Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ is a Canadian - controlled public company. The company has a December 31 fiscal year end. The company has a policy of using

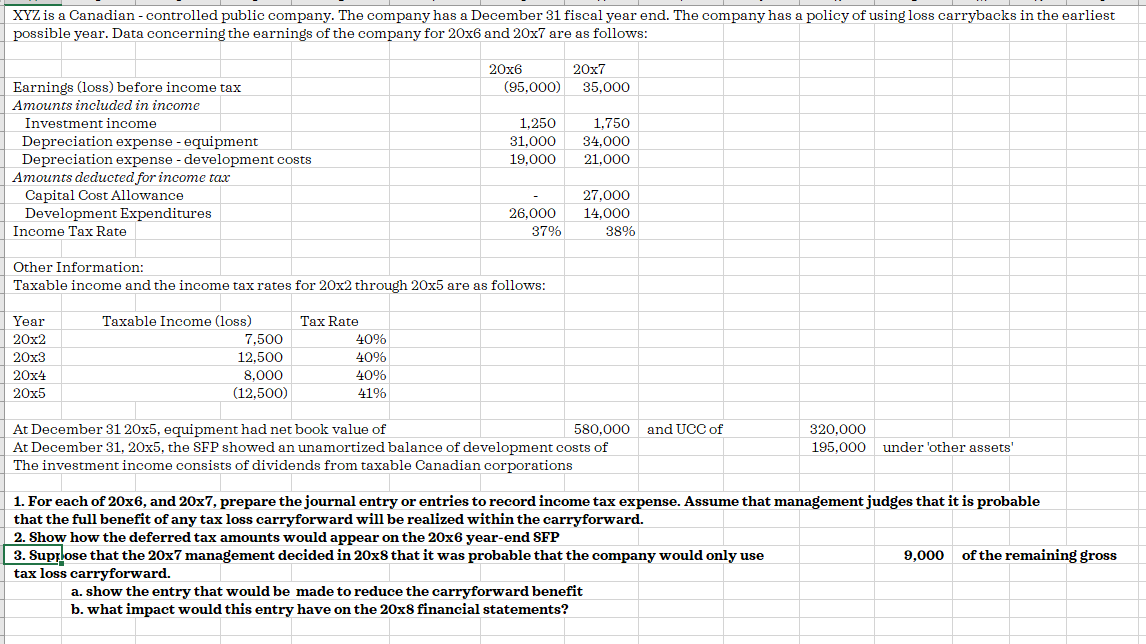

XYZ is a Canadian - controlled public company. The company has a December 31 fiscal year end. The company has a policy of using loss carrybacks in the earliest possible year. Data concerning the earnings of the company for 20x6 and 20x7 are as follows: 20x6 20x7 Earnings (loss) before income tax (95,000) 35,000 Amounts included in income Investment income 1,250 1.750 Depreciation expense - equipment 31,000 34.000 19,000 21,000 Depreciation expense - development costs Amounts deducted for income tax Capital Cost Allowance 27,000 Development Expenditures 26,000 14,000 38% Income Tax Rate 37% Other Information: Taxable income and the income tax rates for 20x2 through 20x5 are as follows: Year Taxable Income (loss) Tax Rate 20x2 7,500 40% 20x3 12,500 40% 20x4 8,000 40% 20x5 (12,500) 41% At December 31 20x5, equipment had net book value of 580,000 and UCC of 320.000 195,000 under 'other assets' At December 31, 20x5, the SFP showed an unamortized balance of development costs of The investment income consists of dividends from taxable Canadian corporations 1. For each of 20x6, and 20x7, prepare the journal entry or entries to record income tax expense. Assume that management judges that it is probable that the full benefit of any tax loss carryforward will be realized within the carryforward. 2. Show how the deferred tax amounts would appear on the 20x6 year-end SFP 3. Suppose that the 20x7 management decided in 20x8 that it was probable that the company would only use 9,000 of the remaining gross tax loss carryforward. a. show the entry that would be made to reduce the carryforward benefit b. what impact would this entry have on the 20x8 financial statements?

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 20x6 Income tax expense 35000 x 40 14000 20x7 Income tax expense 21000 x 41 8610 2 Deferred tax as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started