a company that rented and serviced maiing and office machines. The company had been in business for over 4 years and was wel-run, but needed capital or a "white knight" to invest or purchase the operation. The initial cost totaled $720,000 and was to be depreciated over a period of 10 years (straight line). They projected sales of over $1.443 million during the next five years, and almost $634,000 in aftertax earnings. See Figure 1 below for the data to be used in the analysis Figure 1 Financial Analysis of Proposal 1-Office Machines Proposal 1: Office Machines Intial Tnvstmt Year1 Year 2 Year 3 Year4 Year 5 $720,000 Net cost of new business Incremental Revenue Operating cost Depreciation (straight line, 40 yrs) Net increase in income 1000 170000 263000 394000 525750 26500 27000 27500 28000 28500 18000 1000 1 1800 18000 46500 125000 217500 348000 479250 15245 41250 21725 114840 158153 Less: Tax at 33% Increase in aftertax income Add back depreciation Net cash flow for the period 18000 1001 18000 18000 $720,000) 49155 101750 163725 251160 339098 Proposal 2 The second proposal was to purchase a small plane to be located at a small executive airport nearby and to be used by smal business owners who had travel requirements that commercial airlines could not meet. These business operators were typically owners of growing and expanding businesses, and who needed to travel regionally on short notice. Other transportation altermatives such as commuter trains were not available and car services were too expensive and too slow (too much traffic). I successful, this concept might be considered to expansion to other cities of similar size that had good growth experience for smal businesses. Figure 2 Financial Analysis of Small plane/small airport shuttle service Proposal 2 Small plane/small airport shuttle service Initial nwtnt Year t Year 2 Yer3-Yor4 Years - Net cost of new business Incremental Revenue Operating cost Depreciation (units of production) Net increase in income 105000 202000 303000 445000 595000 36000 39000 42000 4400 46000 121500 178200 20100 120100 170100 (S2500) (15200) 90900 230900 378900 17325) 215 29997 2619 125032 (35125) CA089) 60903 15403 253863 121500 78200 170100 170100 120100 (810000) 86325 168016 231003 324803 423963 Less: Tax at 33% Increase in aftertax income Add back depreciation Net cash flow for the period Proposal 3 The third proposal involved the purchase and use of motor scooters for a courier system in the inner city. It was expected to be very competitive with other similar services, and might grow into the type of operation that could be expanded to other cities of similar size, using a direct investment or franchise model. The initial investment was estimated to be $296,000. The revenues were expected to grow substantially during the first four years, and then to level off as a result of anticipated competition entering the market and driving down rates. Financial Analysis of Courier Service Figure 3 Proposal 3: Intra-city courier service Inizial 296000 Net cost of new business Incremental Revenue Operating cost Depreciation (units of production) Net increase in income 2000 75900 111250 230500 159000 10500 11000 11150 11250 11750 44 65120 62160 62160 62160 (12900) (220) 37940 157090 85090 (4257) (3 12520 51840 28080 (8543) C147) 25420 105250 57010 44400 65120 2160 62160 62160 Less: Tax at 33 % ncrease in aftertax income Add back depreciation (296000) 35757 64973 87580 167410 119170 Net cash flow for the period Proposal 4 The final proposal under consideration involved the utilization of small vehicles for deliveries in a maneuver in congested traffic in downtown areas, and the revenue during the first two years center. The plan was to purchase a number of them and use them to more easily of operation was expected to be substantial. This realy generated interest with Ray Figure 4 Financial Analysis of Delivery Service Proposal 4: Intra-city delivery service Initial Imstmt Year1 Year 2 Year 3 Year 4 Year 5 Net cost of new business Incremental Revenue Operating cost Depreciation (units of production) Net increase in income 513000 379500 331050 88750 77400 52300 45150 42750 27900 26700 25200 26950 112860 10773 107730 107730 257400 175440 (46880) (57030) (80630) 84942 57895 15470) 19920(26608) 172458 112545 (31410) (38210) C54022) 76950 11280 107730 107730 107730 (513000) 249408 230405 76320 69520 53708 Less: Tax at 33 % Increase in aftertax income Add back depreciation Net cash flow for the period The plan was to present the information about each proposal in summary, develop a thorough analysis using appropriate financial analytical techniques and methodologies, and to anticipate the questions and concerns that