Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ Itd is currently manufacturing 5000 units of the product XY100' annually, making full use of its machine capacity. The selling price and total

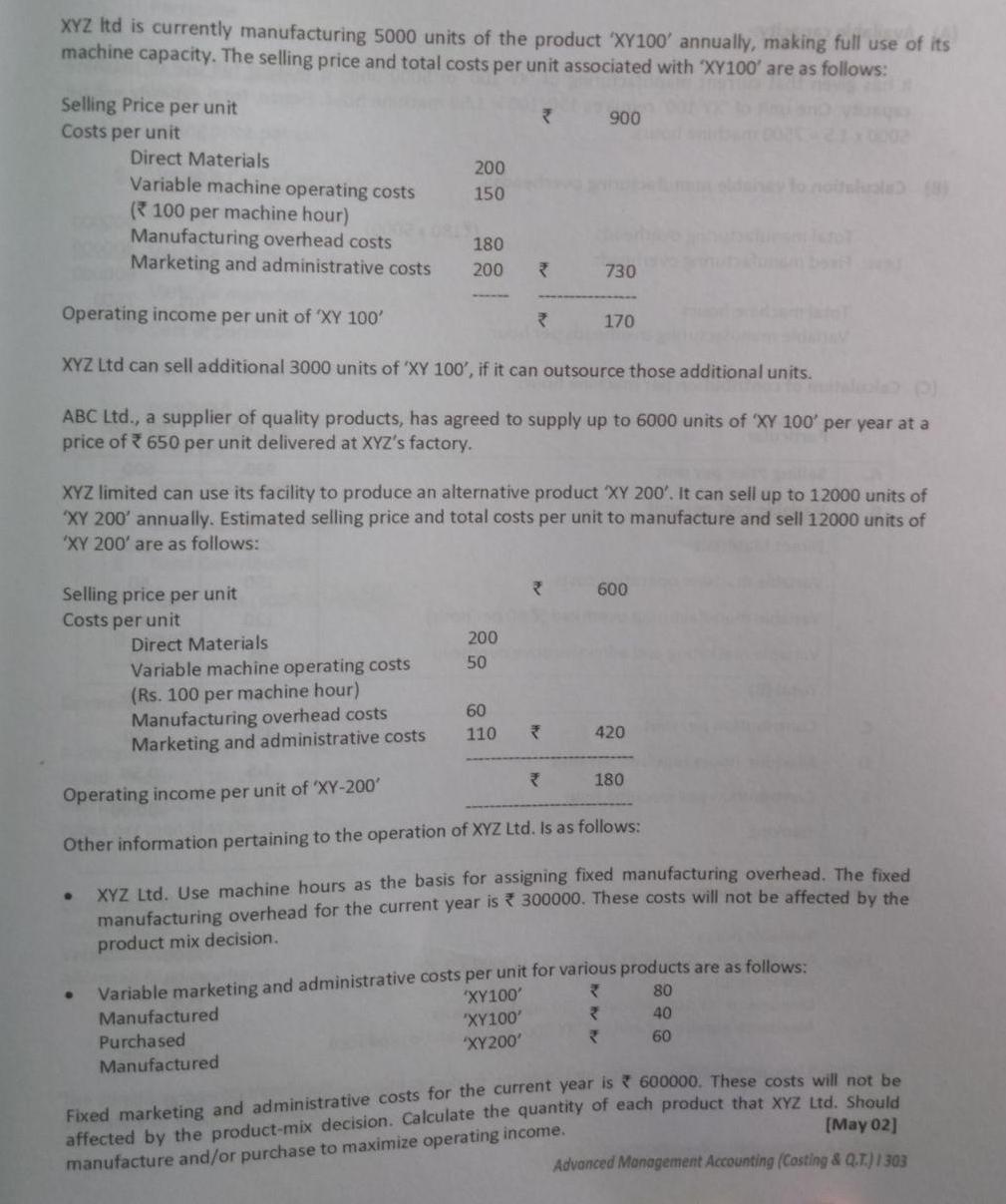

XYZ Itd is currently manufacturing 5000 units of the product XY100' annually, making full use of its machine capacity. The selling price and total costs per unit associated with XY100' are as follows: Selling Price per unit 900 Costs per unit Direct Materials 200 Variable machine operating costs to noitelale 150 (100 per machine hour) Manufacturing overhead costs Marketing and administrative costs 180 200 730 Operating income per unit of XY 100' 170 XYZ Ltd can sell additional 3000 units of 'XY 100', if it can outsource those additional units. ABC Ltd., a supplier of quality products, has agreed to supply up to 6000 units of 'XY 100' per year at a price of 650 per unit delivered at XYZ's factory. XYZ limited can use its facility to produce an alternative product XY 200'. It can sell up to 12000 units of XY 200' annually. Estimated selling price and total costs per unit to manufacture and sell 12000 units of XY 200' are as follows: 600 Selling price per unit Costs per unit 200 Direct Materials 50 Variable machine operating costs (Rs. 100 per machine hour) Manufacturing overhead costs Marketing and administrative costs 60 110 420 180 Operating income per unit of 'XY-200' Other information pertaining to the operation of XYZ Ltd. Is as follows: XYZ Ltd. Use machine hours as the basis for assigning fixed manufacturing overhead. The fixed manufacturing overhead for the current year is 300000. These costs will not be affected by the product mix decision. Variable marketing and administrative costs per unit for various products are as follows: XY100' 80 Manufactured Purchased 40 "XY100' 60 XY200 Manufactured Fixed marketing and administrative costs for the current year is 600000. These costs will not he affected by the product-mix decision. Calculate the quantity of each product that XYZ Ltd, Should [May 02] manufacture and/or purchase to maximize operating income. Advonced Management Accounting (Costing & Q.T.)1 303

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Income statement of making 5000 units of XY 100 and purchasing 3000 from ABC ltd after utilizing full capacity of the factory Particulars Amount Amoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started