Answered step by step

Verified Expert Solution

Question

1 Approved Answer

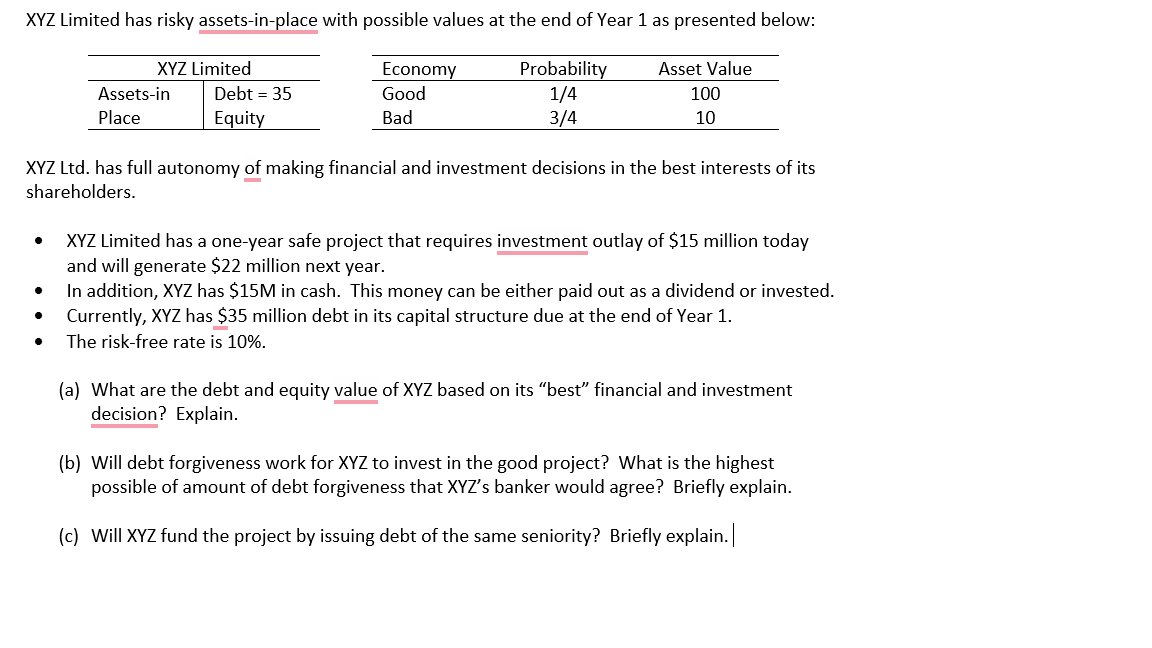

XYZ Limited has risky assets - in - place with possible values at the end of Year 1 as presented below: XYZ Ltd . has

XYZ Limited has risky assetsinplace with possible values at the end of Year as presented below:

XYZ Ltd has full autonomy of making financial and investment decisions in the best interests of its

shareholders.

XYZ Limited has a oneyear safe project that requires investment outlay of $ million today

and will generate $ million next year.

In addition, XYZ has $ in cash. This money can be either paid out as a dividend or invested.

Currently, XYZ has $ million debt in its capital structure due at the end of Year

The riskfree rate is

a What are the debt and equity value of XYZ based on its "best" financial and investment

decision? Explain.

b Will debt forgiveness work for XYZ to invest in the good project? What is the highest

possible of amount of debt forgiveness that XYZs banker would agree? Briefly explain.

c Will XYZ fund the project by issuing debt of the same seniority Briefly explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started