would arise during the discussions with the executive management group. The only constraints were related to the amount of funds they had available for investment-they did not want to borrow at this juncture- and that they could only support one project given the limited availability of seasoned managers to run the project they utimately chose. It had been determined that the cost ofcapital was 10% at the time, and that this rate should be used in any analysis. Rebecca knew that she should use at least three capital budgeting techniques: . Payback (PB) Internal rate of return (IRR) Net present value (NPV) . She was familiar with the techniques (she really wished she had glven more attention to the capital budgeting techniques and rationale covered in her finance courses in her graduate degree program, but was reasonably confident that she could explain them clearly). She was more concened that none of these would appeal to Ray, who had always been focused on accumulated earnings (increase in aftertax income). She had tried to convince Ray that the net present value method was the best approach, but Ray did not understand it and called it "mumbo-jumbo" and "hocus-pocus" finance. She nevertheless prepared her analysis and felt assured that she could convince the executive management group which project would be in the firm's best interest and create the most value, and that Ray would isten to others if her presentation was clear and concise. The calculations are presented in an attachment (spreadsheet) for your review and use. 1. Ray Johns admittedly focused on the level of earnings, and particularly the increase in aftertax income of cach project (proposal). Which proposal do you think Ray will be focused on, and provide reasons for your answer 2. The first method Rebecca is to present is the payback technique. See the computations in the attachment (spreadsheet), and note the how PB Is approximated using the proportion of the year to the nearest decimal place (i.e., 3.4 years). a. Which proposal should they select, given the requirements for the payback method? b. What are the primary disadvantages of this method, and why might it be appealing to an untrained investor 3. The next method Rebecca presented is the net present value (NPV) technique. Review the NPV calculated in the spreadsheet for each proposal and rank the proposals. Which proposal should be selected, based on the ranking? 4. The next method in her presentation is the internal rate of return (IRR). Rank the projects on the basis of their IRR's in the attached spreadsheet. a. Which proposal should they select, based on the criteria of IRR? b. What are the primary disadvantages of using the IRR method? c. If there were an unlimited capital budget, which projects should XYZ invest in, based on the IRR criteria? d. If any are to be excluded, why? Do the IRR and NPV methods reject the same proposals? Discuss briefly. 5. Given the limitations and recommendations from academicians, which proposal should you choose, and why? 6. 94000 5575 443750 20000155 01753 162s 25L1 0.45 445 y 000 m2000 3a3000 445000 595000 DES0000 Net cash ow for e period 810000 9940 2100 16 00 4252 Z1220 S180 28080 2 22420 105052210190 NYZ Investments Group Page 1 of 2 of new business 3700 331050 50 77 52300 929000 45150 42750 27900 26700 Operating cost 252400 175404080)(57030 (80630) Net cash fow for the period 13000) 249408 230405 76320 6952053208 6636 Cumulative eanings 42324555324 13287) 76230 2.44 yrs XYZ Investments Group, Inc. management company that hrough 2018. They were XYZ Investments Group, Inc. is a successful hedge fund and investment had a good track record of investments during the past number of years, t concerned about the stock market's volatility and wanted to begin diversifying so they would not be as susceptible to swings in the market as they had been in the past, and to hedge ageinst the uncertainty they faced several long term investors and traders in the market, but two of them had not had much formal education and training in financial analytical techniques that were being employed in the industry to support investment decision-making-one of them frequently referred to his "gut" as the source of inspiration for making important decislions as in "my gut is telling me... However, they look at a number of direct investment opportunities, one of which they would purchase outright, to nitiate the diversification strategy during 2019. The top managers were a competent group that consisted of Rebecca Moneybags, one of the primary financial analysts at XYZ Investments Group, Inc, knew her education, training, and experience had put her in a good position t concerning potential investments