Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ is a multinational company headquartered in Singapore that engages in diverse activities, including the production of electronic tools such as handheld digital electronic

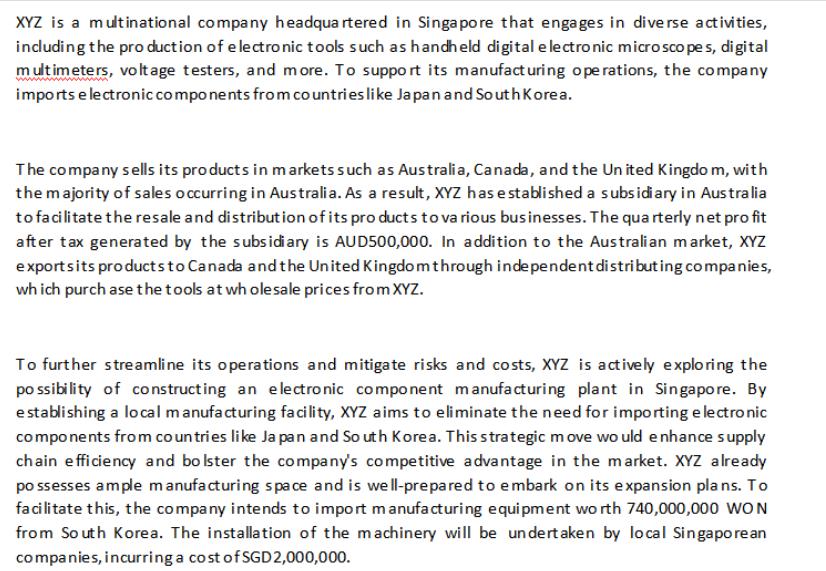

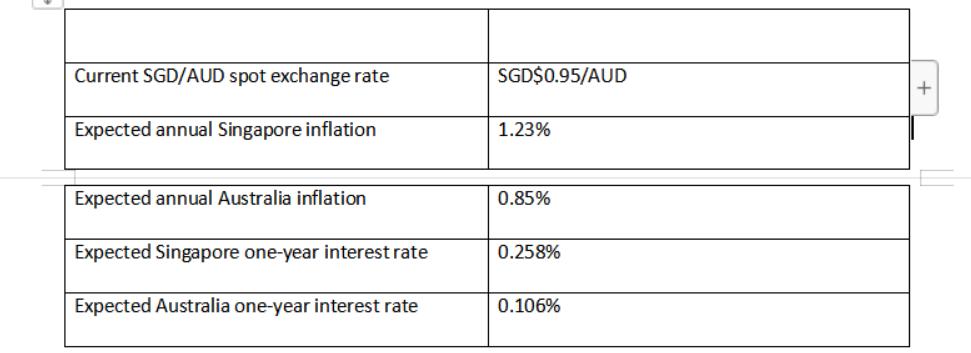

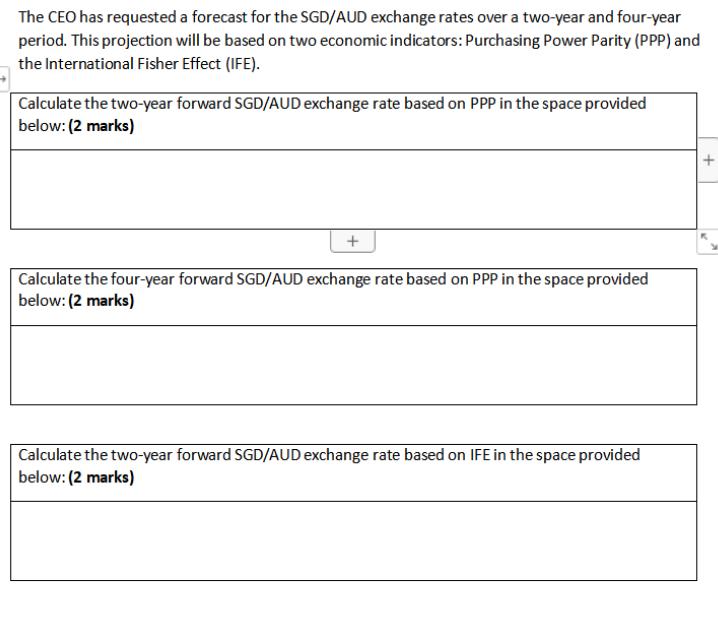

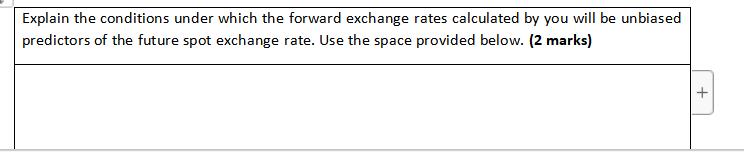

XYZ is a multinational company headquartered in Singapore that engages in diverse activities, including the production of electronic tools such as handheld digital electronic microscope s, digital multimeters, voltage testers, and more. To support its manufacturing operations, the company imports electronic components from countries like Japan and South Korea. The company sells its products in markets such as Australia, Canada, and the United Kingdom, with the majority of sales occurring in Australia. As a result, XYZ has established a subsidiary in Australia to facilitate the resale and distribution of its products to various businesses. The quarterly net profit after tax generated by the subsidiary is AUD500,000. In addition to the Australian market, XYZ exports its products to Canada and the United Kingdom through independent distributing companies, which purchase the tools at wholesale prices from XYZ. To further streamline its operations and mitigate risks and costs, XYZ is actively exploring the possibility of constructing an electronic component manufacturing plant in Singapore. By establishing a local manufacturing facility, XYZ aims to eliminate the need for importing electronic components from countries like Japan and South Korea. This strategic move would enhance supply chain efficiency and bolster the company's competitive advantage in the market. XYZ already possesses ample manufacturing space and is well-prepared to embark on its expansion plans. To facilitate this, the company intends to import manufacturing equipment worth 740,000,000 WON from South Korea. The installation of the machinery will be undertaken by local Singapore an companies, incurring a cost of SGD 2,000,000. Current SGD/AUD spot exchange rate Expected annual Singapore inflation Expected annual Australia inflation Expected Singapore one-year interest rate Expected Australia one-year interest rate SGD$0.95/AUD 1.23% 0.85% 0.258% 0.106% The CEO has requested a forecast for the SGD/AUD exchange rates over a two-year and four-year period. This projection will be based on two economic indicators: Purchasing Power Parity (PPP) and the International Fisher Effect (IFE). Calculate the two-year forward SGD/AUD exchange rate based on PPP in the space provided below: (2 marks) + Calculate the four-year forward SGD/AUD exchange rate based on PPP in the space provided below: (2 marks) Calculate the two-year forward SGD/AUD exchange rate based on IFE in the space provided below: (2 marks) + Explain the conditions under which the forward exchange rates calculated by you will be unbiased predictors of the future spot exchange rate. Use the space provided below. (2 marks) +

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the forward exchange rates based on Purchasing Power Parity PPP and the International Fisher Effect IFE well use the following formulas 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started