Question

XYZ is considering a proposal to produce feed. The feed project requires an investment in new plant and equipment of $2.20 million. This could be

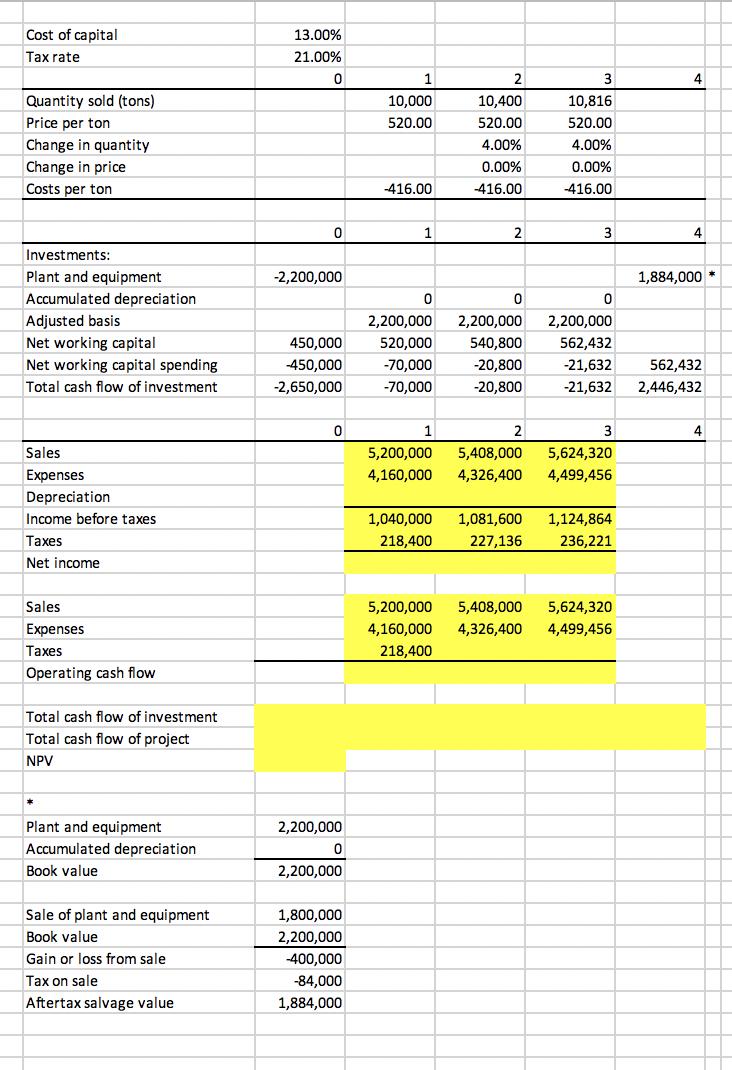

XYZ is considering a proposal to produce feed. The feed project requires an investment in new plant and equipment of $2.20 million. This could be depreciated for tax purposes straight-line over 10 years to zero salvage value. However, the plant and equipment will be sold when the project is terminated for $1.8 million. The project will generate sales for 3 years and will be terminated at the end of year 4. Year 1 sales of feed are expected to be 10,000 tons at $520 per ton, and thereafter quantity is forecasted to grow by 4% a year while the price remains constant. Costs are expected to be $416 per ton. Profits are subject to tax at 21% and the cost of capital is 13%. The project requires the following amounts in working capital, $450,000, $520,000, $540,800, $562,432 in year 0 – year 3, respectively and the accumulated level of working capital in year 3 will be recovered in year 4.

a. Determine the values of yellow background cells in the spreadsheet file and decide if XYZ should invest in this project? Explain.

b. What are possible concerns or questions for further analysis? Explain.

Cost of capital 13.00% Tax rate 21.00% 2 4 Quantity sold (tons) 10,000 10,400 10.816 Price per ton 520.00 520.00 520.00 Change in quantity 4.00% 4.00% Change in price 0.00% 0.00% Costs per ton -416.00 -416.00 -416.00 1 2 3 4 Investments: Plant and equipment -2,200,000 1,884,000 * Accumulated depreciation Adjusted basis 2,200,000 2,200,000 2,200,000 Net working capital 450,000 520,000 540,800 562,432 Net working capital spending -450,000 -70,000 -20,800 -21,632 562,432 Total cash flow of investment -2,650,000 -70,000 -20,800 -21,632 2,446,432 1 2 3 4 Sales 5,200,000 5,408,000 5,624,320 Expenses 4,160,000 4,326,400 4,499,456 Depreciation Income before taxes 1,040,000 1,081,600 1,124,864 xes 218,400 227,136 236,221 Net income Sales 5,200,000 5,408,000 5,624,320 xpenses 4,160,000 4,326,400 4,499,456 es 218,400 Operating cash flow Total cash flow of investment Total cash flow of project NPV Plant and equipment 2,200,000 Accumulated depreciation Book value 2,200,000 Sale of plant and equipment 1,800,000 Book value 2,200,000 -400,000 -84,000 Gain or loss from sale Tax on sale Aftertax salvage value 1,884,000

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

0 1 2 3 4 Sales 5200000 5408000 5624320 Expenses 4160000 4326400 44994...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started