for the company's portfolio, but now she had to utilize some skills that she had not used since her finance courses in graduate school. Executive management at XYz decided to make direct investments in a venture, rather than just purchasing stock or providing capital n other forms. They were looking at four different target acquisitions, and had to make decisions in the next several weeks. It was up to Rebecca to complete the analysis, share her work papers and lead discussions and analysis justify her recommendations. This was going to be a challenge for her, because two of the top managers were "street sawy" but no formail training or education conceming a number of the financial analytical techniques that Rebecca was going to utilize. One of them, Ray Johns, focused almost entirely on net income gains and rates of increase, and would be difficult to convince if she were to use other analytical techniques, which he sometimes referred to as financial "hocus pocus" and often would not listen to the rationale supporting the methodology. She had pulled together the basic information about the four proposals that were under consideration, and summarized them as follows This proposal was to purchase a company that rented and serviced maiing and office machines. The company had been in business for over 4 years and was wel-run, but needed capital or a "white knight" to invest or purchase the operation. The initial cost totaled $720,000 and was to be depreciated over a period of 10 years (straight line). They projected sales of over $1.443 million during the next five years, and almost $634,000 in aftertax earnings. See Figure 1 below for the data to be used in the analysis Figure 1 Financial Analysis of Proposal 1-Office Machines Proposal 1: Office Machines Intial Tnvstmt Year1 Year 2 Year 3 Year4 Year 5 $720,000 Net cost of new business Incremental Revenue Operating cost Depreciation (straight line, 40 yrs) Net increase in income 1000 170000 263000 394000 525750 26500 27000 27500 28000 28500 18000 1000 1 1800 18000 46500 125000 217500 348000 479250 15245 41250 21725 114840 158153 Less: Tax at 33% Increase in aftertax income Add back depreciation Net cash flow for the period 18000 1001 18000 18000 $720,000) 49155 101750 163725 251160 339098 Proposal 2 The second proposal was to purchase a small plane to be located at a small executive airport nearby and to be used by smal business owners who had travel requirements that commercial airlines could not meet. These business operators were typically owners of growing and expanding businesses, and who needed to travel regionally on short notice. Other transportation altermatives such as commuter trains were not available and car services were too expensive and too slow (too much traffic). I successful, this concept might be considered to expansion to other cities of similar size that had good growth experience for smal businesses. Figure 2 Financial Analysis of Small plane/small airport shuttle service Proposal 2 Small plane/small airport shuttle service Initial nwtnt Year t Year 2 Yer3-Yor4 Years - Net cost of new business Incremental Revenue Operating cost Depreciation (units of production) Net increase in income 105000 202000 303000 445000 595000 36000 39000 42000 4400 46000 121500 178200 20100 120100 170100 (S2500) (15200) 90900 230900 378900 17325) 215 29997 2619 125032 (35125) CA089) 60903 15403 253863 121500 78200 170100 170100 120100 (810000) 86325 168016 231003 324803 423963 Less: Tax at 33% Increase in aftertax income Add back depreciation Net cash flow for the period Proposal 3 The third proposal involved the purchase and use of motor scooters for a courier system in the inner city. It was expected to be very competitive with other similar services, and might grow into the type of operation that could be expanded to other cities of similar size, using a direct investment or franchise model. The initial investment was estimated to be $296,000. The revenues were expected to grow substantially during the first four years, and then to level off as a result of anticipated competition entering the market and driving down rates. Financial Analysis of Courier Service Figure 3 Proposal 3: Intra-city courier service Inizial 296000 Net cost of new business Incremental Revenue Operating cost Depreciation (units of production) Net increase in income 2000 75900 111250 230500 159000 10500 11000 11150 11250 11750 44 65120 62160 62160 62160 (12900) (220) 37940 157090 85090 (4257) (3 12520 51840 28080 (8543) C147) 25420 105250 57010 44400 65120 2160 62160 62160 Less: Tax at 33 % ncrease in aftertax income Add back depreciation (296000) 35757 64973 87580 167410 119170 Net cash flow for the period Proposal 4 The final proposal under consideration involved the utilization of small vehicles for deliveries in a maneuver in congested traffic in downtown areas, and the revenue during the first two years center. The plan was to purchase a number of them and use them to more easily of operation was expected to be substantial. This realy generated interest with Ray Figure 4 Financial Analysis of Delivery Service Proposal 4: Intra-city delivery service Initial Imstmt Year1 Year 2 Year 3 Year 4 Year 5 Net cost of new business Incremental Revenue Operating cost Depreciation (units of production) Net increase in income 513000 379500 331050 88750 77400 52300 45150 42750 27900 26700 25200 26950 112860 10773 107730 107730 257400 175440 (46880) (57030) (80630) 84942 57895 15470) 19920(26608) 172458 112545 (31410) (38210) C54022) 76950 11280 107730 107730 107730 (513000) 249408 230405 76320 69520 53708 Less: Tax at 33 % Increase in aftertax income Add back depreciation Net cash flow for the period The plan was to present the information about each proposal in summary, develop a thorough analysis using appropriate financial analytical techniques and methodologies, and to anticipate the questions and concerns that would arise during the discussions with the executive management group. The only constraints were related to the amount of funds they had available for investment-they did not want to borrow at this juncture- and that they could only support one project given the limited availability of seasoned managers to run the project they utimately chose. It had been determined that the cost ofcapital was 10% at the time, and that this rate should be used in any analysis. Rebecca knew that she should use at least three capital budgeting techniques: . Payback (PB) Internal rate of return (IRR) Net present value (NPV) . She was familiar with the techniques (she really wished she had glven more attention to the capital budgeting techniques and rationale covered in her finance courses in her graduate degree program, but was reasonably confident that she could explain them clearly). She was more concened that none of these would appeal to Ray, who had always been focused on accumulated earnings (increase in aftertax income). She had tried to convince Ray that the net present value method was the best approach, but Ray did not understand it and called it "mumbo-jumbo" and "hocus-pocus" finance. She nevertheless prepared her analysis and felt assured that she could convince the executive management group which project would be in the firm's best interest and create the most value, and that Ray would isten to others if her presentation was clear and concise. The calculations are presented in an attachment (spreadsheet) for your review and use. 1. Ray Johns admittedly focused on the level of earnings, and particularly the increase in aftertax income of cach project (proposal). Which proposal do you think Ray will be focused on, and provide reasons for your answer 2. The first method Rebecca is to present is the payback technique. See the computations in the attachment (spreadsheet), and note the how PB Is approximated using the proportion of the year to the nearest decimal place (i.e., 3.4 years). a. Which proposal should they select, given the requirements for the payback method? b. What are the primary disadvantages of this method, and why might it be appealing to an untrained investor 3. The next method Rebecca presented is the net present value (NPV) technique. Review the NPV calculated in the spreadsheet for each proposal and rank the proposals. Which proposal should be selected, based on the ranking? 4. The next method in her presentation is the internal rate of return (IRR). Rank the projects on the basis of their IRR's in the attached spreadsheet. a. Which proposal should they select, based on the criteria of IRR? b. What are the primary disadvantages of using the IRR method? c. If there were an unlimited capital budget, which projects should XYZ invest in, based on the IRR criteria? d. If any are to be excluded, why? Do the IRR and NPV methods reject the same proposals? Discuss briefly. 5. Given the limitations and recommendations from academicians, which proposal should you choose, and why? 6. 94000 5575 443750 20000155 01753 162s 25L1 0.45 445 y 000 m2000 3a3000 445000 595000 DES0000 Net cash ow for e period 810000 9940 2100 16 00 4252 Z1220 S180 28080 2 22420 105052210190 NYZ Investments Group Page 1 of 2 of new business 3700 331050 50 77 52300 929000 45150 42750 27900 26700 Operating cost 252400 175404080)(57030 (80630) Net cash fow for the period 13000) 249408 230405 76320 6952053208 6636 Cumulative eanings 42324555324 13287) 76230 2.44 yrs